Article content material

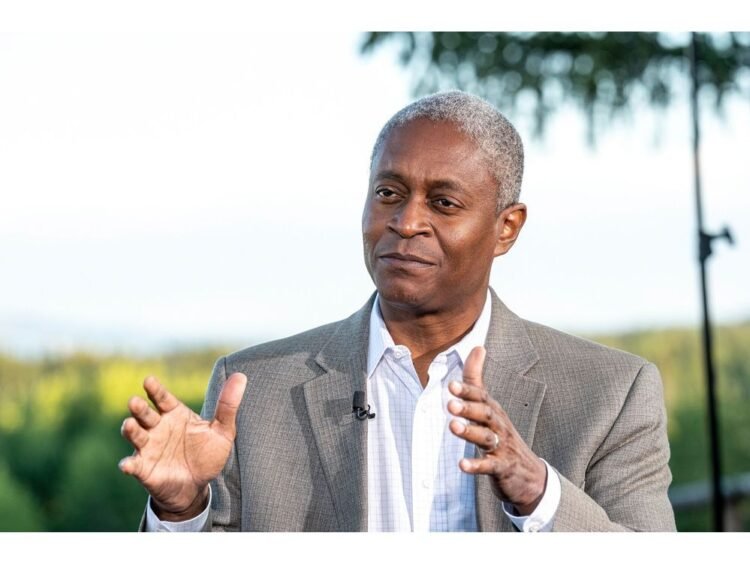

(Bloomberg) — Federal Reserve Financial institution of Atlanta President Raphael Bostic stated that whereas inflation is simply too excessive, policymakers might be affected person for now amid proof of an financial slowdown.

Article content material

“I’ve the view that we might be affected person — our coverage proper now’s clearly within the restrictive territory,” Bostic stated in remarks Monday to the Cobb County Chamber of Commerce in Atlanta. “We proceed to see indicators that the financial system is slowing down, which tells me the restrictiveness is working.”

Article content material

Almost all Fed individuals help extra will increase in rates of interest in 2023, with Bostic an exception who has referred to as for holding regular for the remainder of this yr and “nicely into 2024.” Markets are pricing within the probability of a quarter-point hike on the upcoming July 25-26 assembly of the Federal Open Market Committee.

The Fed has hiked its benchmark price by 5 share factors because it kicked off its tightening marketing campaign in March final yr. Whereas inflation has slowed from its 2022 peak, the tempo stays nicely above the central financial institution’s goal.

Article content material

Bostic highlighted that Friday’s June jobs report confirmed a smaller acquire in employment than economists had forecast. He additionally stated that inflation “is simply too excessive, and we’ve got acquired to get it again to our 2% goal.”

The Atlanta Fed chief stated he’d be involved if expectations for consumer-price will increase grew to become “unanchored,” which might imply policymakers “need to do some extra.” However for now, “inflation continues to be shifting steadily again to focus on” and inflation expectations are centered round 2%, he stated.

“I’m comfy being affected person,” Bostic stated.

Policymakers will get one other key report with the discharge Wednesday of the buyer worth index, anticipated to indicate annual inflation has slowed to three.1% in June, the bottom level in additional than two years. Nonetheless, as soon as unstable power and meals prices are stripped out, core CPI is seen rising 5% from a yr earlier.