Robert Method

Funding Thesis

I’m bullish on BABA given its strategic market place, which I consider will give it upward trajectory traction. In January 2024, I revealed a bullish thesis on Alibaba Group Holding Restricted (NYSE:BABA) the place I reiterated my purchase suggestion. In that evaluation, I asserted that what had been a bearish development was reversing, and a bullish momentum was constructing. Since that protection, the inventory has gained 7.63%, with a complete return of 9.04%. My bullish thesis was primarily based on the corporate’s robust fundamentals similar to its development and profitability, which nonetheless seems to be engaging at present.

Searching for Alpha

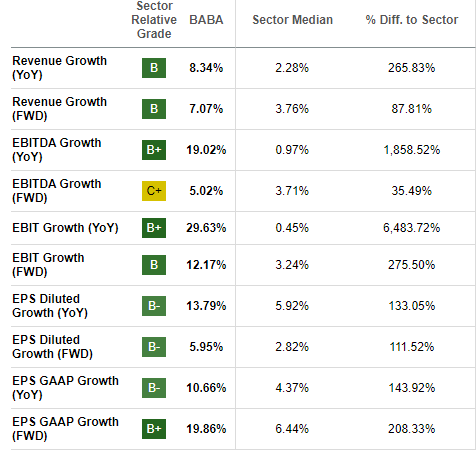

The YoY development and profitability metrics, that are above the sector medians, not solely mirror the corporate’s strong fundamentals, but additionally its superiority within the development and profitability race when in comparison with its friends within the sector. The ahead values, that are additionally above the sector medians, present the corporate’s vivid outlook, which aligns with my bullish stance and vindicates my assertion that the corporate’s strategic positioning will give the corporate’s development steam.

Technical Evaluation

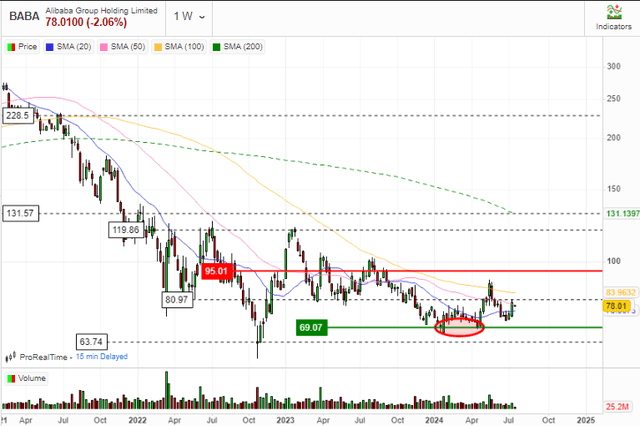

In my earlier protection, I discussed that the inventory was on the help zone at about $69 and that the bearish development was reversing. I did assert that the value was approaching the 20-day MA the place a cross-over above it could affirm the bullish onset, which certainly occurred. Additional, the inventory has shaped a double backside sample (proven by the pink eclipse on the chart) which acted as a retest on the help zone, as I had earlier projected.

Curiously, the value has crossed above the 50-day MA additional confirming that certainly the bullish development is getting stronger, and it’s at present approaching the 100-day and 200-day MAs the place a crossover above them would act as a confirmatory sign of a sustainable long-term upward development.

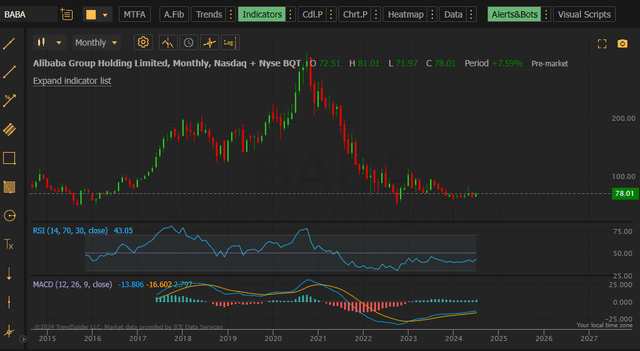

To get a transparent outlook right here, let’s dive deeper and assess what the technical indicators are exhibiting. To start with, each the RSI and the MACD oscillators point out a bullish outlook. The previous is above the sign line and transferring upward, implying that the dominant development is upward. The latter is at present at 43 having bounced on the oversold area of about 25, and it has been trending upward. Most significantly, the RSI is at 43 and reveals that this inventory has an incredible upside potential earlier than hitting the overbought area of 70.

Whereas buying and selling quantity is vital in projecting the course of a inventory, it is rather promising that during the last three months, BABA has seen a major optimistic marginal buying and selling quantity. Its OBV has grown from about -16 million in April to a optimistic determine of about 759 okay indicating a rising demand for this inventory, which I feel will assist propel a sustainable share worth development.

In conclusion, BABA is clearly on the early levels of its bullish development, as proven by it being simply above the 20-day and 50-day MAs. Nevertheless, the symptoms are exhibiting that the development is gaining momentum as proven by the rising OBV, RSI, and MACD. Because of this, I price the inventory a purchase with a worth goal of about $102 which is my resistance zone inside a one-year timeframe within the technical evaluation as proven beneath.

Strategic Market Place: Adoption Of AI Is The New Income Powerhouse

BABA operates via 7 segments, whose detailed dialogue may be present in my earlier evaluation. Its on-line platforms, Taobao and Tmall, are well-known in China, providing a strong home buyer base amounting to 903 billion lively customers by 2023. This determine is critical as a result of in 2023, about 65% of its complete income got here from China. Alibaba’s world growth and cloud providers are essential development drivers, with generative AI applied sciences contributing to a 30% enhance in e-commerce orders.

The corporate’s GenAI is proof of its dedication to innovation and sustaining a bonus over rivals. BABA and different tech behemoths like ByteDance and SenseTime are among the many leaders in China’s GenAI infrastructure providers sector. Alibaba plans to enhance its worldwide digital commerce enterprise [AIDC], which encompasses web sites like Lazada and AliExpress, as a part of this funding. Two examples of its improvements in GenAI are;

- Tongyi Qianwen: Which is a big language mannequin akin to ChatGPT from Open AI. It has been included into its industrial apps, such because the DingTalk app for workplace communication and the Tmall Genie sensible speaker. Alibaba advantages vastly from this connection by way of consumer engagement and operational effectivity, because it improves consumer interplay and expedites enterprise processes.

- Tongyi Wanxiang: That is an AI image-generating mannequin that may create detailed graphics in quite a lot of kinds, together with cartoons in three dimensions, watercolor, oil work, animation, and sketching. Along with serving to with content material manufacturing, this know-how permits for model switch, which creates new visuals. That is very useful for advertising and marketing and product visualization.

These distinctive GenAI improvements not solely distinguish BABA from its rivals but additionally display its dedication to main the AI revolution in e-commerce. By its adoption of AI, its e-commerce division income grew by 45% YoY within the MRQ. Its mixed orders additionally grew by 20% in the identical interval, exhibiting the optimistic impacts on its AI funding, which positions it strategically for development.

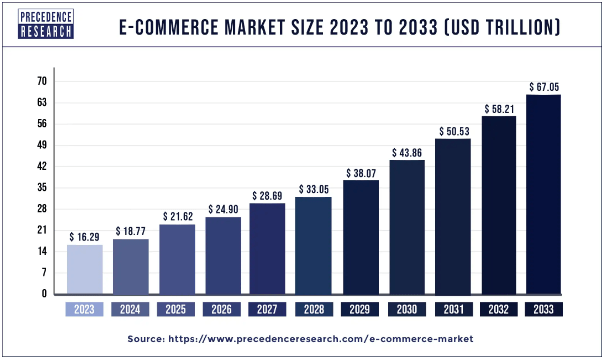

In response to priority analysis, world e-commerce is projected to develop at a CAGR of 15.2% between 2024 and 2033.

Priority Analysis

Given this projected market development, I consider BABA is positioned strategically to grab the chance courtesy of its improvements. These improvements have confirmed vital in driving its development, as exhibited by its double-digit development determine within the MRQ.

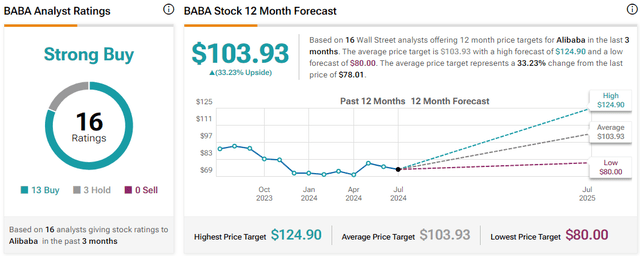

Different Analysts’ Outlook

Contemplating my bullish outlook and purchase suggestion for BABA, I discover it crucial to check my evaluation with that of different analysts. In response to 16 Wall Avenue analysts, they’ve a consensus common worth goal of $103.93 which is barely above my worth goal of $102 mentioned above. This means that my bullish outlook aligns with that of different buyers, probably lending credence to my optimistic view of this inventory.

Dangers

Contemplating American restrictions on the most recent GPU know-how from Nvidia and different producers, Chinese language companies are extra constrained in relation to AI, subsequently Alibaba won’t get the identical fast advantages as American cloud computing giants like Microsoft and Alphabet. Alibaba diminished cloud computing costs concurrently to entice AI builders to make use of its knowledge heart providers. Thus, though synthetic intelligence has vital long-term potential, there could also be some short-term challenges.

Whereas my article is technical analysis-driven, it is very important observe that indicators aren’t static, and subsequently they’re more likely to change with market circumstances, which might result in misjudgment if not carefully monitored.

My Closing Ideas

In conclusion, Alibaba is a good funding alternative given its bullish development, which is gaining momentum. The corporate’s GenAI improvements are giving its development traction, resulting in double-digit development each in income and orders within the MRQ. With a strong projected market development, BABA is effectively positioned to seize share on this market, with its improvements translating to doubtlessly sustainable long-term inventory development. Consequently, I price this inventory a purchase.