Alvin Man/iStock Editorial through Getty Photos

I not too long ago coated Aukland Airport and from there it is just a small step to additionally cowl Air New Zealand. It needs to be saved in thoughts that it is a fully totally different enterprise in comparison with airports which in my opinion have a decrease danger profile. So, Air New Zealand would be the topic of this report during which I’ll talk about the latest earnings, the dangers and alternatives and supply a inventory value goal in addition to a score for the inventory.

Air New Zealand: Challenges To Revenues And Prices

Air New Zealand

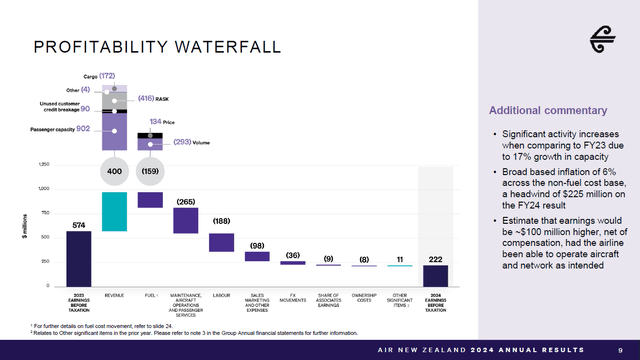

The chart with the profitability waterfall is one thing that I do love, as a result of it fairly clearly reveals how any modifications in profitability attributable to revenues stacked in opposition to prices in comparison with final 12 months. Whole revenues climbed 7% to $6.75 billion NZD on a 17% enhance in cargo and passenger capability. Passenger revenues elevated 11% to $5.9 billion NZD on a 23% enhance in passenger capability, displaying that a lot of the capability progress was offset by weakening in unit revenues. Passenger unit revenues decreased 11%. Cargo revenues declined 27% to $459 million NZD whereas contract companies and different revenues remained kind of steady. This led a $400 million NZD carry to EBIT. Nevertheless, this was absolutely offset by larger gas prices pushed by larger consumption and better pricing, and better working prices together with upkeep and labor in addition to larger gross sales prices leading to EBIT to say no 61% to $222 million NZD. As a result of plane supply delays, there was a $100 million NZD influence on the earnings.

On unit income decline of 11% decline in unit revenues excluding breakage of buyer credit, the unit prices declined by 1.6% and elevated by 0.6% on adjusted foundation which excludes gas value actions, overseas trade charges and third-party upkeep to indicate the working price effectivity with unit prices with solely the gas prices excluded elevated 6%. So, what the outcomes of Air New Zealand confirmed is what we see with many airways and that’s vital capability additions to stay aggressive with different airways thereby eroding unit revenues.

What Are The Dangers And Alternatives For Air New Zealand?

The dangers and alternatives are the identical for Air New Zealand as they’re for different airways. The chance to the highest line is the continued weakening in unit revenues with out benefiting from higher mounted price absorption as prices within the business base stay elevated. Moreover, fluctuations in gas costs pose a danger in addition to continued delays in deliveries of recent fuel-efficient airplanes. Any reversal of that danger would clearly present a possibility for bettering outcomes or on the very least for the margins to be much less pressured.

Air New Zealand Inventory Is A Promote

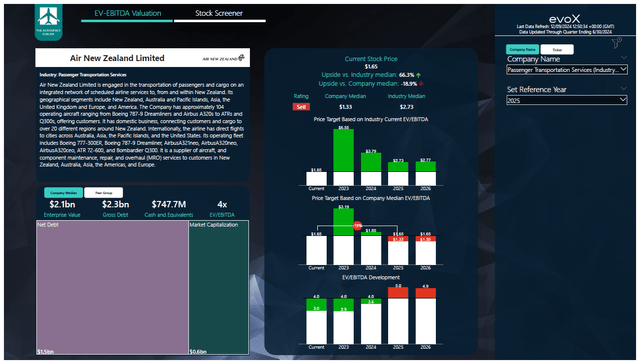

The Aerospace Discussion board

To find out multi-year value targets The Aerospace Discussion board has developed a inventory screener which makes use of a mixture of analyst consensus on EBITDA, money flows and the latest stability sheet information. Every quarter, we revisit these assumptions, and the inventory value targets accordingly. In a separate weblog I’ve detailed our evaluation methodology.

I don’t think about Air New Zealand inventory enticing for funding as EBITDA is predicted to lower additional in FY25 and free money circulation is predicted to be destructive within the coming two years, which I consider would require the corporate to borrow cash whereas the demand setting stays difficult and working prices are elevated. None of this makes for a compelling risk-reward profile and I mark the inventory a promote.

Conclusion: Air New Zealand Holds Little Worth

The outcomes that Air New Zealand posted for FY24 clearly confirmed the pressures on unit revenues and an incapacity to meaningfully cut back unit prices whereas dramatically rising capability. Within the years forward, we don’t see EBITDA get better considerably till FY26 and within the meantime the corporate will probably must borrow extra money to fund the CapEx. Because of this, I don’t see a compelling funding case for Air New Zealand inventory.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.

In order for you full entry to all our stories, information and investing concepts, be a part of The Aerospace Discussion board, the #1 aerospace, protection and airline funding analysis service on Searching for Alpha, with entry to evoX Knowledge Analytics, our in-house developed information analytics platform.