South_agency/E+ through Getty Pictures

Funding Thesis

As a publicly traded funding supervisor, Artisan Companions (NYSE:APAM) has proven a strong observe report of offering worth for his or her purchasers. Their tradition and observe report demonstrates their capability to navigate risky markets and nonetheless generate strong return that may add worth for purchasers. I imagine this firm demonstrates that energetic funding methods can nonetheless work in immediately’s markets. Moreover, the corporate has generously paid dividends to shareholders, demonstrating their dedication to creating shareholder worth. Nevertheless, at 11x FWD earnings, I imagine the inventory is now pretty pricing in all these positives, so buyers ought to proceed to carry the inventory.

Firm Overview

Artisan Companions is “an funding administration agency centered on offering high-value added, energetic funding methods in asset courses for stylish purchasers all over the world”. They supply mutual funds, non-public funds, funding trusts, and individually managed accounts for their purchasers. A lot of their purchasers embrace institutional buyers like endowment funds, public retirement plans, and particular person buyers.

Their funding methods revolve round creating an atmosphere the place individuals can act autonomously and give attention to the long run. To me, this implies they’re allowed to take calculated dangers which will underperform within the short-term however outperform in the long run. This tradition has been vital to their success in my opinion as a result of they will probably take completely different positions than the market and give attention to outperformance as a substitute of hugging the benchmarks.

Based on the annual report, “As of March 31, 2024, roughly 75% of our belongings below administration have been managed for purchasers and buyers domiciled within the U.S. and 25% of our belongings below administration have been managed for purchasers and buyers domiciled exterior of the U.S.”. So, buyers can see they’re primarily a US-based asset supervisor, with most of their cash managed domestically.

As an asset supervisor, they “derive practically all of our revenues from funding administration charges, most of that are primarily based on a specified share of purchasers’ common belongings below administration” in accordance with their annual report. As of Could thirty first, 2024, belongings below administration have been $158.6 billion, which demonstrates a considerable amount of belief positioned below Artisan in my opinion.

The corporate seems very robust with constant funding efficiency throughout most of their funding methods. I imagine their course of, enterprise, and tradition may be very clear as administration has proven to be keen to vary from the group of their funding strategy. Subsequently, I proceed to anticipate good elementary funding efficiency, which is able to probably appeal to and retain Artisan’s purchasers.

Outperformance Stems From Distinctive Tradition

Within the energetic funding world, I imagine that any sustained outperformance should typically come from a willingness to be completely different, and Artisan Companions has proven to essentially lean into this tradition to assist their funding methods. Subsequently, whereas everybody else could also be slowed down by paperwork and portfolios that hug the benchmark, it seems to me that Artisan’s distinctive tradition permits it to outperform their benchmarks.

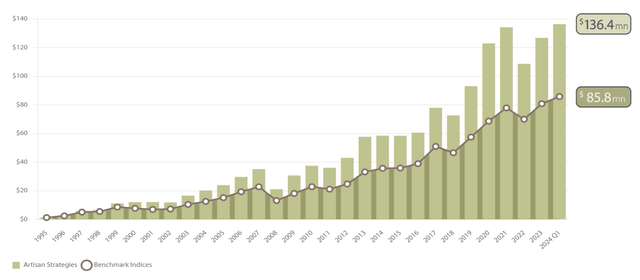

Based on their web site, Artisan Companions “have added vital long-term worth, after charges”. Of their 2023 annual report, they present this graph that illustrates their value-add funding methods,

2023 Annual Report

Their tradition rests on autonomy, which is crucial for his or her “investments first” focus. I imagine there might be no different motive for this outperformance aside from a real dedication to purchasers, by specializing in investments and never charges. Their distraction-free, autonomous funding groups allow them to take positions that prioritize absolute returns over relative efficiency to the benchmark.

So, though it is a aggressive world in funding administration, it appears to me that Artisan’s success primarily stems from their individuals, course of, and philosophy. Lively administration can nonetheless be completed correctly, however to ensure that it to be completed proper it should be long-term, differentiated, and consumer centered in my view. Artisan Companions has demonstrated to me that they’re keen to construct a novel tradition that sustainably creates worth for purchasers, shareholders, and their staff.

Different Methods Are Enticing

I imagine going ahead, administration is appropriately prioritizing new funds, funding methods that play to their strengths. Many different funding methods akin to credit score, debt, high-income, rising markets, and growing world reveal administration’s flexibility in growing new merchandise for purchasers to select from.

Specifically, credit score appears essentially the most fascinating to me due to the comparatively steady returns at comparatively decrease danger in comparison with equities. Based on the earnings transcript,

From its inception, the Artisan Excessive-Earnings Fund ranks quantity two in internet flows out of 138 funds within the Morningstar Excessive Yield class. Critically, although, Brian and the credit score crew have expanded past excessive revenue. They have been constructing out an array of capabilities, methods, and vectors for future progress.

Different funding methods akin to credit score pose a chance for Artisan, as they will create new funds and methods for future progress right here. Their observe report of innovating permits them to extend their AUM, fame, and funding returns for his or her purchasers in my opinion. So, going ahead, I believe administration will proceed to carry out nicely in pockets of the market which might be much less saturated, which supplies them an edge in outperforming for his or her purchasers.

Aligned Government Compensation Is Favorable

The proxy assertion exhibits that govt compensation is one other issue that contributes to the tradition and the ensuing outperformance of Artisan Companions. Based on their proxy assertion,

For 2023, 92% of our Chief Government Officer’s compensation was primarily based on efficiency. For our different named govt officers, performance-based compensation ranged from 86% to 94%.

CEO Eric Colson has demonstrated to be an efficient chief in bringing on the proper individuals to his firm, and his compensation is instantly tied to the general efficiency of the enterprise. He would not have extreme inventory choices that incentivize him to drive the share worth up, however as a substitute his compensation is tied to the success of Artisan’s purchasers.

Efficiency-based compensation is tied to the precise enterprise by way of financials, consumer inflows and outflows, and general funding efficiency of their funds. Moreover, I’m stunned to see that staff of Artisan personal a big quantity of inventory, at round “10.3% of our excellent frequent inventory as of the report date”.

Traders can see that general the manager compensation seems honest, with $6 million going to the CEO not being extreme in my opinion. Their emphasis on tying the efficiency of the enterprise and purchasers to compensation is another excuse why their tradition has uniquely outperformed their benchmarks. In consequence, I imagine their compensation philosophy is favorable for long-term shareholders.

Valuation – $45 Truthful Worth

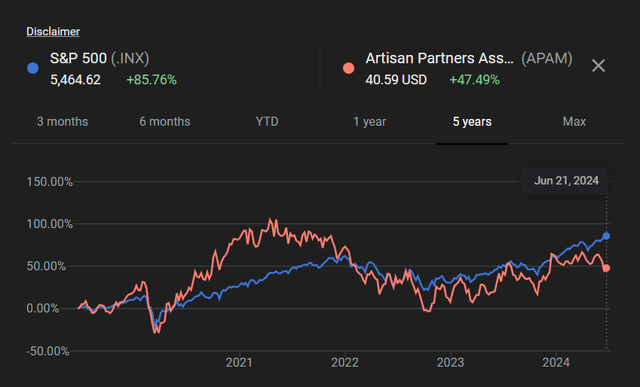

The inventory appears pretty valued, and regardless of the outperformance they’ve for his or her purchasers, the inventory hasn’t actually outperformed the SP 500 over the previous 5 years. Up to now 5 years, Artisan Companions went up 47%, in comparison with the SP 500 returns of 85%.

Google Finance

Artisan Companions is not tremendous low cost at 11x FWD earnings, in comparison with the sector median of 10x. Assuming revenues develop at round 5% yearly, Artisan Companions ought to have gross sales of $1.15 billion by 2027. Apply a internet margin of 23%, which is their 5-year common, will get me earnings of $264.5 million. Divide by shares excellent of 64 million will get me EPS of $4, rounded down. Apply a 11x FWD earnings a number of will get me round $45 honest worth, rounded up.

So, buyers can see the inventory is probably going pretty valued, and I do not anticipate it to outperform the SP 500 from right here. At this level, Artisan Companions might be relied on for its dividend, however its share worth is unlikely so as to add vital worth for shareholders.

Whereas the corporate spots a really excessive internet revenue per worker of $400,000, which is far above the sector median of $83,000, I imagine the corporate is as environment friendly as doable. Subsequently, their margins and profitability metrics are as excessive as they will go in my opinion, which additional reinforces my view that shares current restricted upside as compared with the SP 500.

Dangers

Market downturns, recessions, and financial headwinds can negatively affect funding efficiency, which in flip lowers the charges Artisan earns on belongings below administration. Administration should be cautious to navigate financial uncertainties of their portfolio and keep diversified to climate any potential storm.

Funding managers function in a aggressive discipline with many funds competing on charges, returns, and methods. I anticipate the business to get extra aggressive as extra money flows into various funding methods, probably placing Artisan’s aggressive place in danger.

Key personnel can depart, which can put the tradition vulnerable to deteriorating, and the distinctive autonomous atmosphere could also be vulnerable to altering, which can negatively affect funding efficiency. Passive investing may proceed to be aggressive, as its low-fees could trigger extra money to stream into index funds moderately than Artisan’s actively managed funds.

Maintain Artisan Companions

Traders ought to do fairly nicely in the event that they maintain right here, however I do not anticipate the inventory to outperform the SP 500. At round honest worth of $45, AUMs aren’t growing quick sufficient to justify any outperformance within the shares. I like administration, the tradition they’ve constructed, nevertheless it appears the market already acknowledges these strengths. So, I anticipate the inventory to commerce sideways at round $45 a share for the following 12 months.