Gold has lengthy been thought of a retailer of wealth, and the gold value usually makes its largest positive aspects throughout turbulent occasions as buyers search for cowl on this safe-haven asset.

The twenty first century has to date been closely marked by episodes of financial and sociopolitical upheaval. Uncertainty has pushed the valuable metallic to document highs as market contributors search its perceived safety. And every time the gold value rises, there are requires even greater record-breaking ranges.

Gold market gurus from Lynette Zang to Chris Blasi to Jordan Roy-Byrne have shared eye-popping predictions on the gold value that might intrigue any investor — gold bug or not.

Whereas some have posited that the gold value could break US$3,000 per ounce and keep it up as excessive as US$4,000 or US$5,000, there are these with hopes that US$10,000 gold and even US$40,000 gold may grow to be a actuality.

These spectacular value predictions have buyers asking, what was the best gold value ever? The reply to that query is revealed beneath. And by taking a look at how the gold value has moved traditionally, it’s attainable to know what which means for the yellow metallic sooner or later.

How is gold traded?

Earlier than discovering what the best gold value ever was, it’s value taking a look at how the valuable metallic is traded. Figuring out the mechanics behind gold’s historic strikes will help illuminate why and the way its value adjustments.

Gold bullion is traded in {dollars} and cents per ounce, with exercise happening worldwide in any respect hours, leading to a dwell value for the metallic. Buyers commerce gold in main commodities markets akin to New York, London, Tokyo and Hong Kong. London is seen as the middle of bodily valuable metals buying and selling, together with for silver. The COMEX division of the New York Mercantile Alternate is residence to most paper buying and selling.

There are a lot of standard methods to spend money on gold. The primary is thru buying gold bullion merchandise akin to bullion bars, bullion cash and rounds. Bodily gold is bought on the spot market, that means that consumers pay a particular value per ounce for the metallic after which have it delivered. In some elements of the world, akin to India, shopping for gold within the type of jewellery is the biggest and most conventional path to investing in gold.

One other path to gold funding is paper buying and selling, which is finished by the gold futures market. Contributors enter into gold futures contracts for the supply of gold sooner or later at an agreed-upon value. In such contracts, two positions might be taken: a protracted place underneath which supply of the metallic is accepted or a brief place to offer supply of the metallic. Paper buying and selling as a way to spend money on gold can present buyers with the flexibleness to liquidate belongings that aren’t out there to those that possess bodily gold bullion.

One important long-term benefit of buying and selling within the paper market is that buyers can profit from gold’s safe-haven standing without having to retailer it. Moreover, gold futures buying and selling can supply extra monetary leverage in that it requires much less capital than buying and selling within the bodily market.

Apparently, buyers also can buy bodily gold by way of the futures market, however the course of is difficult and prolonged and comes with a big funding and extra prices.

Except for these choices, market contributors can spend money on gold by exchange-traded funds (ETFs). Investing in a gold ETF is much like buying and selling a gold inventory on an alternate, and there are quite a few gold ETF choices to select from. For example, some ETFs focus solely on bodily gold bullion, whereas others concentrate on gold futures contracts. Different gold ETFs heart on gold-mining shares or comply with the gold spot value.

It is very important perceive that you’ll not personal any bodily gold when investing in an ETF — on the whole, even a gold ETF that tracks bodily gold can’t be redeemed for tangible metallic.

On the subject of the efficiency of gold versus buying and selling shares, gold has an attention-grabbing relationship with the inventory market. The 2 usually transfer in sync throughout “risk-on intervals” when buyers are bullish. On the flip facet, they have an inclination to grow to be inversely correlated in occasions of volatility.

In response to the World Gold Council, gold’s capability to decouple from the inventory market during times of stress makes it “distinctive amongst most hedges within the market.” It’s usually throughout these occasions that gold outperforms the inventory market. For that purpose, it’s usually used as a portfolio diversifier to hedge towards uncertainty.

What was the best gold value ever?

The gold value hit US$2,530.30, its all time highest value on the time of this writing, on August 20, 2024.

Gold broke by the necessary psychological stage of US$2,000 per ounce in late 2023 on rising expectations that the US Federal Reserve would start to reverse course on rates of interest, and set a number of new all time highs in 2024. Gold climbed all through Q2 to over US$2,450 in Could, after which moved to US$2,483.35 on July 17.

Whereas rate of interest cuts have but to materialize as of mid-August, gold climbed to over US$2,500 in mid-August on a weakening greenback, constructive financial information and the information on August 16 that the Chinese language authorities issued new gold import quotas to banks within the nation following a two month pause. Central financial institution gold shopping for has been one of many tailwinds for the gold value this 12 months and China’s central financial institution has been one of many strongest consumers. It climbed additional the next week to its new all-time excessive.

Fears of a looming recession — or the robust perception {that a} recession is already right here — are additionally extremely supportive for gold heading as we head deeper into 2024.

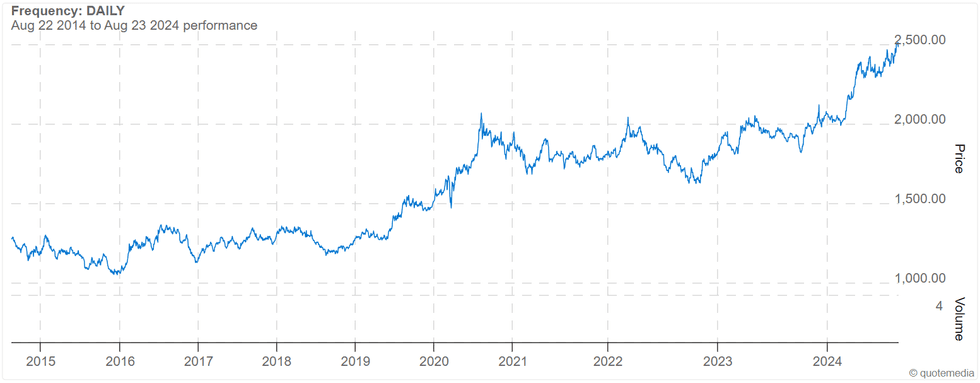

10 12 months gold value chart, August 22, 2014, to August 23, 2024.

Chart by way of Quotemedia.

Regardless of these current runs, gold has seen its share of each peaks and troughs during the last decade. After remaining rangebound between US$1,100 and US$1,300 from 2014 to early 2019, gold pushed above US$1,500 within the second half of 2019 on a softer US greenback, rising geopolitical points and a slowdown in financial development.

Gold’s first breach of the numerous US$2,000 value stage in mid-2020 was due largely to financial uncertainty brought on by the COVID-19 pandemic. To interrupt by that barrier and attain what was then a document excessive, the yellow metallic added greater than US$500, or 32 %, to its worth within the first eight months of 2020.

The gold value neared that stage once more in early 2022 as Russia’s invasion of Ukraine collided with rising inflation around the globe, growing the attract of safe-haven belongings. In 2023, continued inflation and subsequent fee hikes from the Fed threatened the opportunity of a recession, as soon as once more pushing gold above US$2,000 and even placing it in sight of its then all-time excessive.

The evolving banking disaster within the spring of 2023 and the outbreak of the Israel-Hamas conflict in October additionally positioned upward stress on gold, permitting it to check its earlier all-time excessive.

What’s subsequent for the gold value?

What’s subsequent for the gold value isn’t a straightforward name to make. There are a lot of elements that have an effect on the gold value, however a few of the most prevalent long-term drivers embrace financial growth, market danger, alternative value and momentum.

Financial growth is among the major gold value contributors because it facilitates demand development in a number of classes, together with jewellery, know-how and funding. Because the World Gold Council explains, “That is notably true in growing economies the place gold is usually used as a luxurious merchandise and a way to protect wealth.” Market danger can also be a chief catalyst for gold values as buyers view the valuable metallic because the “final secure haven,” and a hedge towards forex depreciation, inflation and different systemic dangers.

Going ahead, along with the Fed, inflation and geopolitical occasions, specialists can be on the lookout for cues from elements like provide and demand. By way of provide, the world’s 5 high gold producers are China, Australia, Russia, Canada and the US. The consensus within the gold market is that main miners haven’t spent sufficient on gold exploration lately. Gold mine manufacturing has fallen from round 3,200 to three,300 metric tons annually between 2018 and 2020 to round 3,000 to three,100 metric tons annually between 2021 and 2023.

On the demand facet, China and India are the largest consumers of bodily gold, and are in a perpetual struggle for the title of world’s largest gold shopper. That stated, it is value noting that the previous few years have introduced a giant rebound in central financial institution gold shopping for, which dropped to a document low in 2020, however reached a 55 12 months excessive of 1,136 metric tons in 2022.

The World Gold Council has reported that central financial institution gold purchases in 2023 got here to 1,037 metric tons, marking the second 12 months in a row above 1,000.

“We predict that gold has entered into a brand new section of this bull market,” Adam Rozencwajg, managing associate at Goehring & Rozencwajg, instructed the Investing Information Community (INN) in a June 2023 interview. “It most likely began within the third and fourth quarter of final 12 months, and it actually revolves round central banks’ conduct as a lot as the rest. I believe it’ll propel gold a lot a lot greater on this leg of the bull market.”

Joe Cavatoni, North American market strategist on the WGC, instructed INN in an electronic mail on the finish of Q1, “As central banks proceed to be important consumers and geopolitical dangers and world uncertainties drive buyers in the direction of the perceived security of gold, the present surroundings underscores gold’s significance as a strategic asset for portfolio diversification and danger mitigation. Subsequently, whereas there could have been a notion of western disinterest in gold, current developments point out a sustained and broad-based demand for the valuable metallic.”

At first of Q3, INN spoke with Brien Lundin, editor of Gold E-newsletter, on the Rule Symposium in Boca Raton, Florida.

“I believe clearing US$2,400 for good — buying and selling a couple of weeks above that stage could be key,” Lundin stated. “Finally I believe we’ll go a lot greater. The timing of that’s at all times the exhausting half. Getting again to the place I believe we’ll be on the finish of this cycle, I believe the gold value goes to be someplace between US$6,000 and US$8,000.”

In August, INN spoke with Brett Heath, CEO and director of Metalla Royalty & Streaming (TSXV:MTA,NYSEAMERICAN:MTA), who sees gold going to US$2,600 to US$3,000 this 12 months.

“You’ve got seen such an unbelievable breakout (in gold), such an unbelievable setup — and the general public’s simply not within the commerce but,” he stated. “Once they do come again in, I believe on the again of a few of these capital flows, then that’ll be a giant driver of not solely gold, however the equities, which immediately we nonetheless actually haven’t seen any materials inflows.”

Do you have to watch out for gold value manipulation?

As a remaining observe on the worth of gold and shopping for gold bullion, it’s necessary for buyers to bear in mind that gold value manipulation is a sizzling matter within the trade.

In 2011, when gold hit what was then a document excessive, it dropped swiftly in only a few quick years. This decline after three years of spectacular positive aspects led many within the gold sector to cry foul and level to manipulation. Early in 2015, 10 banks have been hit in a US probe on valuable metals manipulation. Proof offered by Deutsche Financial institution (NYSE:DB) confirmed “smoking gun” proof that UBS Group (NYSE:UBS), HSBC Holdings (NYSE:HSBC), the Financial institution of Nova Scotia (NYSE:BNS) and different corporations have been concerned in rigging gold and silver charges available in the market from 2007 to 2013.

Not lengthy after, the long-running London gold repair was changed by the LBMA gold value in a bid to extend gold value transparency. The twice-a-day course of, operated by the ICE Benchmark Administration, nonetheless entails quite a lot of banks collaborating to set the gold value, however the system is now digital.

Nonetheless, manipulation has on no account been eradicated, as a 2020 nice on JPMorgan (NYSE:JPM) exhibits. The following 12 months, chat logs have been launched in a spoofing trial for 2 former valuable metals merchants from the Financial institution of America’s (NYSE:BAC) Merrill Lynch unit. They present a dealer bragging about how simple it’s to control the gold value.

Gold market contributors have persistently spoken out about manipulation. In mid-2020, Chris Marcus, founding father of Arcadia Economics and writer of the guide “The Large Silver Brief,” stated that when gold fell again beneath the US$2,000 mark after hitting near US$2,070, he noticed similarities to what occurred with the gold value in 2011.

Marcus has been following the gold and silver markets with a spotlight particularly on value manipulation for practically a decade. His recommendation? “Belief your intestine. I imagine we’re witnessing the final word ’emperor’s actually bare’ second. This isn’t complicated monetary evaluation. Typically I consider it as the best hypnotic thought experiment in historical past.”

Investor takeaway

Whereas we now have the reply to what the best gold value ever is as of now, it stays to be seen how excessive gold can climb, and if the valuable metallic can attain as excessive as US$5,000, US$10,000 and even US$40,000.

Even so, many market contributors imagine gold is a should have in any funding profile, and there’s little doubt buyers will proceed to see gold value motion making headlines this 12 months and past.

That is an up to date model of an article first revealed by the Investing Information Community in 2020.

Don’t overlook to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Melissa Pistilli, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the data reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

From Your Website Articles

Associated Articles Across the Internet