Seize your espresso…

Whereas this is probably not the perfect matter to interrupt out at your upcoming household BBQ or church espresso hour, I promise it’s going to provide you one thing to consider — and a potential technique so as to add a little bit juice to your portfolio.

I used to be attending our quarterly Banyan Hill brainstorming session earlier this month, and a colleague and I began discussing the distinction between “optimistic skew” and “destructive skew” methods.

They every provide very completely different return profiles that, in easy phrases, seem like this:

- Unfavorable skew: plenty of small winners, a couple of giant losses.

- Constructive skew: plenty of small losses, a couple of giant winners.

They’re mirror photographs of one another.

One just isn’t objectively “higher” than the opposite. You’ll be able to put $10,000 right into a negative-skew technique and one other $10,000 in a positive-skew technique and find yourself with $15,000 from each as a result of the skewness of every technique doesn’t converse to its return over time.

As a substitute, skewness speaks to the “path” of these returns, and thus the expertise an investor has whereas investing in a technique.

Constructive- and Unfavorable-Skew Methods

For example, a buy-and-hold technique of the broad inventory market (i.e., S&P 500) is a negative-skew technique.

It suits the “plenty of small winners, a couple of giant losses” return profile as a result of most days, weeks, months and years … the inventory market edges greater (aka small wins) — however often, inventory costs fall sharply decrease in a short while, handing buyers outsized losses.

Since so many buyers are already invested in negative-skew methods, including a positive-skew technique to the combo is a pleasant complement, since they are usually lowly or negatively correlated. That dampens general volatility on the portfolio degree with out sacrificing returns.

That mentioned, it requires self-discipline and a cool head to comply with many positive-skew methods. Analysis from the Nobel prize-winning behavioral psychologist Daniel Kahneman suggests that is the case as a result of we people downplay “giant, impactful” occasions in our minds (whether or not destructive or optimistic) when recounting historical past.

Unfavorable-skew methods, like purchase and maintain, lead buyers to attenuate or downplay the giant and impactful, however short-lived, shedding intervals they’ve suffered previously.

They see the continuous drip of “small winners” at face worth, and effectively definitely worth the occasional agony of bear markets and crashes, that are finally given diminished significance.

We see that enjoying out now as nearly two-thirds of U.S. adults age 65 and older proceed to carry fairness in shares, regardless of the brutal bear market we simply went by. That’s up from round half earlier than the 2008 monetary disaster, in response to The Wall Avenue Journal.

However, the massive winners of positive-skew methods come alongside solely often. And in response to Kahneman, we additionally finally downplay the significance of these giant winners in our minds, and as a substitute disproportionately bear in mind and really feel the ache of the long-lasting durations of losses {that a} positive-skew technique tends to endure.

All informed, most mortals have a more durable time sticking to a positive-skew technique, reminiscent of diversified trend-following commodity buying and selling advisors, than they do sticking to a negative-skew technique, like purchase and maintain the inventory market.

Everyone seems to be completely different, however for me, it simply takes an understanding of the technique I’m buying and selling to keep it up … and prudent position-sizing, too, in fact.

And that’s the place I are available in with the most recent characteristic of my premium service Max Revenue Alert — the reside commerce room.

Rinse and Repeat

If you happen to’ve been studying The Banyan Edge, or following my work at my Cash & Markets dwelling base, you’ve doubtless heard of my Wednesday Windfalls technique.

This positive-skew technique relies on calendar patterns. These are common, exploitable patterns that are likely to repeat themselves every week. Right here’s a fast breakdown:

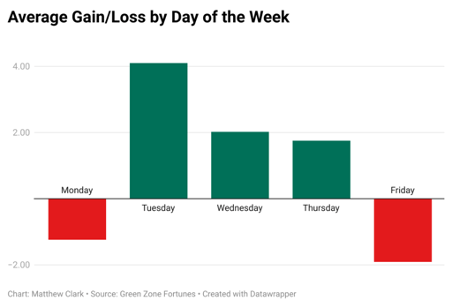

- Mondays and Fridays are usually weaker and traditionally present losses on common.

- Tuesdays, Wednesday and Thursdays are optimistic on common.

- The best returns occur on Tuesdays.

Why is that this the case? We are able to solely hypothesize.

Maybe merchants take earnings on Fridays to keep away from having publicity over the weekend. Possibly, contemporary off the weekend, buyers make portfolio adjustments on Mondays after which reallocate on Tuesdays.

There isn’t a definitive reply. However the sample may be very actual, and this sample is on the core of my Wednesday Windfalls buying and selling technique.

It’s a easy, two-day method to buying and selling. You’re in on Monday afternoon at 2 p.m. Japanese time … and out once more 48 hours in a while Wednesday. And we comply with this similar sample every week.

If you happen to’re searching for a option to complement your typical negative-skew buy-and-hold means of inventory investing, my Wednesday Windfalls technique is an ideal match.

And that’s the place my brand-new Commerce Room is available in.

Each Monday that markets are open, from 10:30 a.m. to 11:30 a.m. Japanese time, my chief analysis analyst, Matt Clark, and I be a part of tons of of buyers such as you to have an open dialogue about Wednesday Windfalls trades.

We stroll by potential indicators for that week, assessment previous trades, give insights into the broader technique and reply any questions our unbelievable subscribers have.

Consider it as a possibility to study extra about buying and selling, and a preview of the week’s motion earlier than I ship my Wednesday Windfalls suggestions in a while Monday at 2 p.m. Japanese time.

We’re nonetheless within the early levels, however I’ve been actually impressed by the information everyone seems to be bringing to the desk. It’s a neighborhood that provides plentiful alternatives to study and develop your investing toolkit.

If that appears like one thing you need to partake in, I encourage you to click on right here for extra data. The commerce room is only one facet of my Max Revenue Alert premium service, however it might be an important hour of my week.

See you tomorrow morning!

To good earnings,

Adam O’Dell

Adam O’Dell

Chief Funding Strategist, Cash & Markets