1. Bitcoin teases all-time excessive

Bitcoin recovered over the weekend from a dip final Friday, climbing above US$69,000 by Monday (October 28), fueled by rising optimism that Donald Trump will win the upcoming election, as mirrored in his favorable odds on betting platforms. This surge widened Bitcoin’s dominance to virtually 60 p.c, its highest since March 2021, fueled by sturdy ETF inflows.

The rally continued Tuesday (October 29), pushing Bitcoin previous the elusive US$70,000 it had been caught beneath for weeks to US$71,540. By Wednesday (October 30) it was close to its all-time excessive, hitting US$73,295. This triggered some liquidations, however sturdy exchange-traded fund inflows steered continued demand.

Bitcoin efficiency, October 26 to November 1, 2024.

Chart by way of CoinGecko.

Nonetheless, profit-taking on Thursday led to a selloff, driving Bitcoin’s value under US$70,000.

The following 24 hours had been marked by excessive volatility, with Bitcoin’s value swinging from US$68,840 to US$71,500 and again to US$69,350 in lower than a day. By the tip of the buying and selling week, Bitcoin closed at US$69,284, reflecting a 4.39 p.c lower from its highest level this week.

2. Blended ends in tech earnings reviews

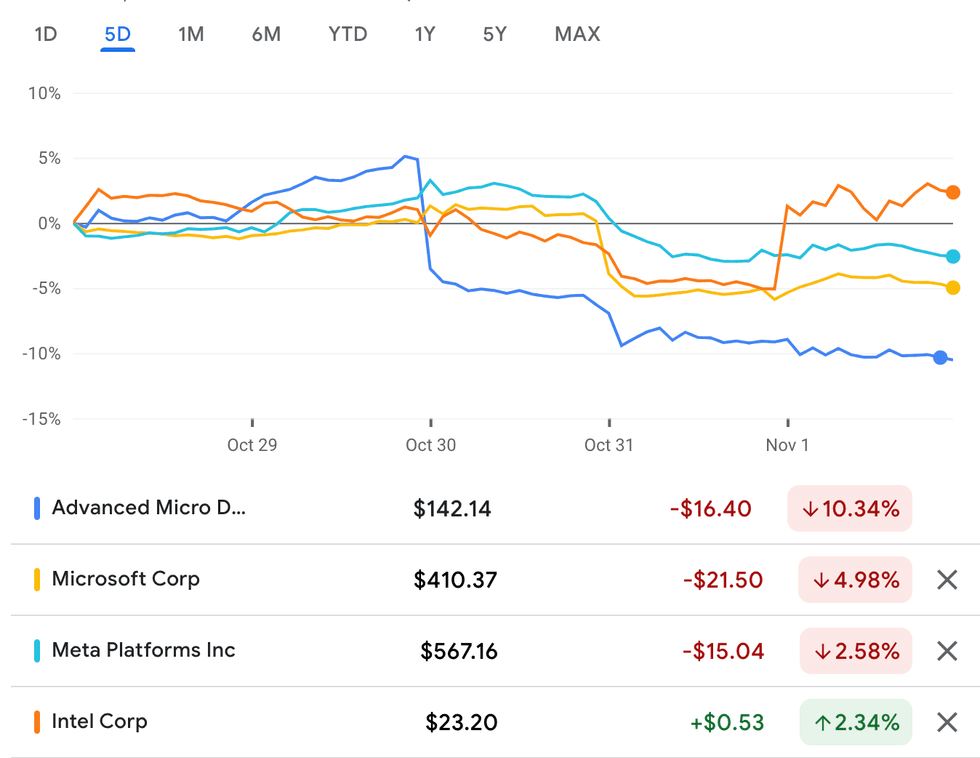

This week’s tech earnings reviews had been a blended bag, with most firms going through investor skepticism. AMD (NASDAQ:AMD), the first to report on Tuesday (October 29), noticed its share value decline attributable to a lower-than-expected gross sales forecast, regardless of exceeding income predictions and demonstrating progress in gross sales of its knowledge middle chips.

Equally, Microsoft’s (NASDAQ:MSFT) sturdy income progress was overshadowed by issues a few slowdown in its Azure cloud enterprise. Executives attributed the lower to capability constraints moderately than decreased demand, however it wasn’t sufficient to appease buyers who despatched its share value down by three p.c after hours.

AMD, Microsoft, Meta Platforms and Intel efficiency, October 28 to November 1, 2024.

Chart by way of Google Finance.

Apple (NASDAQ:AAPL), regardless of reporting its highest quarterly income progress in two years, disenchanted buyers with its gross sales forecast, following a lackluster reception to its restricted AI characteristic launch. Apple shares are down 4.54 p.c for the week.

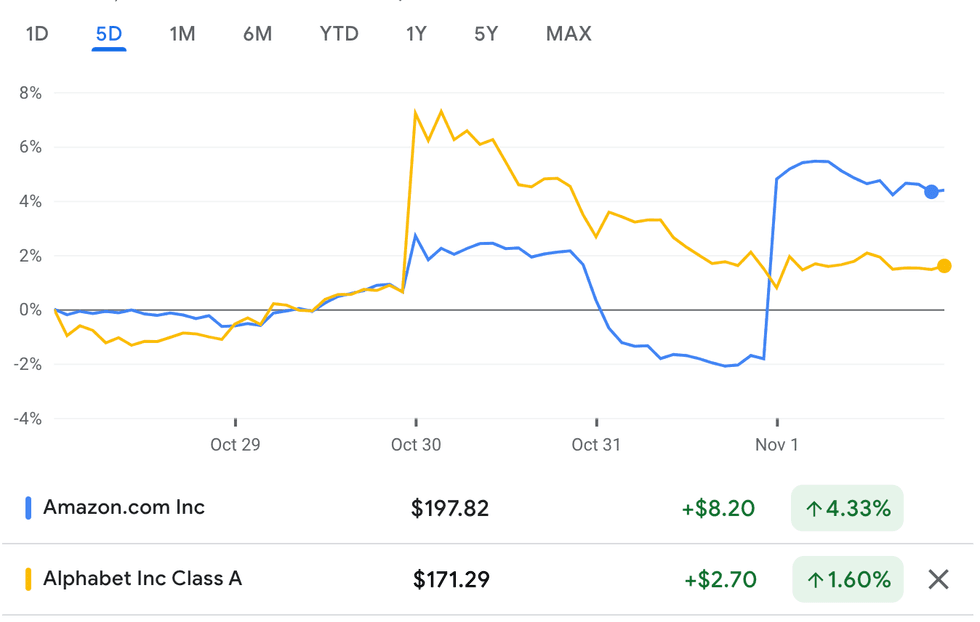

Each Amazon and Alphabet (NASDAQ:GOOGL) reported sturdy general income progress, with their cloud computing companies as a key progress driver. Alphabet was buying and selling barely forward main as much as the discharge of its Q3 report, which revealed a rise in whole income to US$88 billion, 15 p.c larger than final 12 months’s Q3 and beating estimates of US$86.44 billion. The first contributor to Alphabet’s progress was its Google Cloud enterprise, which expanded by 39 p.c. This progress was fueled by AI, which attracted new customers and elevated engagement with present ones.

Conversely, search advert progress decelerated, lowering by 12 p.c in comparison with the earlier quarter’s 14 p.c decline. Capital expenditures, which have set a working price of round US$13 billion per quarter this 12 months, are set to extend in 2025, though progress will doubtless be smaller than it was in 2024, which can have eased buyers’ worries that spending on AI will eat into the corporate’s earnings.

Amazon and Alphabet efficiency, October 28 to November 1, 2024.

Chart by way of Google Finance.

Later, on Thursday night, Amazon’s Q3 report confirmed 50 p.c progress in Amazon Net Providers’ quarterly working revenue to US$10.4 billion. Income additionally elevated by 19 p.c to US$27.5 billion. Buyers appeared unconcerned about Amazon’s vital capital expenditures, sending its shares up 6.75 p.c on Friday morning.

That is doubtless as a result of AWS’s generative AI enterprise is quickly increasing. Andrew R. Jassy, president and CEO of Amazon, defined throughout a convention name that AWS’ AI section is rising at a triple-digit price, exceeding even AWS’s early progress trajectory.

Then again, Meta’s (NASDAQ:META) 4.19 p.c share value dip was triggered by plans for elevated capital expenditure and anticipated losses in its AI division, highlighting rising investor impatience with the corporate’s bold spending on AI ventures, particularly as its cloud enterprise hasn’t generated the earnings seen by Amazon, Alphabet and Microsoft to offset these losses.

Lastly, after a disastrous efficiency in Q2, Intel (NASDAQ:INTC) managed to revive some investor confidence. Its Q3 outcomes beat analysts’ expectations, regardless of reporting a 6 p.c decline in quarterly income to US$13.28 billion and losses of US$16.6 billion, arising from the corporate’s ongoing restructuring efforts. The corporate’s inventory is up 2.34 p.c for the week.

3. Apple’s week of product launches

Apple had a busy week of product rollouts, beginning with the launch of Apple Intelligence on October 28 (Monday). Nonetheless, the preliminary launch proved underwhelming attributable to its restricted performance, providing solely AI enhancements to Photographs and Writing instruments. Most extremely anticipated options are delayed till December, and customers are required to be a part of a waitlist to realize entry to them.

Apple additionally launched its new line of iMacs that includes M4 chips and built-in Apple Intelligence, which did not garner enthusiasm. Apple ended the buying and selling day barely under its opening value.

Tuesday noticed the launch of the brand new Mac mini, a compact 5×5 inch desktop designed for flexibility; the pc is offered as a stand-alone product and is appropriate with non-Apple peripherals, permitting customers to design their very own system by including their most well-liked show, keyboard and mouse. This product launch resulted in a marginal improve in its share worth.

On October 30 (Wednesday), Apple launched the highly effective M4 Professional and M4 Max chips, designed for high-performance customers with larger reminiscence bandwidth and extra GPU cores than the usual M4. Nonetheless, within the lead-up to the corporate’s Q3 earnings report on Thursday, Apple’s share worth dipped by over one p.c.

General, Apple’s inventory worth has decreased by 4.54 p.c this week.

4. Tremendous Micro Pc faces monetary turmoil

Shares of Tremendous Micro Pc (NASDAQ:SMCI) are down a whopping 45.5 p.c this week after the California-based server maker disclosed that world accounting agency EY had resigned.

The agency cited points with the corporate’s monetary reporting as the rationale for terminating the connection, saying it had recognized points that raised issues in regards to the Audit Committee’s representations. The information was reported by Reuters on Wednesday and resulted in a 33 p.c drop in Tremendous Micro’s share value.

Tremendous Micro Pc, whose valuation peaked in 2024 at US$118.81 mid-March and was up over 65 p.c year-to-date earlier than this story broke, disagrees with the agency’s findings; nevertheless, buyers appear to be airing on the aspect of warning, as this newest growth provides to a collection of unanswered questions surrounding the corporate’s monetary reporting.

Tremendous Micro delayed submitting its annual report in late August to evaluate its inside controls over monetary reporting after Hindenburg Analysis made claims of potential account manipulation. Tremendous Micro then employed a particular committee to analyze the matter, which EY stated it may “not depend on” in a current submitting with the US Securities and Alternate Fee. The US Division of Justice reportedly additionally started an investigation into the corporate in September, based on a report by the Wall Avenue Journal.

5. Google Cloud positive aspects a brand new associate

Google Cloud introduced a partnership with web3 infrastructure supplier MANTRA on Tuesday.

Underneath the phrases of the deal, Google Cloud will function the first validator and infrastructure supplier for the MANTRA Chain, a Layer-1 blockchain designed to facilitate the tokenization of real-world property (RWAs). MANTRA Chain will likely be built-in into Google Cloud’s Web3 portal, giving builders the instruments they should construct RWA options on the platform. The partnership goals to drive the adoption of RWAs in industries like finance and actual property.

Moreover, MANTRA and Google Cloud are launching MANTRA Incubator in 2025, an accelerator program to assist real-world asset tokenization tasks with assets and experience.

This settlement presents a probably profitable income stream for Google Cloud and strengthens the corporate’s presence within the Web3 area. As the first validator for MANTRA, Google Cloud will earn rewards for validating transactions and securing the community. Because the MANTRA Chain grows and handles extra transactions, Google Cloud’s income will doubtless improve.

This collaboration marks a major step for each firms, highlighting the rising curiosity and potential of blockchain expertise in remodeling conventional industries.

Do not forget to observe us @INN_Technology for real-time information updates!

Securities Disclosure: I, Meagen Seatter, maintain no direct funding curiosity in any firm talked about on this article.