gorodenkoff/iStock through Getty Photos

Funding Thesis

Inflation is predicted to stay elevated within the close to time period which makes worth shares engaging. The market is shifting in direction of small and mid-cap shares, which may supply interesting returns due to their comparatively low valuation. One of the shares that matches these standards is Benchmark Electronics (NYSE:BHE), a world supplier of digital manufacturing companies (EMS) for numerous industries.

With a market cap of $900 million and a projected income of $2.85 billion for 2023, Benchmark inventory trades at a P/S ratio of solely 0.4, a lot decrease than the S&P 500 common of two.5. This displays the low-margin nature of its business, which limits its profitability. Nevertheless, Benchmark has proven indicators of margin enchancment in latest quarters and expects to ship sturdy EPS progress within the subsequent a number of quarters.

On this article, we are going to clarify how the corporate’s valuation will enhance over time and why we consider Benchmark is a superb purchase for buyers who’re searching for small-cap worth shares with a excessive return potential.

Firm Technique: Give attention to Advanced Merchandise

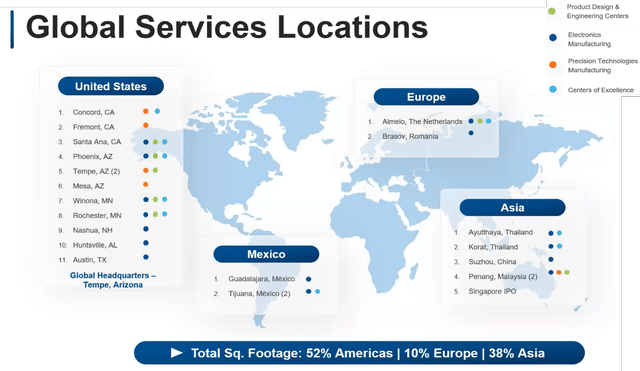

Benchmark Electronics is a world design, engineering and manufacturing firm that operates in 8 nations, has 21 manufacturing areas, 7 world design facilities and 13,500 workers worldwide (see beneath).

Benchmark Electronics World Footprint (Benchmark Electronics)

The corporate is a part of a extremely aggressive EMS business, the place it faces many rivals corresponding to Jabil, Foxconn, Flex, Plexus, and Celestica. The standard traits of those EMS firms are that they function on very low margins, excessive volumes, and quick turnaround occasions. Additionally they should take care of advanced provide chains, dynamic buyer necessities, and strict high quality requirements. To stay aggressive, they should continually put money into new applied sciences, tools, and services. These are all price drivers that scale back the profitability of the EMS firms.

Benchmark’s technique to win in such a aggressive and dynamic business is to go after high-complexity alternatives inside focused sectors, leveraging its superior expertise and design companies. It focuses on advanced options that require larger ranges of engineering, expertise, and manufacturing experience, in addition to larger high quality requirements and regulatory compliance. These merchandise sometimes have larger margins, longer life cycles, and decrease cyclicality than much less advanced merchandise.

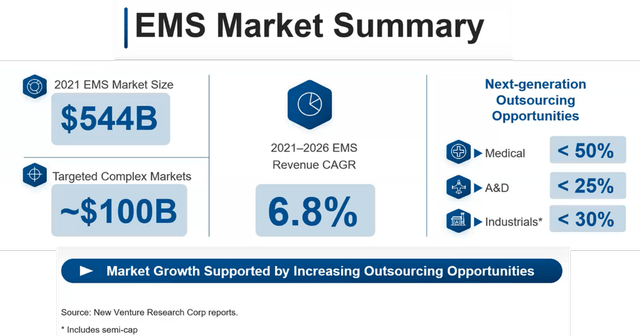

In keeping with the corporate, the advanced EMS market is price about $100 billion in whole (see beneath).

EMS Market Dimension (Benchmark Electronics)

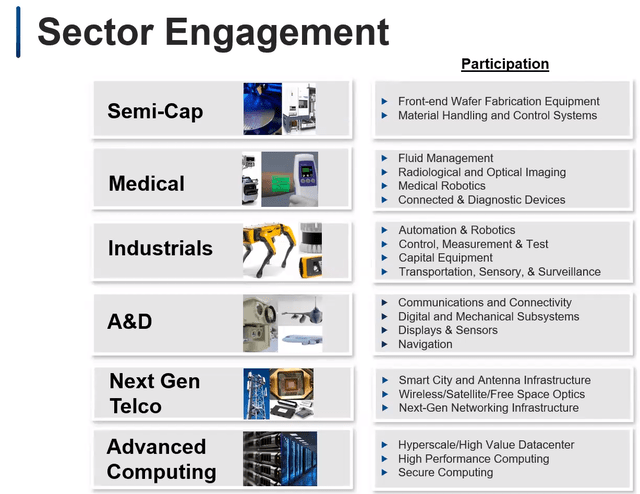

Benchmark Electronics has diversified its portfolio with a multi-sector strategy and focuses on the advanced options inside every sector. The corporate goals to make the most of its world engineering and manufacturing capabilities in essentially the most environment friendly method in direction of these focused sub-sectors and ship high-quality merchandise to its prospects. Benchmark thinks that this technique is a differentiator out there, which we discover compelling. Being extremely focused is at all times a great technique because it drives experience, diminished competitors and longer-term buyer relationships. Beneath you’ll be able to see the listing of market sectors and the sub-sectors that Benchmark is engaged in.

Benchmark Electronics Sectors (Benchmark Electronics)

Monetary Overview –Weak spot in Most Sectors to Proceed

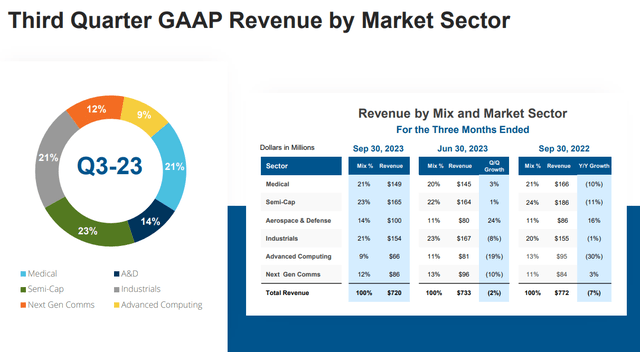

Benchmark segments its enterprise in 6 completely different market sectors. The next desk reveals the Q3 FY2023 income breakdown by sector:

Benchmark Electronics Q3 Earnings Presentation (Benchmark Electronics)

Just like different EMS firms, Benchmark faces a drop in gross sales in most of its segments, apart from A&D and Subsequent Gen Comms, which try to offset the unfavorable impact.

The corporate’s outlook for the fourth quarter of 2023 can also be unfavorable, as most sectors are dealing with stock challenges. As per the firm earnings name, the medical sector income is predicted to say no additional as a result of decrease demand. The semi-cap sector is prone to stay tender till the second half of 2024. The A&D sector, then again, may be very constructive about its future progress, particularly in protection, and anticipates a quicker year-over-year progress in This fall. The industrials sector is experiencing sturdy home demand, however it’s offset by weaker worldwide markets, anticipating in a sequential decline in income. The superior computing sector, which noticed a drop in income as a result of completion of a number of tasks within the first half of the 12 months, is now delivering a brand new HPC program that’s anticipated to drive sequential progress in This fall. And eventually, the next-generation communications sector is projected to be down as a result of undertaking delays and macro points.

In conclusion, the corporate guides for a declining income in This fall. We anticipate this downtrend to proceed in FY2024 H1, in parallel with the continued macro weak spot.

Precedence is Working Margins and Money Move

The corporate realizes that its gross sales progress is constrained by macroeconomic elements, so it focuses on growing its working margin as an alternative. Benchmark goals to reinforce its profitability and generate extra cash movement by streamlining its operations. The corporate believes that free money movement is a key indicator of its monetary well being and efficiency, in addition to its skill to put money into progress alternatives, return capital to shareholders, and scale back debt.

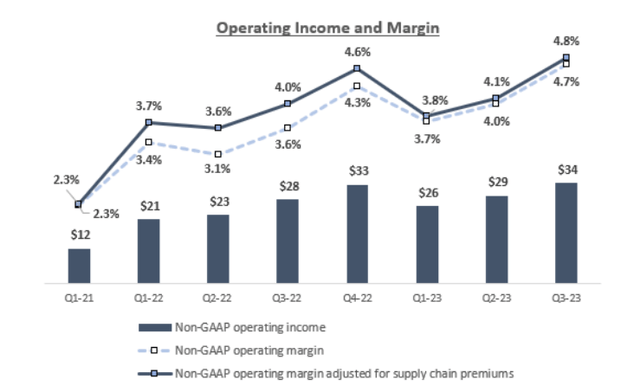

Once we have a look at the working margin trajectory, we are able to see it’s on an uptrend. Firm administration expects This fall margins to be between 4.8% and 5.0%, which is a 7% enhance year-over-year on its midpoint. And with its continued operational efficiencies, it expects its working margin to maintain rising sooner or later.

BHE Working Margins (Benchmark Electronics)

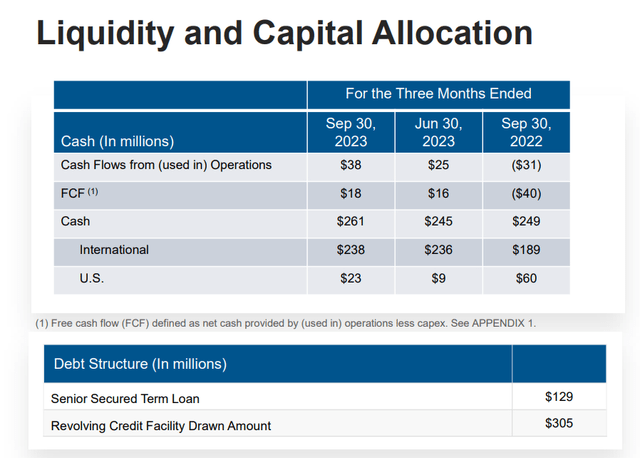

Benchmark additionally improved its free money movement from -$40 million in Q3 2022 to $18 million in Q3 2023, by decreasing its stock ranges (see beneath). It has been producing constructive FCF for the previous two quarters, totaling $34 million and expects to provide greater than $70 million FCF in FY 2023. We anticipate this FCF development to proceed and think about it as a really favorable issue for firm’s valuation.

Liquidity and Capital Allocation (Benchmark Electronics)

Steadiness Sheet Overview

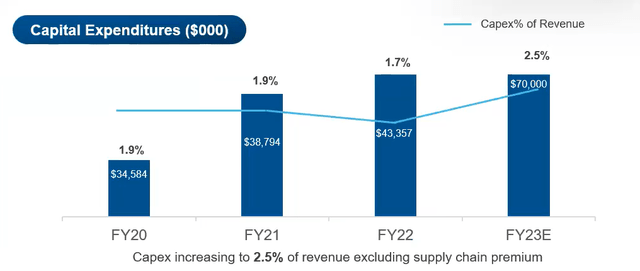

As per its steadiness sheet, Benchmark has elevated its debt stage to fund capex tasks in engineering and provide chain areas. Capex represents at the moment 2.5% of its projected income for FY2023, reflecting its progress ambitions (see beneath).

BHE Capital Expenditures (Benchmark Electronics)

As of September 30, 2023, the corporate had money and money equivalents of $261 million and whole debt of $561 million, leading to a web debt place of $300 million. The corporate’s present ratio is 2.4 and its debt-to-equity ratio is 0.4, indicating it has sufficient liquidity and might meet its short-term and long-term obligations.

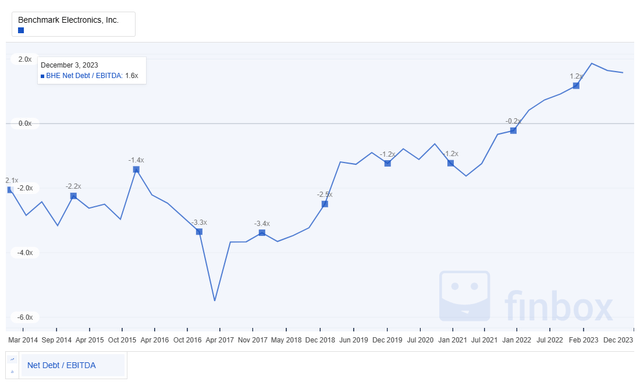

The corporate’s capital construction could seem extremely leveraged, however we consider that the debt is manageable. The leverage ratio of 1.6 will not be too excessive, contemplating the sustained EBITDA progress. We would not have any main concern for Benchmark to handle its debt. See beneath the Internet DebtEBITDA leverage ratio which is on the rise.

Internet DebtEBITDA leverage (Benchmark Electronics)

Valuation

Our funding thesis is that the corporate is enhancing its working margin and money movement era, thereby decreasing its earnings multiples and making it a sexy funding alternative.

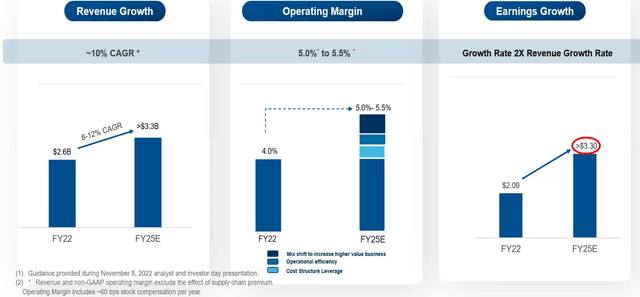

The corporate anticipates its FY 2025 EPS to be at the very least $3.3(see beneath), leading to a ahead P/E ratio of seven.6x. This ratio stands considerably beneath its historic averages. Consequently, we consider that Benchmark Electronics is at the very least 50% undervalued at its present worth stage of $25.

Future Income and Earnings Progress (Benchmark Electronics)

Dangers

Dangers to our valuation are as follows:

Potential Monetary Misery: Benchmark Electronics is taking over extra debt to fund its capex spending. This might worsen its monetary place and constrain its skill to service its debt if the macroeconomic setting deteriorates.

Macro Uncertainties: Benchmark Electronics is a world firm and uncovered to macroeconomic uncertainties, geopolitical conflicts and provide chain disruptions that will have an effect on its buyer demand and operational effectivity.

Competitors: The corporate faces sturdy competitors in a cyclical business. It has to compete with main world contract producers that will affect its market share.

Conclusion

Benchmark Electronics faces progress challenges in its enterprise, as a result of macro slowdown in a few of its goal sectors. The corporate’s leverage has additionally elevated considerably as a result of elevated capex investments. Nevertheless, Benchmark additionally has some constructive facets that aren’t factored in by its present worth.

Its concentrate on operational efficiencies and productiveness is leading to working margin growth and elevated money movement. We predict this margin growth development will drive its valuation larger even when its revenues keep flat within the close to time period. Our ahead P/E valuation implies important upside.

In conclusion, there are constructive elements in Benchmark Electronics enterprise, and we see it as a great worth funding. We price Benchmark as a Purchase.