PM Photos/DigitalVision through Getty Photos

Introduction

In my final article, I carried out a deep dive into two ETFs: Schwab U.S. Dividend Fairness ETF (NYSEARCA:SCHD) and iShare’s (DGRO). That article bought me considering… is SCHD really the perfect dividend ETF for all buyers in search of money movement right now and a complete return?

Many buyers, reminiscent of myself, benefit from the candy feeling of seeing a dividend hit your checking account, or for the old-fashioned buyers, a bodily examine mailed to your property tackle. It is one of many small easy pleasures of investing: to see the incremental progress you make in the direction of no matter your monetary targets… For some, it is retirement, for others a house, everybody has their purpose.

However earlier than that nice feeling of receiving a dividend might be skilled one should resolve the place to speculate one’s cash. And there are tons of dividend ETFs on the market lots of which boast the same technique.

To assist clear up the thriller, in my upcoming articles, I plan on exploring these totally different methods extra deeply, as a part of that sequence, right now I might like to check Schwab’s (SCHD) and JPMorgan Fairness Premium Earnings ETF (NYSEARCA:JEPI), an ETF with a coated name technique.

Why JEPI?

Why am I JEPI? Effectively JEPI is not like many different conventional dividend ETFs, sure it nonetheless targets a excessive yield to offer buyers with money movement, but it surely focuses on larger development names which can be lacking in most dividend ETFs. In reality, lots of the holdings pay no dividends in any respect.

So how then, if lots of its holdings pay no dividend, do its distributions appear like this?

Dividend Historical past: JEPI (Looking for Alpha)

And the way does the yield appear like this?

Dividend Yield: JEPI (Looking for Alpha)

Effectively, really, I did simply tease it, it is by way of the implementation of a coated name technique. Let me attempt to clarify with a hypothetical.

Think about you personal 100 shares of inventory, perhaps the inventory pays no dividend, however you continue to wish to make some more money from the inventory with out promoting shares that can assist you cowl day-to-day bills.

That is the place a coated name technique might be helpful.

A coated name technique is whenever you promote another person the best to purchase your inventory at a selected value (the strike value) for a sure time frame. In return for giving them that proper, you obtain a premium (money). If the inventory value stays beneath the strike value, you retain the premium and your inventory. But when the inventory value exceeds the strike value, the customer can train their proper and purchase your inventory from you. The web impact is you place a cap on short-term upside potential in alternate for a premium, thereby producing money movement.

JEPI makes use of that coated name technique with high-growth tech shares however with an additional benefit. By the wrapper of an ETF, particular person buyers needn’t fear about executing and rolling over the choice contracts on their very own as it’s all dealt with by JPMorgan within the ETF wrapper making JEPI rather more handy.

Why SCHD?

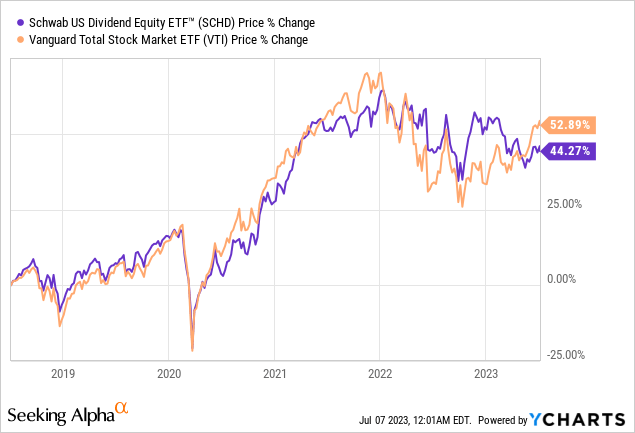

Effectively, I do not wish to rehash my final article as to why I’m so keen on this fund, I’ll present a quick abstract of a number of the key explanation why it’s so common. I do not wish to spoil the complete article at this stage, however as a primer, it is one of many few high-yield ETFs that has been capable of sustain with the market (relying on the timeframe, even outperforming the market).

With out additional ado, let’s begin the comparability. Identical to final time, inside this text I will be evaluating the efficiency of those funds over time, their holdings, sector allocations, and extra.

Excessive Degree

Let’s cowl the fundamentals first. SCHD has ~$47 billion Web Property unfold throughout 104 holdings with an expense ratio of simply 6 foundation factors, that is 0.06%. JEPI has ~$28 billion unfold throughout 136 holdings with an expense ratio of 35 foundation factors, 0.35%.

First off, each of those funds are large, sure they’re dwarfed in AUM by stalwarts like (SPY) however inside the dividend ETF house, these are enormous. Subsequent, these funds are each concentrated, 104-136 holdings are fairly concentrated when you think about that the S&P 500 has 500 firms inside it (stunning, I do know).

A observe on the expense ratios, first, 6bps is grime low-cost, not just for a dividend ETF however even in comparison with vanilla-market cap ETFs. 35bps alternatively, is extra “common” however I’ll caveat that assertion with this: working a coated name choice technique is rather more labor-intensive than a pure vanilla technique, 35bps when taking the operational complexity into consideration is definitely not all that costly.

Whole Return

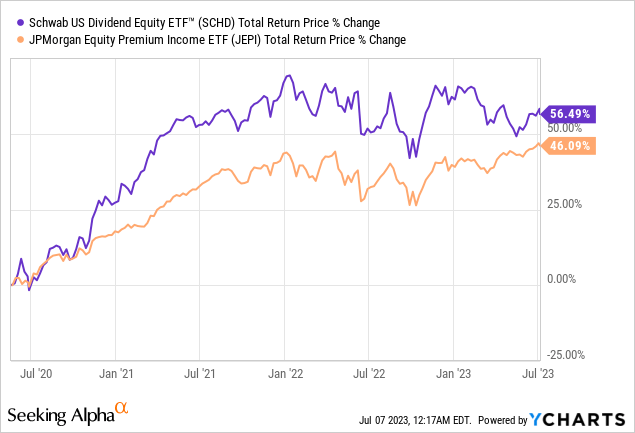

Now let’s soar forward a bit earlier than I dive into the holdings. what do the returns appear like for these funds?

Given the shorter working historical past of JEPI, it is exhausting to make any definitive conclusions from the above chart. What is obvious is that the tech publicity helped them outperform in 2020 and 2021 however was a significant headwind in 2022.

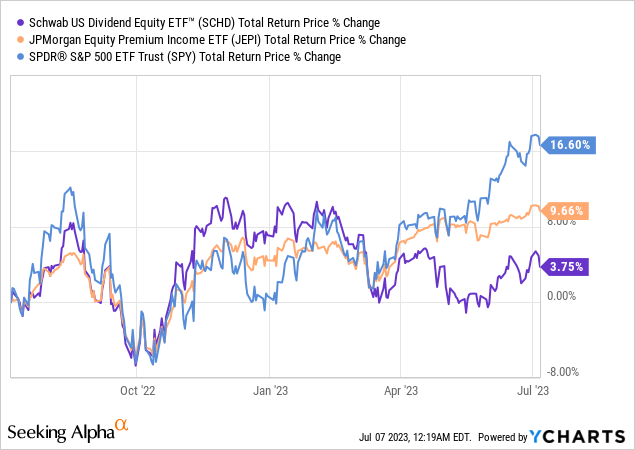

Whereas these funds have carried out properly since 2020, over the previous 12 months efficiency has been considerably lackluster, each funds are trailing the S&P after many mega-cap shares took off over the previous couple of months, maybe driving on the hype of AI.

Holdings

As I discussed earlier, each funds are comparatively concentrated, holding simply round 100 holdings. Whereas that’s true, JEPI is way much less concentrated in its prime 10 holdings the place the ten largest holdings solely make up ~15% of the portfolio in comparison with 41% for SCHD.

| High 10 Weight: 40.72% | High 10 Weight: 15.15% |

| SCHD High 10 Holdings | JEPI High 10 Holdings |

| Broadcom (AVGO) | Adobe (ADBE) |

| Verizon (VZ) | Microsoft (MSFT) |

| UPS (UPS) | Amazon (AMZN) |

| Merck (MRK) | Mastercard (MA) |

| PepsiCo (PEP) | Visa (V) |

| Cisco (CSCO) | Comcast (CMCSA) |

| House Depot (HD) | PepsiCo (PEP) |

| Texas Devices (TXN) | Accenture (ACN) |

| Coca-Cola (KO) | Hershey (HSY) |

| AbbVie (ABBV) | AbbVie (ABBV) |

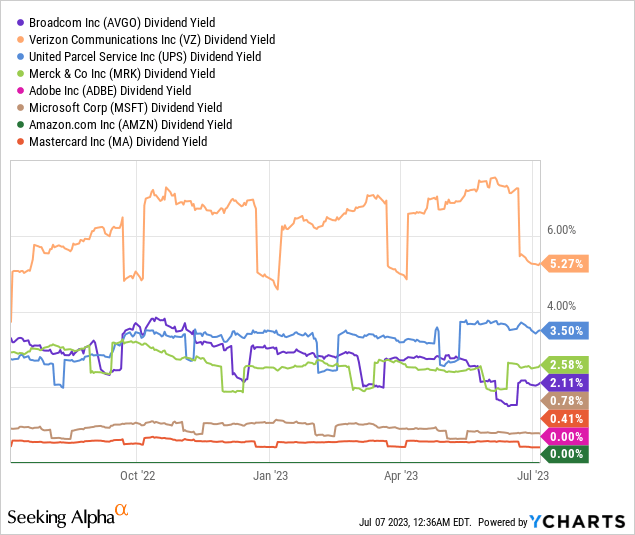

As you’ll be able to see there are a few non-dividend paying firms in JEPI’s holdings, Adobe, and Amazon are the 2 huge ones. Typically, JEPI holds many lower-yielding firms, whereas SCHD focuses on these that are higher-yielding.

Dividend Yield

YCharts helps to verify this for us, as you’ll be able to see quantity the highest 4 holdings of every ETF, JEPI’s holdings are yielding lower than 1% whereas all 4 of SCHD’s are yielding larger than 2%.

30 Day SEC Yield (Schwab and JPMorgan)

Conversely, as a result of its coated name technique, JEPI as a fund yields considerably greater than SCHD, which already yields greater than the market as a complete. Traders ought to observe although, that in alternate for this larger yield, you’re capping a few of your upside potential.

Income Progress

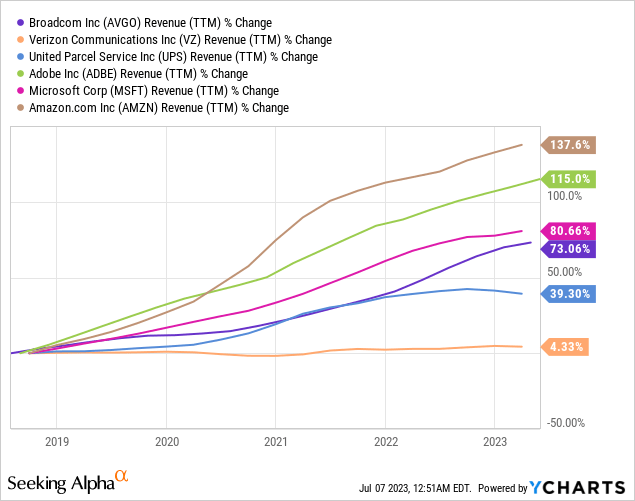

Unsurprisingly, when income development the holdings of JEPI shine in comparison with that of SCHD. Evaluating the highest 3 holdings inside every fund we are able to see that over the previous 5 years, JEPI’s holdings have elevated their income by 81-138% whereas SCHD’s holdings have elevated income between 4 and 73%.

Valuation

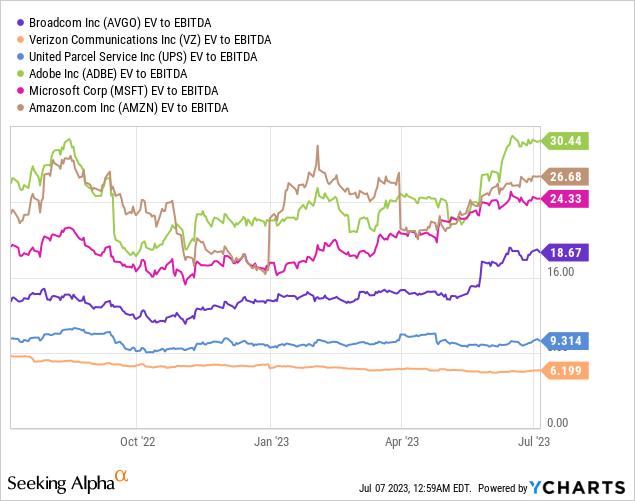

However income development by itself isn’t every thing, valuation issues too, and JEPI’s holdings are simply extra richly valued, on common, in comparison with SCHD.

The highest 3 holdings of JEPI all commerce between 24x to 30x EV to EBITDA whereas the highest 3 holdings of SCHD commerce between 6x and 19x, fairly the distinction! So sure, you may have development at JEPI, however at a excessive price when trying on the particular person holdings.

Sector Publicity

One other main distinction between these two funds is their totally different sector exposures, whereas SCHD is skewed closely in the direction of industrials and well being care, JEPI skews towards expertise, communications, and “different” (choices contracts).

Controlling for these choices contracts, we are able to see rather more clearly the place JEPI’s sector publicity lies.

Schwab and JPMorgan (Writer’s Calculations)

One thing that stunned me performing this evaluation is that JEPI is definitely rather more diversified throughout sectors than SCHD is. Utilities, Communications, and Actual Property are areas the place SCHD has minimal publicity.

Regardless of sharing a dividend yield focus, each of those ETFs present wildly totally different publicity and implement completely totally different methods, the sector publicity variations are additional proof of this.

Conclusion

Each of those funds have seen wild success when it comes to fund inflows, and it is no shock, as they look like nice funds. These two ETFs present buyers with publicity two to totally different segments of the market whereas each delivering an above-average yield for cashflow-conscious buyers.

So, relying on the targets of the person investor I consider each funds may make sense…

If one needs the very best yield attainable with an honest complete return, JEPI is sensible. If one needs the next yield, does not wish to complicate their portfolio with choices, or prefers a price investing technique, then SCHD may make loads of sense. As for myself, I’m within the latter class.

I charge each SCHD and JEPI a “Purchase”.