RiverNorthPhotography

Verizon Communications Inc. (NYSE:VZ) (NEOE:VZ:CA) is a well-managed telecommunications firm with a excessive, recurring stage of EBITDA and free money circulation.

The Telco earns its dividend with Free Money Move on a full-year foundation and is poised to announce a dividend hike for the approaching yr.

Bearing in mind that Verizon Communications is promoting at an affordable earnings a number of and that the Telco continues to have subscriber tailwinds in its Broadband section, I feel that the danger/reward ratio for VZ stays fairly compelling.

A concentrate on debt repayments could possibly be a catalyst for Verizon Communications to re-rate to its intrinsic worth.

My Ranking Historical past

In my final piece on Verizon Communications, I highlighted the corporate’s Broadband momentum as one motive why the inventory was interesting to passive earnings buyers.

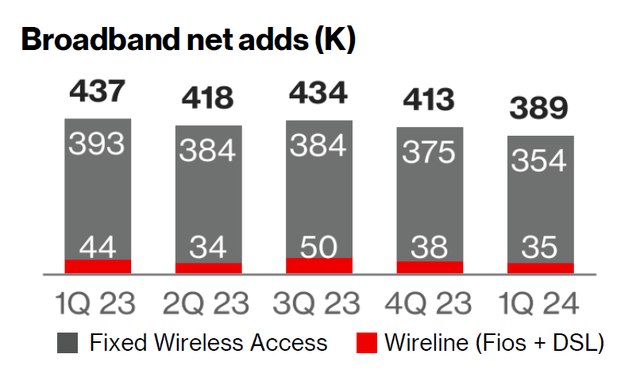

Within the first quarter, the Telco continued to make impression with its rising subscriber base and whole Broadband web additions amounting of 389K. I feel that Verizon Communications will select, as AT&T Inc. (T) did, to repay extra of its debt within the coming quarters.

Free Money Move, Broadband Upside

Verizon Communications is primarily a ‘Sturdy Purchase’ for its sizable Free Money Move. Telcos don’t are likely to have so much upside in gross sales, EBITDA or Free Money Move, however the amount of money that enormous telecommunications firms rake in, is not less than guaranteeing a gradual circulation of dividend earnings to passive earnings buyers.

Verizon Communications added 389K new subscribers to its Broadband community within the first quarter, which included greater than 50K Fios web web additions. Broadband Enterprise had 151K mounted wi-fi web additions in 1Q24.

Broadband is doing effectively for Verizon Communications and the continuing momentum in web additions, effectively above 300K per quarter, is probably the most compelling motive to personal a bit of the Telco’s Broadband motion.

Broadband Web Provides (Verizon Communications)

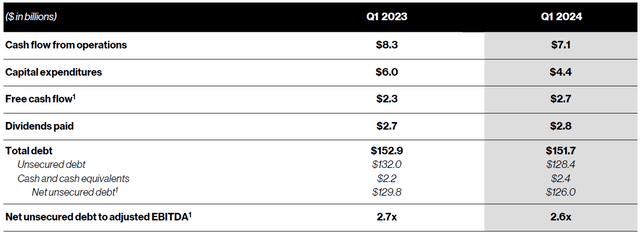

Verizon Communications produced $2.7 billion in Free Money Move within the first quarter, which confirmed an enchancment of $400 million in contrast towards 1Q23.

Free Money Move was not ample, nevertheless, to cowl the primary quarter dividend of $2.8 billion and the Telco fell $100 million wanting its fee obligation. The Free Money Move dividend pay-out ratio was 103% in 1Q24.

With that stated, although, Verizon Communications’ Free Money Flows are likely to even out through the course of the enterprise yr and the Telco is broadly anticipated to greater than earn its dividend pay-out in 2024.

Within the prior yr, regardless of additionally under-earning its dividend with FCF in 1Q23, Verizon Communications ended up incomes $18.7 billion in Free Money Move and paying out 59% of its Free Money Move as dividends.

Free Money Move (Verizon Communications)

A New Dividend Will Be Introduced In 3Q24

Within the case of Verizon Communications, and in a significant distinction to A&T, the Telco’s dividend is rising. The dividend is presently anchored at $0.665 per share per quarter, however Verizon Communications is anticipated to quickly announce its new dividend for the third quarter, which is when the Telco ordinarily raises its pay-out.

In my opinion, the dividend may rise to a variety of $0.675-0.680 per share in 3Q’24 if the corporate’s final dividend hike serves as a benchmark. Thus, I’m trying ahead to getting a 2% increase on my dividend earnings. The current yield for Verizon Communications is 7%.

Verizon Communications Below Strain To Do Extra About Its Debt

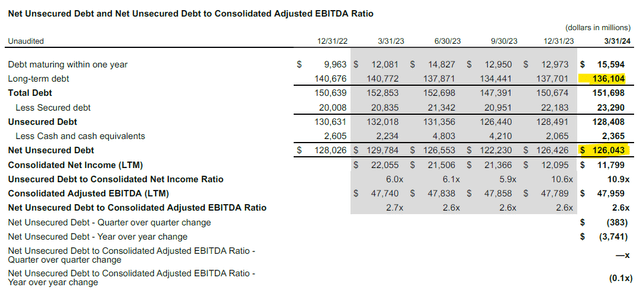

AT&T is transferring into the route of decreasing its debt repayments, which I feel may put Verizon Communications beneath stress to do the identical. Each firms have long-term debt approach north of $100 billion, and AT&T just lately paid $4.7 billion of its long-term debt maturities in 1Q24 and thereby lowered its whole web debt by $6.0 billion.

Verizon Communications is just not doing as a lot, the Telco lowered its long-term debt solely by $1.6 billion within the final quarter, however there may be room for enchancment, primarily due to the Telco’s Free Money Move pay-out ratio that’s prone to clock in someplace within the 50-percent vary in 2024 (because it did in 2023). This extra Free Money Move could possibly be utilized to the Telco’s monumental excellent long-term debt and decrease the corporate’s leverage.

Lengthy-Time period Debt (Verizon Communications)

Verizon Communications Is Nonetheless A Steal

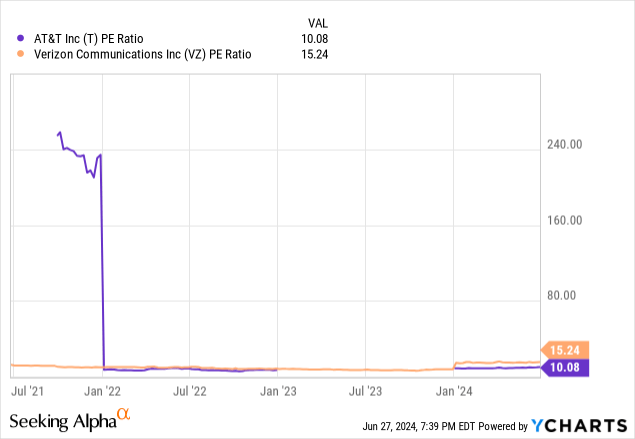

What can’t be argued about, in my opinion, is that Verizon Communications’ inventory remains to be a steal. Promoting for less than 8.7x main earnings, whereas AT&T is promoting for 8.1x main earnings. Each Telcos are a cut price, so far as I’m involved as a result of each Verizon Communications and AT&T cowl their dividend pay-outs with Free Money Move. Within the case of Verizon Communications, passive earnings buyers get the additional benefit of really seeing a rising dividend.

I feel that VZ and T are each basically undervalued, as each firms produce a considerable quantity of Free Money Move. I made the argument these days, within the case of AT&T that the Telco could possibly be valued at 10-11x main earnings, which is identical argument I’m making right here (due to its extra FCF). This a number of vary leaves us with between 15% and 27% upside, or an intrinsic worth interval of $47 to $52.

Why The Funding Thesis May Disappoint

Passive earnings buyers shouldn’t anticipate a lot by way of re-rating potential, in my opinion, until Verizon Communications strikes ahead with a concrete debt discount plan.

What has been holding again Verizon Communications’ inventory value is the Telco’s substantial debt burden that’s taking a chunk out of earnings and weighing on sentiment. If Verizon Communications fails to do one thing about its substantial debt, I don’t see a path for a better inventory valuation.

My Conclusion

Verizon Communications income from momentum in its Broadband section, and the corporate loved quantity of buyer web additions within the first quarter, because it did up to now couple of quarters.

Except one thing actually out of the abnormal occurs, I might suppose that this momentum has continued within the second quarter and I anticipate that the Telco added a quantity near 400K subscribers to its Broadband unit in 2Q24 additionally.

What makes Verizon Communications a present is its excessive Free Money Move that’s accessible to passive earnings buyers at a really low value, an 8.7x earnings a number of.

The dividend is poised to develop in 3Q24, and I’m trying ahead to receiving a 2% hike for my dividend earnings stream.