Crypto fans are hopeful {that a} once-in-four-years occasion which rewrites the underlying code of the world’s greatest cryptocurrency will lengthen the present market rally. However the milestone additionally dangers sounding the demise knell for sure Bitcoin miners.

Article content

(Bloomberg) — Crypto enthusiasts are hopeful that a once-in-four-years event which rewrites the underlying code of the world’s biggest cryptocurrency will extend the current market rally. But the milestone also risks sounding the death knell for certain Bitcoin miners.

Advertisement 2

Article content material

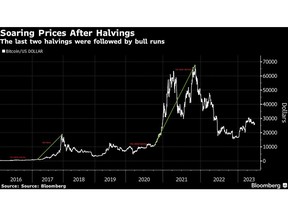

The quadrennial occasion, fairly ominously dubbed “the Halving” or “Halvening,” has traditionally been adopted by exponential surges in Bitcoin’s value. The final three occurrences in 2012, 2016 and 2020 noticed the token bounce practically 8,450%, 290% and 560% a 12 months on, Bloomberg knowledge exhibits. Bitcoin was launched in 2009 by a pc programmer or group of programmers beneath the pseudonym Satoshi Nakamoto.

Article content material

Halvings — because the title suggests — slash in half the quantity of Bitcoin every miner can earn for validating transactions on the digital asset’s blockchain utilizing specialised, energy-intensive computer systems. The subsequent halving, slated for April 2024, will minimize miners’ rewards to three.125 Bitcoin per block — or $94,438 — from the present 6.25 or $188,876.

Article content material

Commercial 3

Article content material

The scarcer provide is seen by crypto proponents as serving to to keep up Bitcoin’s worth in the long term, or a minimum of till the utmost variety of tokens that may ever be mined — 21 million — is reached round 2140. To this point, miners have been in a position to make up for the loss in income when the rewards are minimize because of the rallies in Bitcoin’s value after every halving, in addition to technological developments which have improved the effectivity of their mining rigs.

However mining economics forward of the following halving look extra troubling than earlier ones.

“Practically half of the miners will undergo given they’ve much less environment friendly mining operations with increased prices,” predicts Jaran Mellerud, crypto-mining analyst at Hashrate Index.

He factors to the break-even electrical energy value of the commonest mining machine, which is predicted to drop to 6 cents per kilowatt-hour from 12 cents/kWh after the halving. Round 40% of miners nonetheless have increased working prices per kWh than that, Mellerud stated. Miners with working prices above 8 cents per kilowatt-hour will battle to remain afloat, as will smaller miners that don’t run their very own mining rigs however outsource them as a substitute, he stated.

Commercial 4

Article content material

“In the event you depend in all the pieces, the whole value for sure miners is properly above Bitcoin’s present value,” added Wolfie Zhao, head of analysis at TheMinerMag, a analysis arm of mining consultancy BlocksBridge. “Web earnings will flip damaging for a lot of miners with much less environment friendly operations.”

Bitcoin has rallied greater than 80% this 12 months to round $30,000, although the worth continues to be lower than half the document of just about $69,000 reached in late 2021. In the meantime, miners’ manufacturing prices have risen in tandem with electrical energy costs, and debt burdens have turn out to be unsustainable for a lot of of them.

The worldwide mining trade has $4.5 billion to $6 billion in debt — down from $8 billion in 2022 — spanning senior debt, loans collateralized by mining rigs, and Bitcoin-backed loans, estimates Ethan Vera, chief operations officer at crypto-mining companies agency Luxor Applied sciences. Excellent loans for 12 main public mining firms akin to Marathon Digital Holdings and Riot Platforms stood at round $2 billion on the finish of the primary quarter, down from $2.3 billion within the earlier quarter, knowledge compiled by Hashrate Index exhibits.

Commercial 5

Article content material

The borrowing spate was partly pushed by miners migrating to North America from China after the Communist nation’s home mining ban in late 2021. “One factor the miners didn’t have is entry to the capital market,” stated Zhao. “Debt financing is way more out there within the US.”

Rising competitors amongst Bitcoin miners has additionally compressed revenue margins. Mining problem, a measure of computing energy to mine Bitcoin, hit a document excessive in June, knowledge from btc.com exhibits. For miners to maintain the identical revenue margins after the halving, Bitcoin’s value must rise to $50,000-$60,000 subsequent 12 months, stated Kevin Zhang, senior vice chairman of mining technique at crypto-mining agency Foundry, which is owned by trade heavyweight Digital Foreign money Group.

Commercial 6

Article content material

And whereas miners loved a quick respite earlier this 12 months as Bitcoin’s value rebounded after a protracted crypto winter and electrical energy prices fell, energy costs are climbing once more. Texas, a significant crypto hub, is already experiencing an early warmth wave.

Bitcoin miners are taking various measures to guard themselves forward of the halving, akin to locking in energy costs, bolstering conflict chests and chopping again on investments.

“Coming to the halving itself, miners are making ready by attempting to be extra subtle with their energy prices and safe the pricing from their energy suppliers prematurely,” stated Zhang.

Hut 8 Mining Corp. entered right into a $50 million credit score facility final month with a unit of Coinbase International Inc. to assist protect its Bitcoin treasury forward of the halving. And Texas-based Bitcoin miner Lotta Yotta is shoring up six months’ money stream whereas scaling again investments to arrange for the occasion, in response to its CEO, Tiffany Wang.

Commercial 7

Article content material

“Throughout halving 12 months, it’s excessive threat,” Wang stated in a textual content message, referring to extra funding in Bitcoin mining services. “It’s higher to avoid wasting fund within the account to maintain the corporate working.”

The halving is in the end anticipated to double Bitcoin’s manufacturing value to about $40,000, JPMorgan Chase & Co. strategists led by Nikolaos Panigirtzoglou wrote in a June 1 observe. The price of producing one Bitcoin ranged between about $7,200 to $18,900 within the first quarter throughout a cohort of 14 publicly-listed miners, knowledge compiled by TheMinerMag exhibits. The prices calculated don’t embrace different main bills like debt curiosity funds, administration compensation or advertising and marketing, stated Zhao.

“Everybody must be ready,” Wang stated. “Sadly, numerous miners will finally be pushed out of the market.”

Feedback

Postmedia is dedicated to sustaining a vigorous however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback might take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. We have now enabled electronic mail notifications—you’ll now obtain an electronic mail if you happen to obtain a reply to your remark, there may be an replace to a remark thread you comply with or if a consumer you comply with feedback. Go to our Group Pointers for extra info and particulars on the best way to modify your electronic mail settings.

Be a part of the Dialog