Arizona Lithium Restricted (ASX: AZL, AZLO, OTC: AZLAF) (“Arizona Lithium”, “AZL” or “the Firm”), an organization targeted on the sustainable growth of two giant lithium growth tasks in North America, the Prairie Lithium Challenge (“Prairie”) and the Large Sandy Lithium Challenge (“Large Sandy”), is happy to supply a progress replace for the business scale proof of idea facility at Pad #1 and additional outlay the event plan for the Prairie Challenge. The Prairie Challenge might be put into manufacturing throughout three phases of growth. Phases I, II, and III symbolize the methodical steps being taken to cost-effectively deliver the venture into manufacturing whereas minimising the chance related to commercialising a first-of-its-kind course of.

HIGHLIGHTS

- Up to date strategic phased growth plan has been carried out for the Prairie Lithium Challenge.

- Section I’ll see the Prairie Lithium Challenge go into manufacturing at Pad #1 utilizing a commercial-scale DLE unit able to producing 150tpa of Lithium Carbonate Equal (LCE).

- To get into manufacturing, solely AUD35m (USD22m) required to spend on Section 1 CAPEX.

- Non-dilutive capital initiatives presently being thought of with a number of potential strategic companions finishing in depth due diligence on the Prairie Lithium Challenge, along with current Authorities grants and loans being thought of in addition to conventional debt financing options.

- First business manufacturing marks the primary Firm in North America to achieve this milestone.

- De-risking by a business scale proof of idea permits manufacturing to be elevated by speedy replication of the method at Pad #1.

- Development work will begin at Pad #1 in Q2 2025.

- Section 2 will instantly increase the power with further commercial-scale DLE items. Further items could be quickly deployed to extend manufacturing at Pad #1. Section III will see the Pad design replicated throughout the already drilled and de-risked Pad #2, and Pad #3. Further Pad areas are additionally being finalised in 2025.

- Gray Owl Engineering has been engaged for facility engineering, procurement, and building (EPC). Gray Owl is a number one Western Canadian oil & gasoline services engineering firm.

- The Prairie Lithium Challenge in Canada is completely positioned to feed battery-grade lithium carbonate into the mature Asian battery market. Battery-grade samples produced from the Prairie venture are presently being distributed and examined in Asia.1

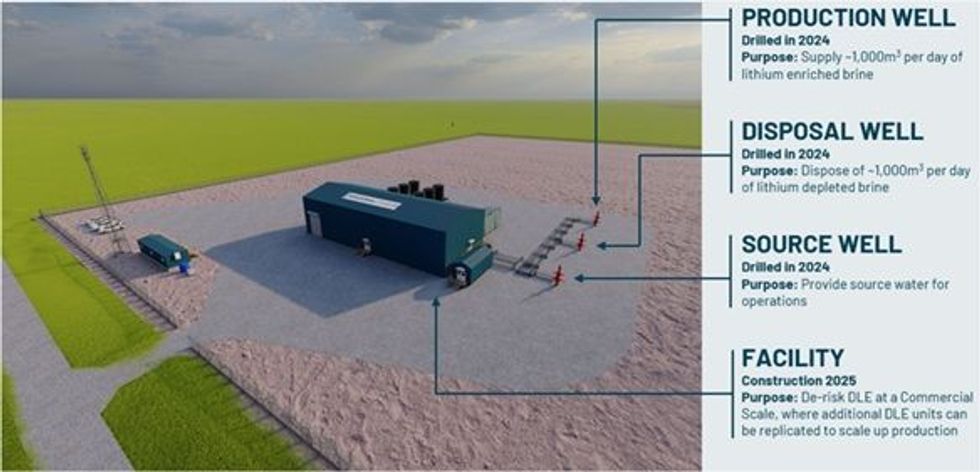

Section I’ll see the venture go into manufacturing at Pad #1 utilizing a commercial-scale Direct Lithium Extraction (“DLE”) unit able to producing 150 Tonnes Per Annum (“TPA”) Lithium Carbonate Equal (“LCE”). The lithium produced might be used to de-risk finish market alternatives the place battery-grade samples are presently being examined by teams in Asia. Section I’ll course of brine at a price of roughly 1,000m3 per day. It’s essential to course of uncooked brine at this business scale to de-risk the temperature, strain and chemical constituents of the brine whereas feeding a business scale DLE unit 24 hours per day, 7 days every week. A video rendering of Section I at Pad #1 has been ready and could be seen right here: https://youtu.be/mUNExsUBjfo

This can symbolize one of many world’s largest DLE services and supply the steering required to scale up manufacturing cost-effectively throughout the Prairie Challenge shortly thereafter. Upon commissioning and working at this scale, the Firm may have considerably de-risked the method and proceed to Section II.

Section II will see the instant enlargement of manufacturing on Pad #1. Section II enlargement will spotlight the advantages of modularised scale-up as further commercial-scale DLE items might be quickly deployed. Further wells will even be drilled to maximise manufacturing from Pad #1.

Section III will see the replication of the wells and facility at Pad #1, utilized to Pad #2, Pad #3 and extra Pads which might be presently being recognized.

Determine 1: Rendering of web site structure and facility for Section I at Pad #1

Determine 1: Rendering of web site structure and facility for Section I at Pad #1

Arizona Lithium Managing Director, Paul Lloyd, commented:“We’re excited to share further particulars about our plans for the Prairie Challenge. In 2023, a PFS was launched that highlighted lithium manufacturing throughout three pad areas from the Prairie Challenge. In 2024, we partnered with three landowners to safe the three pad areas and instantly went to work allowing and clearing the bottom for the pads. A serious drilling program was then executed throughout these three pads, which considerably de-risked the venture and put us ready to proceed growth towards manufacturing. 2025 might be a 12 months of facility building and commissioning Section I at Pad #1. Our phased growth plan clearly articulates how we are going to proceed to de-risk and develop the venture. Modularisation permits speedy and cost-effective scale-up to extend manufacturing in Section II and III.”

In regards to the Prairie Lithium Challenge

AZL’s Prairie Lithium Challenge is situated within the Williston Basin of Saskatchewan, Canada. Positioned in one of many world’s high mining pleasant jurisdictions, the venture has easy accessibility to key infrastructure together with electrical energy, pure gasoline, contemporary water, paved highways, and railroads. The venture additionally goals to have robust environmental credentials, with Arizona Lithium focusing on to make use of much less freshwater, land and waste, aligning with the Firm’s sustainable method to lithium growth.

Click on right here for the total ASX Launch

This text contains content material from Arizona Lithium, licensed for the aim of publishing on Investing Information Australia. This text doesn’t represent monetary product recommendation. It’s your duty to carry out correct due diligence earlier than appearing upon any info offered right here. Please check with our full disclaimer right here.