Erik Isakson

Vertiv Holdings (NYSE:VRT) stays one of many massive AI winners that hasn’t actually seen enormous advantages to the enterprise. The AI infrastructure firm has reported large order progress, however the prime line is not seeing an enormous profit. My funding thesis stays Bearish on the inventory after the latest massive rebound.

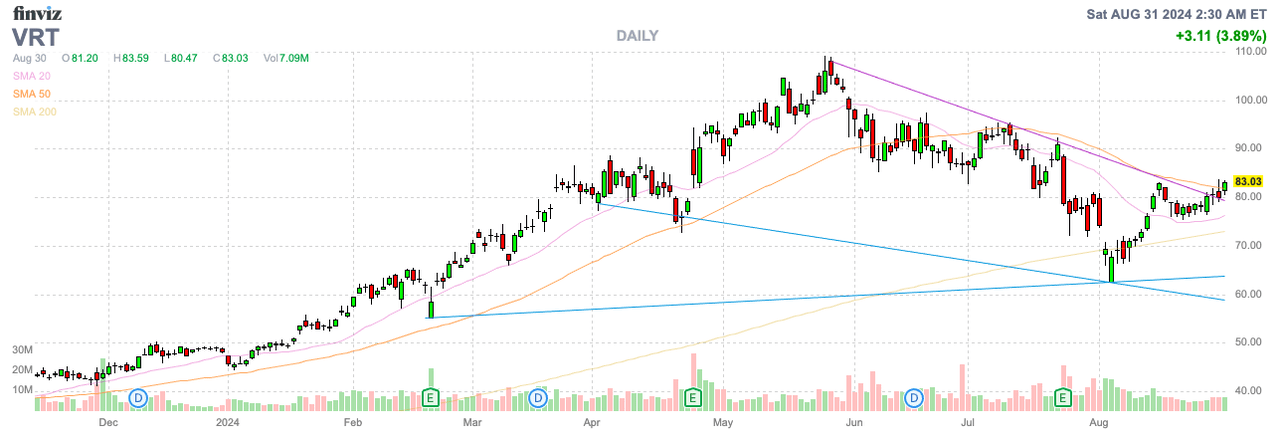

Supply: Finviz

Booming Orders

Vertiv has surged from $10 again in 2022 to over $80 now attributable to surging orders. The corporate reported a large 57% increase in natural Q2 orders, with complete orders up 37% on a trailing 12-month foundation.

AI information middle demand is surging, however Vertiv was solely capable of hike revenues steering for the yr by a minimal $50 million. A giant motive for that is that orders have elongated and can now begin declining within the upcoming quarters

The corporate reported Q2’24 gross sales grew 14% to $1.95 billion, however the massive order progress was for a number of years. On the Q2’24 earnings name, the CFO summarized the order progress as follows:

As a consequence, loads of the orders are for future years, and we be ok with how 2025 is shaping. Pipeline, orders, backlog, all three are optimistic in the identical route, and we like what we’re seeing.

Vertiv forecasts a decline within the sequential orders in Q3, with the 12-month orders progress remaining within the 30s vary. The actual secret’s the lengthening of the order e-book timeline, which the corporate hasn’t confirmed by way of any metrics exterior of not mountain climbing any income progress targets.

The info middle infrastructure firm advantages extra from constructing of the brand new information facilities associated to energy and cooling options, particularly the large give attention to liquid cooling expertise. Whereas Nvidia (NVDA) reported 122% gross sales progress attributable to surging GPU information middle demand and Tremendous Micro (SMCI) forecasts a roughly doubling of gross sales within the present FY regardless of the difficulty with submitting the 10-Okay on time, Vertiv would not profit in the identical means with energy and cooling gross sales demand rising, however not on the similar ratio because the GPUs and servers.

The inventory has surged as a result of AI pleasure and to the elevated gross sales boosting margins. Vertiv reported working margins jumped 510 foundation factors to 19.6%. The corporate will not see the identical step-up margin progress going ahead.

Vertiv guided to Q3 adjusted working margins in the identical 19.6% vary and annual margins at simply 18.7%. The corporate might need a tough time pushing a lot above 20% margins sooner or later, with solely low double-digit gross sales progress charges.

Too A lot AI Hype

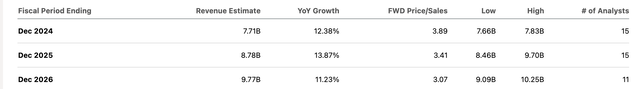

The consensus analyst estimates solely have gross sales rising ~14% in 2025 following progress topping 12% in 2024. The targets are just for 11% progress in 2026 in an indication of how the large order progress and surging AI GPU chip demand is not resulting in large progress for different AI infrastructure provided by Vertiv.

Supply: Searching for Alpha

The corporate is forecast to earn $2.50 per share this yr, with a giant EPS soar subsequent yr to succeed in $3.23. The inventory trades at about 26x EPS targets for 2025, whereas the large soar would not seem warranted based mostly on the minimal progress charges.

Vertiv might want to generate working margins of 20% in 2025 to generate the web revenue to supply the $3.23 EPS. The market wants the corporate to hit this goal with the intention to warrant the present inventory worth, a lot much less warrant additional upside.

The corporate has seen the market cap soar to over $31 billion, whereas the corporate is simply forecast to supply free money circulation this yr within the $900 million vary. The corporate undoubtedly advantages from surging AI demand, particularly with the problems tied to energy consumption and the wants to make use of cooling expertise to decrease the facility calls for, however precise gross sales progress is not that spectacular.

Takeaway

The important thing investor takeaway is that Vertiv simply is not the easiest way to play the AI increase. The corporate would not seem to have the capability for substantial upside, with low double-digit progress charges anticipated regardless of the orders and booming demand.

Traders ought to use the latest rally to unload the inventory, because the market seems to have once more bought too enthusiastic about massive progress in orders with none clear understanding that these orders are for a number of years and never an indication of accelerated progress charges.