It’s greatest apply to steadily verify your credit score reviews, which function a form of monetary resume outlining your entire cash issues. Credit score reviews will help you retain observe of your money owed and verify for indicators of identification theft.

Because of the Truthful Credit score Reporting Act (FCRA), you’ll be able to at all times request one free credit score report a 12 months from every of the three massive credit score bureaus — Experian, Equifax and TransUnion — on-line at AnnualCreditReport.com. The three credit score bureaus usually cost for every further report past the free annual one, however due to the pandemic and the financial uncertainty that ensued, you’re now allowed to tug a credit score report without cost every week till no less than Dec. 31, 2023.

Right here’s all the things you must find out about getting your credit score reviews.

Desk of contents:

The best way to get your credit score report

Getting your credit score report is pretty straightforward, and it must be free in nearly all circumstances — particularly till Dec. 31. That makes this a simple private finance job to verify off your listing. Right here’s how you can do it.

The best way to get a free credit score report from AnnualCreditReport.com

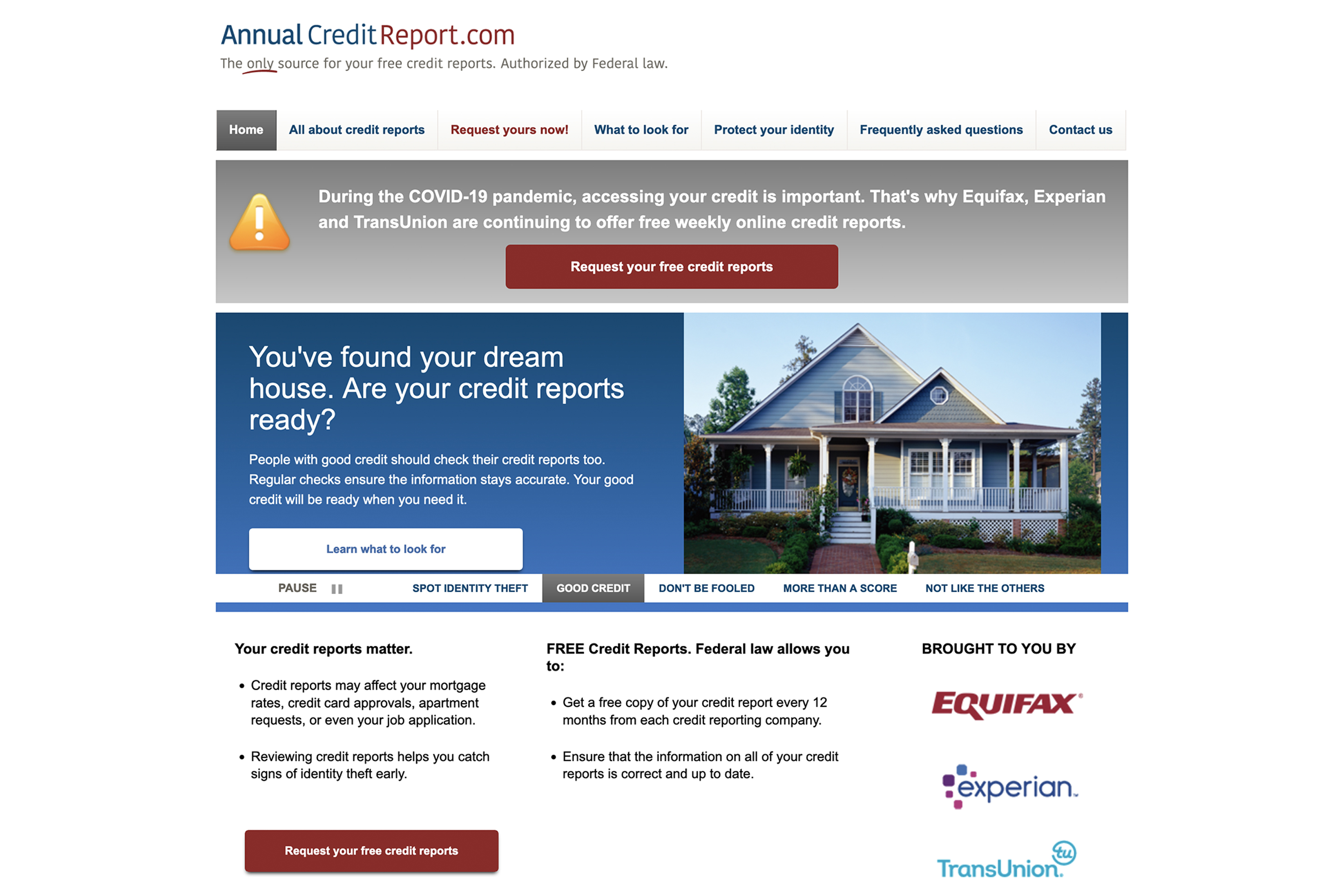

AnnualCreditReport.com is the one web site licensed by the federal authorities to give you your free annual credit score reviews from Equifax, Experian and TransUnion. This web site can also be the place you’ll be able to entry a free copy of your credit score report every week till the top of this 12 months.

When you’re prepared, head to AnnualCreditReport.com on a non-public, safe web connection. Don’t enter delicate data whereas related to public Wi-Fi, even in case you belief the web site. And do make sure that you’re on the right webpage, as there are a lot of look-alike websites that may attempt to harvest your private data.

From the house web page, click on on “Request your free credit score reviews.” You’ll want to finish three most important steps to entry them, which shouldn’t take you greater than 5 or 10 minutes you probably have your entire private data memorized or have the required paperwork close by.

Step one is to fill out an internet request type. You will have to supply the next data:

- Your full title

- Your Social Safety quantity

- Your date of beginning

- Your telephone quantity

- Your present deal with

- And your earlier deal with in case you’ve lived at your present residence for 2 years or fewer

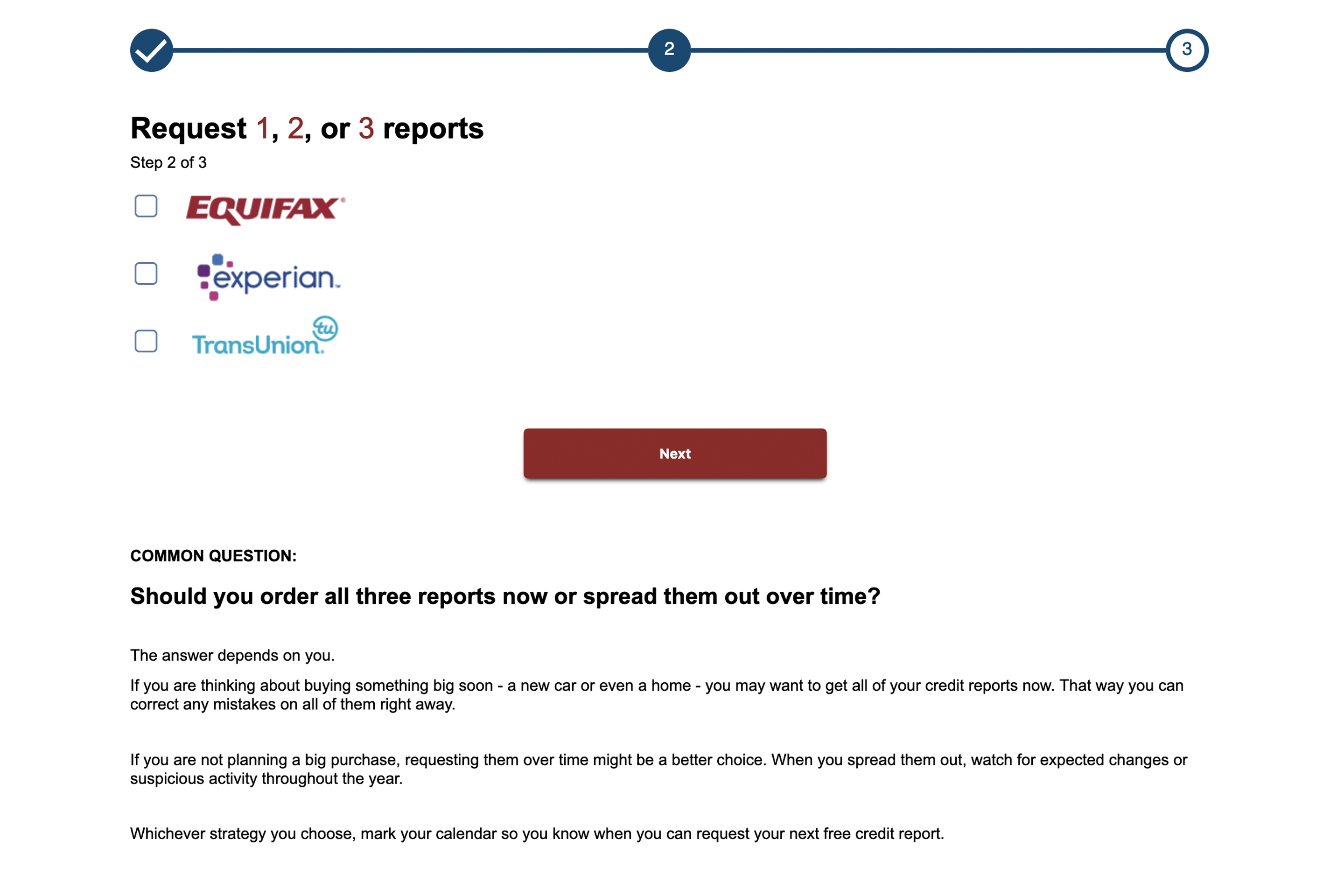

The second step is to pick which of the three credit score bureaus you want to a credit score report from. You may choose one or all three, in case you’d like.

For the reason that reviews are quickly free every week, requesting all three directly shouldn’t be a difficulty. Nonetheless, as soon as the credit score bureaus cease providing this weekly service without cost, the Shopper Monetary Safety Bureau (CFPB) says it might be a good suggestion to unfold out every request, that method you’ll be able to higher monitor your credit score all year long.

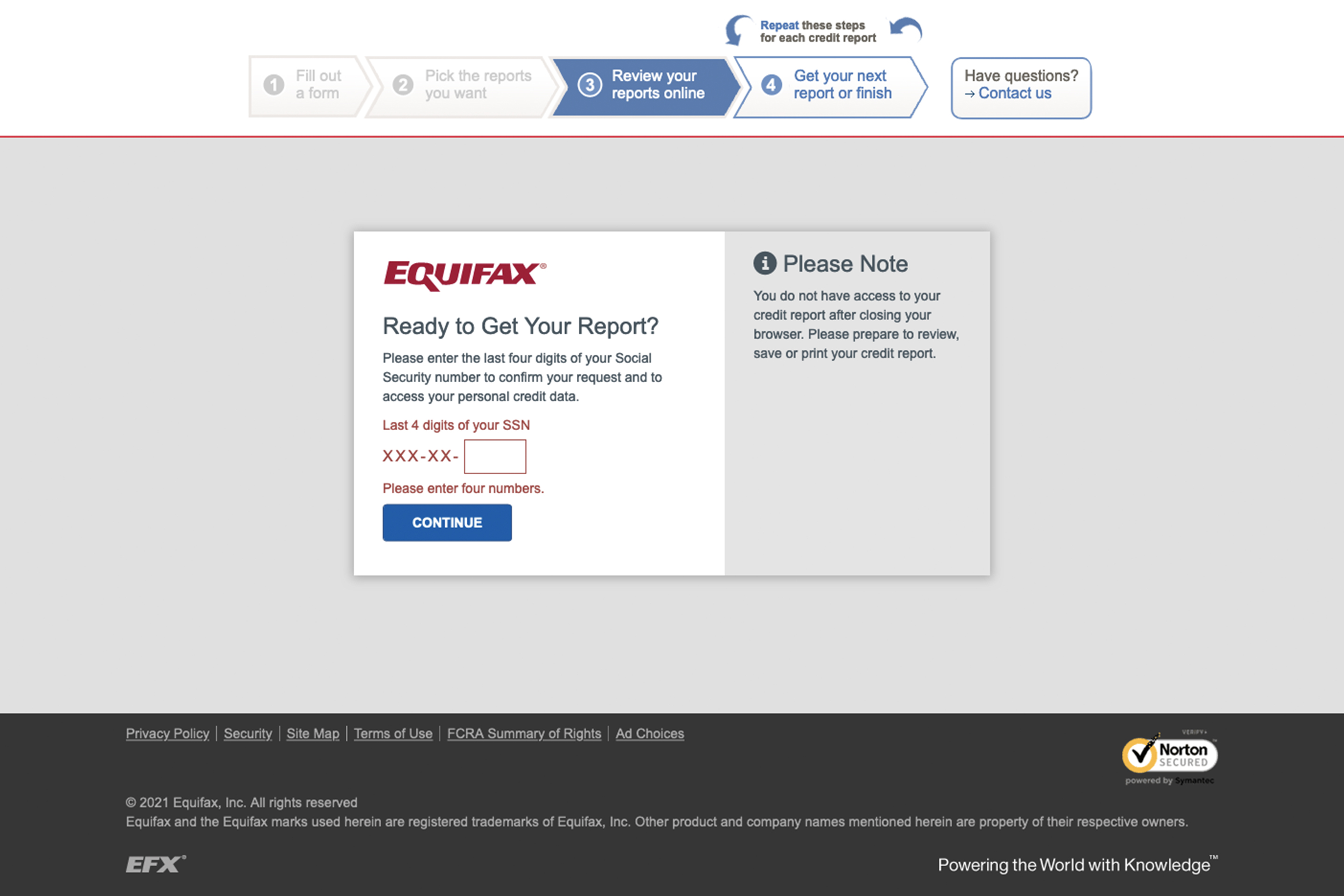

Lastly, you will have to reply just a few inquiries to confirm your identification for every of the credit score bureaus you chose.

For instance, in case you chosen the Equifax report, you may be forwarded to Equifax’s web site. There, you’ll need to supply the final 4 digits of your Social Safety quantity and reply safety questions on your credit score historical past, together with particulars about your bank cards, earlier lenders, contact data, present or former addresses, earlier employers and extra. Trick questions are included, so be ready.

Repeat this course of as essential for every credit score bureau.

After finishing the verification steps, you’ll overview and/or dispute your credit score reviews on-line. You can too print or obtain the reviews for later use.

For those who favor to not — otherwise you’re unable to — full the net course of outlined above, you may also request your credit score reviews by mail and telephone. The corporate Central Supply, LLC runs the web site, and you may name them straight at 1-877-322-8228 to request your credit score reviews.

Alternatively, you’ll be able to print out and full a bodily request type, generally known as the annual credit score report request type, then mail it to the next deal with:

Annual Credit score Report Request Service

P.O. Field 105281

Atlanta, GA 30348-5281

As soon as you have acquired your entire credit score reviews, it is essential that you just overview your credit score data for any inaccuracies. For those who come throughout errors or any new credit score accounts you do not acknowledge, appropriate the knowledge with the bureaus instantly.

You’ll discover that your credit score report doesn’t embrace your credit score rating, neither your FICO rating nor your VantageScore. That isn’t a mistake. Credit score reviews merely don’t embrace that data. You may entry your free credit score rating with these strategies.

Your credit score report does, nevertheless, embrace credit score account data (Ex. Varieties of credit score and credit score limits), your fee historical past and data on damaging occasions like bankruptcies. Right here’s extra on how you can learn your credit score report.

The best way to request your credit score report from a credit score bureau

For primary credit score hygiene, getting your three free credit score reviews from AnnualCreditReport.com is an effective begin.

Nonetheless, there could also be circumstances the place you’ll need to verify your credit score report extra steadily than what’s obtainable without cost. For example, chances are you’ll be shopping for a house or beginning a brand new job. Or maybe you’re doing all your due diligence to guard in opposition to identification theft. Pulling your credit score report in all of those circumstances can be a considered transfer. However in some circumstances, it might include a payment.

In keeping with the CFPB, the credit score bureaus legally cannot cost you greater than $14.50 per report. As a reminder, the three main bureaus are permitting you to verify their credit score reviews each week without cost till Dec. 31. After that date — or within the meantime if you must verify your credit score report greater than as soon as per week — you’ll be able to contact the bureaus straight to purchase your credit score report.

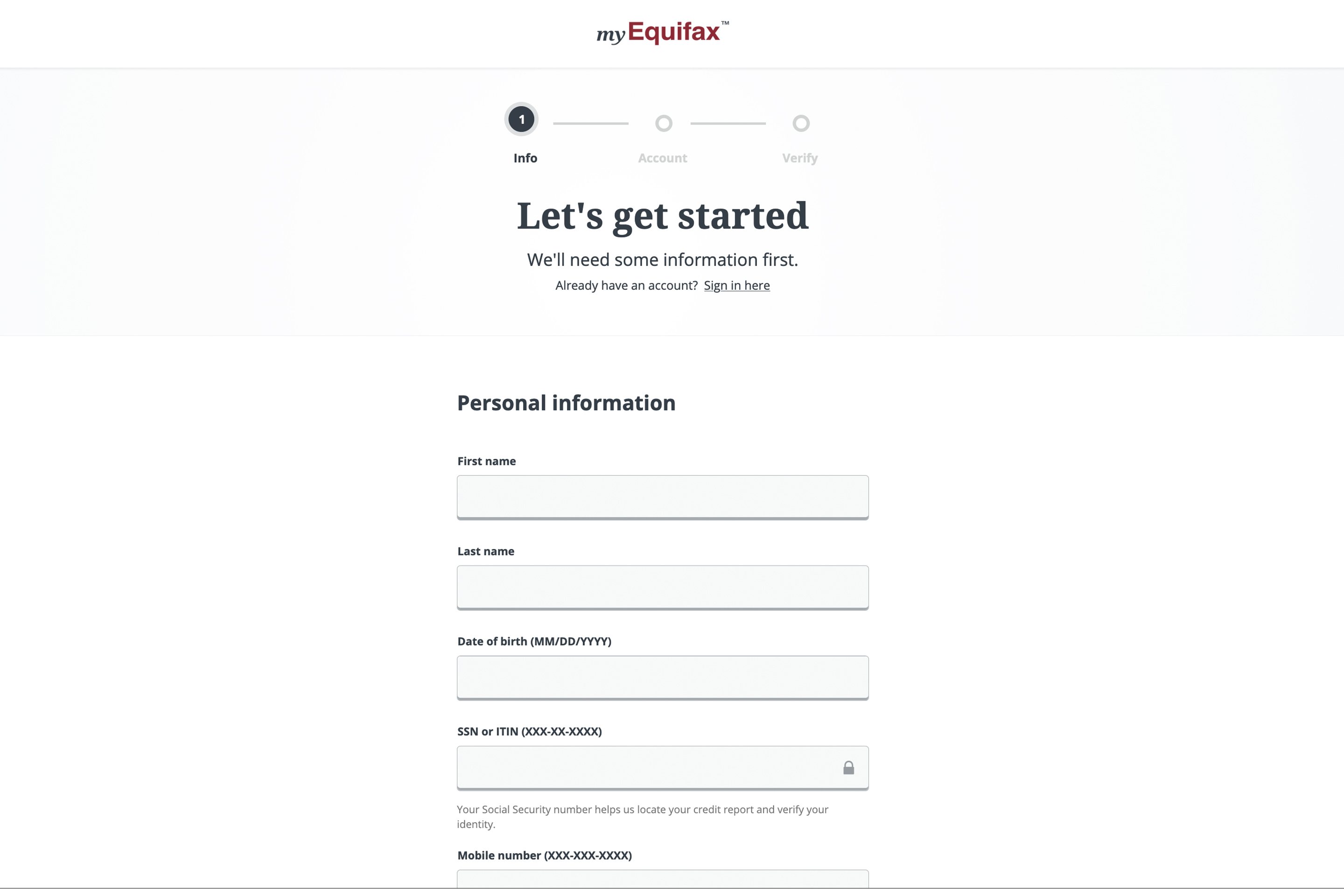

Equifax

To request a credit score report straight from Equifax, you’ll be able to name 1-800-685-1111 toll free. You can too request one on-line by making a myEquifax account. As soon as your profile is ready up, you’ll be able to request a credit score report out of your account web page.

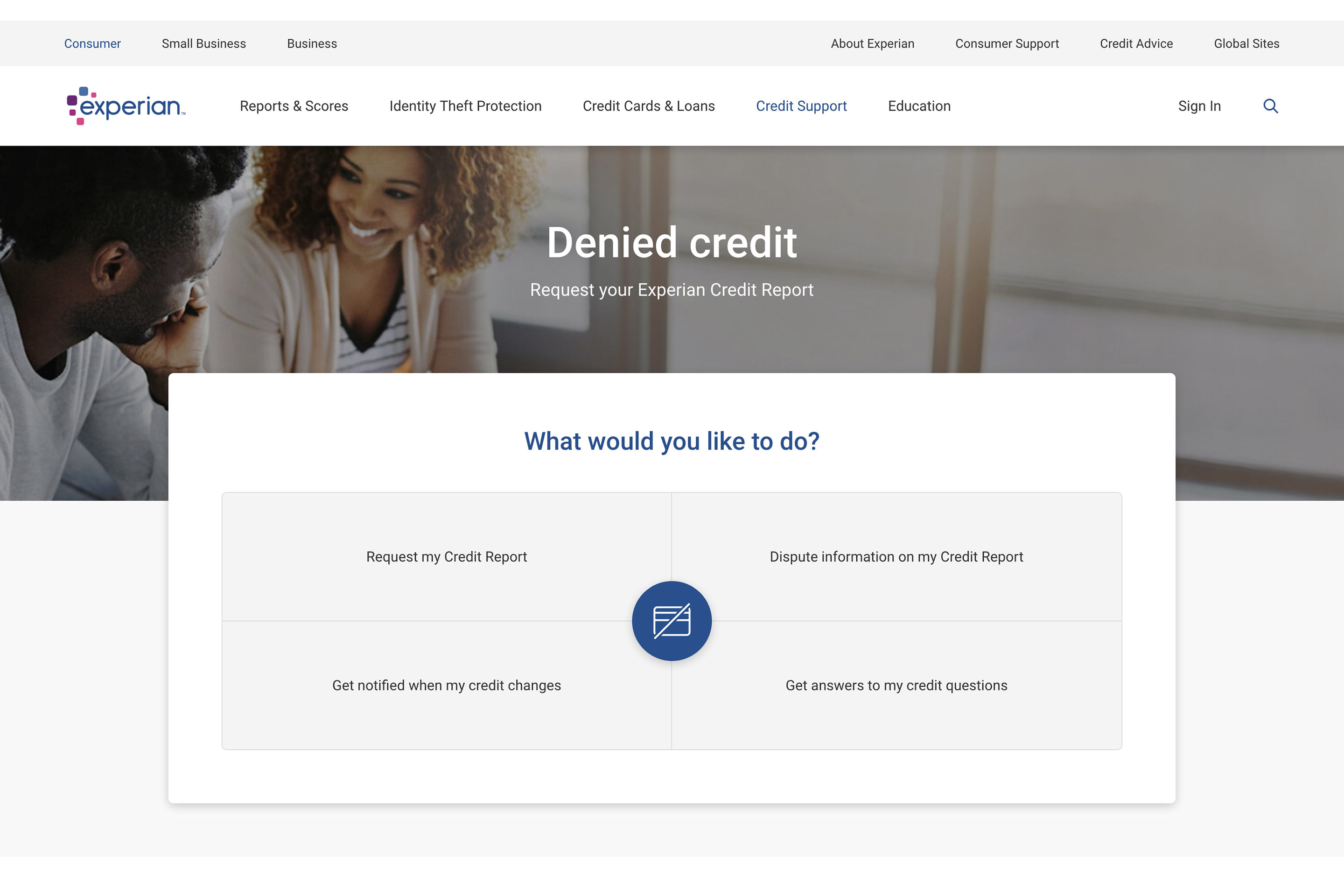

Experian

To get your Experian credit score report straight from the corporate, both name 1-888-397-3742 or go to Experian’s report-access web page, choose “Request my Credit score Report” and observe the prompts to find out in case you qualify for a further free credit score report or in case you are required to buy one.

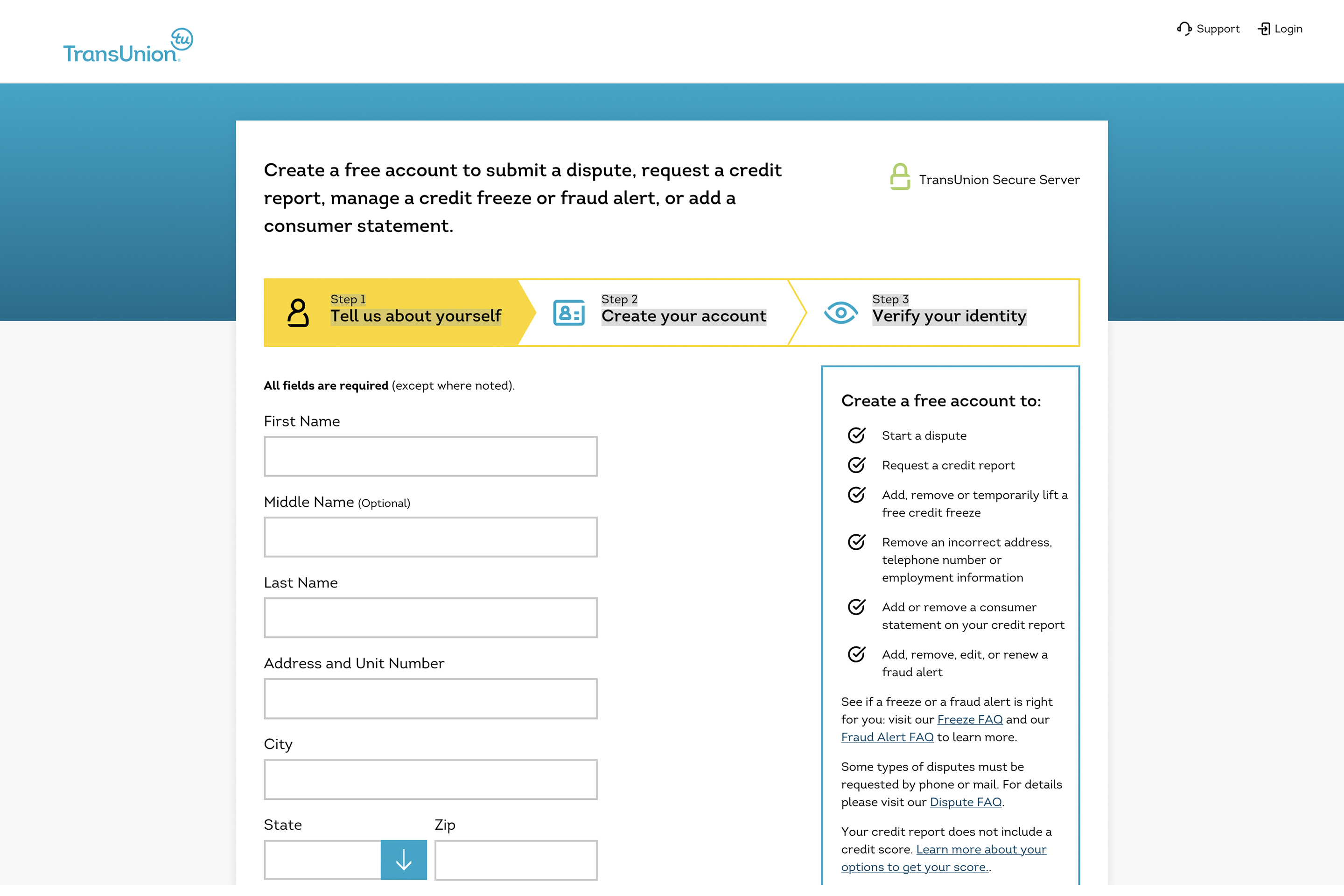

TransUnion

Lastly, you’ll be able to name TransUnion straight at 1-888-909-8872 in case you want further credit score reviews past those which might be obtainable without cost. To request a TransUnion credit score report on-line, you’ll need to create a TransUnion account. Out of your account’s dashboard, chances are you’ll request a credit score report as soon as each 24 hours.

Remember the fact that although the three credit score bureaus are professional, they could additionally attempt to upsell you. Keep in mind that you’re solely there to request a credit score report — and to not purchase further companies associated to credit score scores, identity-theft safety or credit score monitoring.

By federal regulation, credit-reporting corporations can solely cost you as much as $14.50 per report. In case your whole is increased at checkout, double verify that there are not any further monetary merchandise tacked on.

In keeping with the Federal Commerce Fee (FTC), there are a number of situations by which you may qualify for added free credit score reviews past the free weekly (for now) reviews:

- You probably have a fraud alert in your credit score file and/or in case you consider your credit score report is inaccurate due to identification theft or fraud.

- For those who’re on public help, similar to unemployment insurance coverage or different welfare applications.

- For those who’re jobless and plan to seek for employment inside the subsequent 60 days.

- For those who get an “opposed motion discover,” which is an alert that signifies you’ve been denied credit score, insurance coverage, employment or different advantages based mostly on data out of your credit score report.

- In case your state’s legal guidelines present further free credit score reviews.

Additionally, as a part of the settlement for the large Equifax knowledge breach in 2017, you’ll be able to obtain six free Equifax credit score reviews per 12 months till 2026.

If any of the above situations apply to you, don’t pay in your credit score report. For those who’re not sure, attempt calling the toll free numbers of the credit score bureaus to elucidate your state of affairs.

Extra methods to accumulate your credit score report

The above methods are targeted on the three main credit score bureaus: Equifax, Experian and TransUnion. Nonetheless, whereas these three bureaus are nationwide and are prone to have essentially the most complete client knowledge on you, they don’t seem to be the one organizations to compile credit score reviews.

In keeping with the CFPB, you’re additionally eligible to obtain free annual reviews from greater than 50 further specialty credit-reporting businesses. These corporations compile client knowledge within the following areas:

- Checking and banking accounts

- Employment historical past

- Gaming (casinos and race tracks) historical past

- Low earnings and subprime credit score

- Medical information

- Private property insurance coverage

- Retail returns and fraud

- Supplementary credit score information (together with public information)

- Tenant and rental information

- Utility funds

Whereas it might be overkill to tug dozens of credit score reviews from these area of interest businesses regularly, their reviews can come in useful in sure circumstances. If a financial institution denies your request to open a checking account or if a landlord rejects your rental utility, you’ll be able to pull a report from the corresponding businesses to see if one thing’s in your client file.

View the CFPB’s detailed listing of credit score businesses for contact particulars of the person corporations and what areas they focus on. Be aware that not the entire corporations are nationwide, and they won’t all have knowledge on you.

What to do if there’s an error in your credit score report?

For those who spot an error in your credit score report, your first step is to dispute the problem with the credit score bureau or bureaus exhibiting the inaccuracy. You are able to do this on-line with all three bureaus, however you have got choices additionally to provoke disputes by mail or by telephone. The credit score report dispute course of takes just a few weeks, and the bureaus will notify you of the findings.

You can too ship a dispute letter to the corporate that seems to have reported false data to the credit score bureaus. That may very well be a financial institution, your landlord or a bank card firm — they’re all required to simply accept dispute letters, in accordance with the CFPB.

If you must contest collections exercise in your credit score report, you’ll be able to observe the steps right here.

FAQs about checking your credit score report

What’s the best technique to verify my credit score report?

Is it unhealthy to verify your credit score report?

There’s completely nothing unsuitable with checking your credit score report, and usually talking, it is a good suggestion to get within the behavior of repeatedly checking your credit score report back to guarantee that all the things is so as. Whereas it might be pointless to continuously verify your credit score reviews — and doing so extraordinarily typically may develop into costly in case you’re exceeding the one free request per week per bureau — it will not negatively have an effect on your credit score file in any method.

How typically ought to I verify my credit score report?

That is as much as you, and it actually is dependent upon your circumstances. Earlier than the pandemic, Individuals would save a few of their free credit score report requests as a result of they had been solely given just a few per 12 months. Now which you can request reviews on a weekly foundation, it is best to be happy to verify your credit score report extra repeatedly. However except your credit score state of affairs is in flux or you have got some kind of upcoming monetary transfer that’s contingent on what’s in your credit score file, checking your report on a weekly foundation most likely is not essential. The CFPB simply recommends that you just verify it as soon as per 12 months at a minimal.

What is the distinction between a credit score report and a credit score rating?

Your credit score rating is a quantity that represents your creditworthiness, or the diploma to which you are certified to borrow cash. Your credit score reviews embrace details about your accounts, balances, fee historical past, credit score inquiries, and so forth. The data in your credit score report determines your credit score rating, however your credit score rating isn’t going to be listed in a credit score report.

Abstract of Cash’s information on how you can get your credit score report

- AnnualCreditReport.com is the perfect place to begin to get your free credit score reviews from Equifax, Experian and TransUnion multi function spot.

- Since 2020, Equifax, Experian and TransUnion have all provided free weekly credit score reviews — additionally obtainable via AnnualCreditReport.com. That is in place till Dec. 31, 2023.

- You probably have exhausted your entire free credit score reviews from the foremost bureaus, chances are you’ll contact them on to buy further reviews. They legally can’t cost you greater than $14.50 per report.

- Whereas Equifax, Experian and TransUnion are the most well-liked credit score bureaus, they’re not the one locations to supply credit score reviews. In keeping with the CFPB, you’re additionally eligible without cost annual credit score reviews from dozens of different credit-reporting businesses, most of which focus on a distinct segment credit score matter.

Chris Huntley contributed to this text.

Extra from Cash:

Finest Credit score Restore Corporations

The best way to Take away Gadgets From Your Credit score Report in 2022