Andrii Yalanskyi

Thesis

Ginkgo Bioworks Holdings, Inc. (NYSE:DNA) lately signed a five-year partnership with Google Cloud (GOOGL). This partnership will present Ginkgo with a lot wanted funding and assist enhance their model recognition. The partnership might end in new sources of income and can assist the corporate bridge the hole to profitability. For these causes, we’re upgrading our score on the corporate to impartial to replicate the decreased danger profile over the short-medium time period.

The Information

You may learn extra about Ginkgo’s press launch relating to their new partnership with Google Cloud by clicking right here.

To summarize the deal, Ginkgo and Google Cloud have entered a strategic five-year cloud and AI partnership. This entails Ginkgo creating new giant language fashions for organic engineering purposes. To do that, the corporate will make use of Google Cloud’s Vertex AI platform. The partnership contains funding from Google Cloud, and in return Ginkgo will make Google their major supplier of cloud providers.

The businesses are in search of to monetize this partnership in a couple of methods. From Google’s viewpoint, they’ll improve the attractiveness of their cloud platform by giving their cloud clients entry to the instruments and analysis that Ginkgo will develop. Within the worst-case state of affairs, the corporate might be getting a few of their a refund by means of Ginkgo paying them to make use of their cloud providers, which has the added impact of boosting their cloud progress numbers. From Ginkgo’s viewpoint, they want to create further income streams to clean out the monetary features of their enterprise. Biosecurity was beforehand a brilliant spot for the corporate however has since tapered off. Ginkgo wants a worthwhile phase to gasoline the expansion of their foundry enterprise, which has an unconventional income mannequin revolving round each up entrance income and milestone funds. These milestone funds may be far out into the longer term and Ginkgo must fund their enterprise within the meantime. Their upcoming work in growing LLMs and different instruments for organic engineering purposes might present them with a a lot wanted supply of profitability at a time when biosecurity revenues are declining. At worst, Ginkgo will get an extra supply of funding from Google which can prolong their runway.

Here is what the CEOs of Ginkgo and Google Cloud need to say about this partnership.

Jason Kelly, CEO of Ginkgo Bioworks:

We imagine that by partnering with Google Cloud, Ginkgo can supercharge our mission to make biology simpler to engineer. Probably the most urgent challenges of our era require organic options, and we should work out methods to higher leverage our collective capabilities and transfer quicker. With Ginkgo’s automated Foundry to generate giant scale organic information, Google Cloud’s computing horsepower, and Google’s AI experience, I am unable to consider a greater accomplice to scale AI options in organic engineering.

Thomas Kurian, CEO of Google Cloud:

Google Cloud sees important potential within the synergy between AI and biotechnology, and the transformative influence it might probably have on the world. Our strategic partnership with Ginkgo is a first-of-its-kind for Google Cloud, underscoring our confidence that Ginkgo will play a crucial and pioneering function within the life sciences area, leveraging AI to reshape humanity’s understanding of biology.

As of now optimism abounds surrounding the partnership, however the monetary impacts on each events stay to be seen. Ginkgo’s most up-to-date quarterly report confirmed disappointing outcomes. The corporate will finally want to show issues round with a purpose to stay a viable enterprise.

A Disappointing Quarter From Ginkgo Bioworks

In Ginkgo’s Q2 earnings report, the corporate confirmed a decline in income that was disappointing to some traders. On the intense facet, the corporate did handle to considerably enhance their working losses from the 12 months in the past interval. Regardless of this enchancment the corporate stays deeply unprofitable. Whereas Ginkgo does have an ample money pile of $1,105,787,000, it can finally run out if these large working losses are sustained for much longer. For individuals who give attention to money from operations, that determine was unfavorable $164,118,000 for the six months ended June 30. Any approach you slice it Ginkgo wants to enhance the profitability of their enterprise. Their current partnership with Google Cloud might find yourself being precisely what they want. Biosecurity income might additionally choose up once more which might be an added bonus.

Revenue Assertion (Ginkgo Bioworks Second Quarter 2023 Monetary Outcomes)

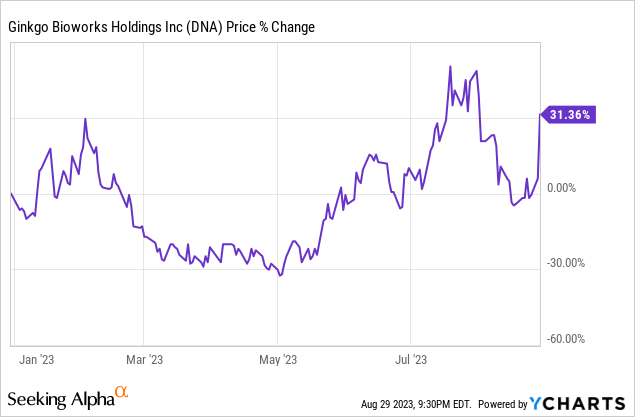

DNA Inventory Value Motion and Valuation

The inventory has gotten a pop off the information, and rightly so. This partnership looks like a win-win and helps to de-risk Ginkgo’s inventory over the short-medium time period.

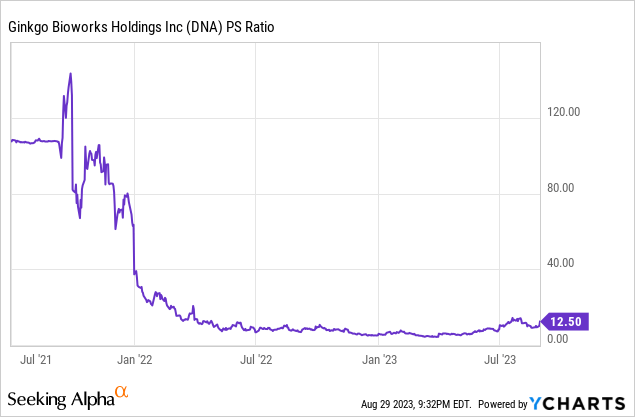

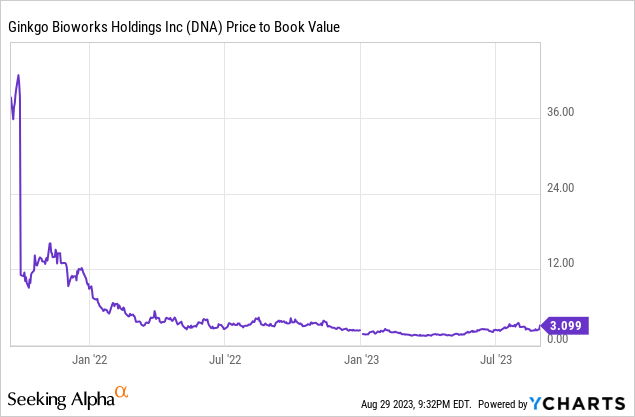

Patrons of the inventory might want to have religion that Ginkgo can speed up their enterprise sooner or later as a PS of 12.5 for a corporation with working margins of -228% appears very costly. At 3x ebook worth with a big money steadiness it is potential that Ginkgo will get acquired for his or her information. This will occur at a a lot lower cost and would possible be the results of sharks smelling blood within the water fairly than an occasion that might profit those that buy the inventory at these costs.

We view the valuation and danger/reward as being exceedingly horrible however the partnership with Google goes a great distance in direction of de-risking the corporate and will present a a lot wanted income and profitability. This is able to bridge the corporate to a degree the place their foundry enterprise can meaningfully speed up. The character of biotech/biotech adjoining firms is one in every of excessive danger and excessive potential reward. For now we’re impartial on the corporate however are looking forward to indicators of additional deterioration within the fundamentals.

The story of Ginkgo might find yourself turning out like Amyris (OTC:AMRSQ), which we coated right here. The story of Amyris is an efficient reminder of how biotech adjoining firms can promote pipe desires and burn by means of money whereas traders give them the good thing about the doubt, all the way in which till the bitter finish. Whereas we predict the elemental image of Ginkgo is at present tenable, the state of affairs might deteriorate quickly and as such we would not be capable of be optimistic on the corporate till they grew to become constantly GAAP worthwhile. Till then the inventory is a no-touch for us.

Dangers

The danger to the bull case for Ginkgo is that they might by no means run a financially viable enterprise and burn by means of all of their money. This is able to end in a low-ball acquisition or a flat out chapter, much like what occurred with Amyris.

The danger to the bear case is that if Ginkgo can create a brand new enterprise line or improve their biosecurity revenues. This is able to give them a profitability bridge to scale their foundry platform. If the corporate can grow to be constantly worthwhile it could punch a large gap within the bear case.

General we predict it is too near name, nonetheless the sheer quantity of horror tales on this sector/business needs to be an indication for traders to proceed with excessive warning. As we talked about earlier, we would not contact this inventory with a ten foot pole till they grew to become constantly GAAP worthwhile. These with a background within the sector might have a greater grasp of the danger/reward than we do and will view this as a shopping for alternative, which we will perceive. Over time we now have seen so many blowups within the area that essentially the most optimistic we may be is impartial.

Key Takeaway

We’ve upgraded our Ginkgo Bioworks Holdings, Inc. score to impartial in gentle of Ginkgo’s new partnership with Google Cloud. This helps to broaden their runway and might result in the creation of a brand new enterprise phase. That being stated, we do not see a compelling motive to purchase the inventory at the moment and would a lot fairly observe from the sidelines till the elemental image meaningfully improves.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.