What’s a Dividend in Shares

What are Dividend Tax Charges

Calculating the Dividend Yield

What’s the Dividend Payout Ratio

What are Ex Dividend Dates

What’s a Dividend Report Date

When is the Dividend Paid

How Usually is a Dividend Paid

Investing in a REIT

Blue Chip Shares with Dividend

Understanding dividend-related terminology could be the important thing to unlocking increased returns in your investments.

By studying about phrases comparable to dividend yield, payout ratio, and ex-dividend date, you possibly can establish corporations which have a historical past of paying constant and dependable dividends. This may also help you construct a portfolio of shares that not solely have the potential for capital appreciation but in addition present a gradual stream of revenue.

Moreover, by understanding the tax implications of dividends, you may make strategic choices that may assist enhance your general returns. In brief, taking the time to know dividend-related terminology is an funding in your monetary future.

So, let’s get began!

What’s a Dividend in Shares

A dividend is a fee an organization makes to its shareholders. It is a portion of the corporate’s earnings, determined by the board of administrators, that’s given to shareholders. Dividends could be given in money, shares of inventory or different varieties.

When an organization makes a revenue, it could actually both maintain the cash or give a few of it to shareholders as dividends. The quantity of the dividend is normally a hard and fast quantity or a share of the inventory value.

Dividend-paying shares could be a good funding selection for many who desire a regular revenue, nevertheless it’s vital to do not forget that dividends aren’t assured they usually can change or cease.

You could find out what’s the dividend paid by a sure firm utilizing completely different instruments and it’s normally free of charge. Right here is how one can see it for AAPL on a easy “Dividend AAPL” Google Search:

Dividend of Apple. Supply: Google Search

What are Dividend Tax Charges

Dividend tax charges consult with the tax that traders must pay on the dividends they obtain from proudly owning shares in an organization. The tax fee on dividends can fluctuate relying on the nation or jurisdiction by which the investor resides and the kind of dividends acquired.

In some nations, the tax fee on dividends could be decrease than the tax fee on different varieties of revenue, comparable to curiosity or capital positive factors, to be able to encourage funding in corporations.

You could find the dividend tax fee to your nation utilizing OECD.stat.

It is vital to notice that the tax legal guidelines are topic to alter and are completely different by nation, it is all the time a good suggestion to verify with knowledgeable tax advisor or your native tax workplace to know the tax guidelines and rules that apply to you.

Calculating the Dividend Yield

Dividend yield is a option to measure how a lot cash you’ll get again from a inventory funding primarily based on the dividends paid by the corporate. It’s normally proven as a share of the present inventory value. To calculate it, you divide the annual dividends by the inventory value:

Dividend Yield = (Annual Dividend per Share) / (Present Inventory Value per Share)

For instance, if a inventory is $50 and pays $1.50 in dividends per 12 months, the dividend yield is 3% (1.5/50=0.03).

Though you normally do not must calculate it by your self, as it’s publicly given, it’s helpful to know how that numbers is calculated.

Under is an actual instance utilizing dividend of T:

Calculating the Dividend Yield. Instance on AT&T inventory.

It is vital to do not forget that dividend yield doesn’t assure future efficiency and the businesses can change or cease dividends, additionally the inventory value adjustments can have an effect on the dividends yield. It is a good suggestion to analysis the corporate and its monetary well being earlier than investing.

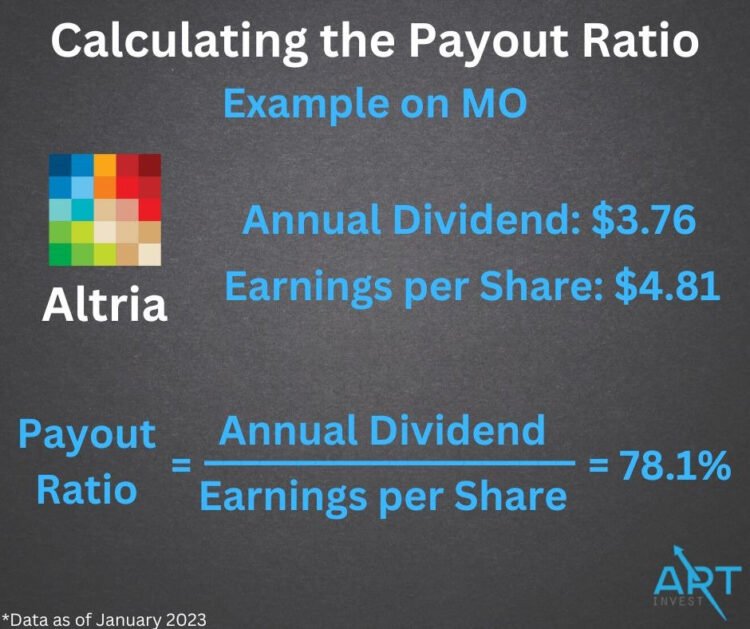

What’s the Dividend Payout Ratio

The dividend payout ratio is a option to measure how a lot of an organization’s income are given to shareholders as dividends. It is proven as a share and also you calculate it by dividing the dividends paid per share by the earnings per share (EPS).

Payout Ratio = (Annual Dividend per Share) / (Earnings per Share)

For instance, if an organization has EPS of $2 and pays $1 in dividends, the payout ratio is 50% (1/$2).

Under is an actual instance utilizing Dividend for MO:

Calculating the Payout Ratio. Instance on Dividend for MO

A low payout ratio means the corporate is maintaining extra of its income to take a position or pay debt, whereas a excessive payout ratio means the corporate is giving extra income to shareholders.

It is vital to understand that a excessive payout ratio also can imply that the corporate might not have sufficient income to pay future dividends or make investments sooner or later.

What are Ex Dividend Dates

Ex-dividend date is the date when a inventory is traded with out the precise to its most up-to-date declared dividend. In the event you purchase a inventory on or after the ex-dividend date, you will not be capable of obtain the following dividend fee. This implies the inventory is being traded “ex-dividend” (with out the dividend).

It is vital to do not forget that the ex-dividend date is just not the identical because the fee date, which is when the dividend is paid to the shareholders. Buyers ought to consider the ex-dividend date when shopping for or promoting shares to ensure they obtain dividends or not.

What’s a Dividend Report Date

The document date is the date when an organization makes a listing of its shareholders to resolve who will obtain the dividends. The corporate will verify its listing of shareholders on this date, and whoever is on the listing will obtain the dividends.

On the document date, the corporate will normally shut its books, which implies that if you happen to purchase the inventory after this date, you will not get the upcoming dividends. Buyers ought to take note of the document date to ensure they are going to obtain the dividends in the event that they personal the inventory on this date. The document date is normally set after the ex-dividend date and earlier than the fee date.

When is the Dividend Paid

The dividend fee date, often known as the “fee date,” is the date on which the corporate distributes the dividends to its shareholders. This date is ready by the corporate’s board of administrators and is normally introduced together with the dividend quantity and ex-dividend date.

On the fee date, the dividends are paid out to shareholders who had been on the corporate’s books on the document date. It is vital for traders to concentrate to the fee date to make sure that they obtain their dividends and likewise to plan for the money movement. The fee date is normally set after the ex-dividend date and the document date.

How Usually is a Dividend Paid

Dividends are usually paid frequently, comparable to quarterly or yearly. Some corporations pay dividends on a month-to-month or semi-annual foundation, however that is much less widespread. The frequency at which an organization pays dividends is decided by its board of administrators and is often primarily based on the corporate’s monetary efficiency and money movement.

Quarterly dividends are paid 4 occasions a 12 months, usually on the finish of every quarter. Firms that pay dividends quarterly are inclined to have a steady monetary efficiency and money movement, they usually are inclined to pay constant dividends over time.

You may simply discover What are Ex Dividend Dates, What’s the Dividend Report Date, When is the Dividend Paid, and When is the Dividend Paid for a specific inventory utilizing publicly obtainable data. Right here is how this data appears to be like on SeekingAlpha within the case of Dividend for IBM:

Investing in a REIT

REITs are corporations that personal and function income-producing actual property comparable to buildings and properties. They permit particular person traders to spend money on these actual property portfolios, much like how they may spend money on different industries by way of shares.

REITs pay out a big portion of their revenue as dividends to shareholders, making them a superb supply of regular revenue. They are often publicly traded on inventory exchanges or privately held and may concentrate on particular varieties of properties or be diversified.

REITs provide a means for folks to spend money on actual property with out having to personal and handle properties themselves. Needless to say REITs have the identical dangers as different publicly traded corporations and could be affected by adjustments in the true property market.

A few of the most dependable REITs in keeping with Forbes are:

1. Stag Industrial (STAG)

2. Realty Earnings (O)

3. Omega Healthcare Buyers (OHI)

4. Medical Properties (MPW)

5. Iron Mountain (IRM)

6. Crown Fort (CCI)

REITs Dividends

Blue Chip Shares with Dividends

Blue chip shares are shares of well-established and financially steady corporations which have a protracted historical past of constant progress and a robust observe document of paying dividends. These corporations are usually leaders of their business and have a fame for offering a steady return on funding.

Blue chip shares are thought of to be much less dangerous than different varieties of shares, as they’re much less more likely to be affected by market fluctuations or financial downturns.

The Dow Jones Industrial Common (DJIA) which includes 30 blue-chip shares which are thought of to be the leaders of their respective industries

Some examples of blue chip shares are:

1. Basic Electrical (GE)

2. Procter & Gamble (PG)

3. Coca-Cola (KO)

4. Dwelling Depot Inc. (HD)

5. Walmart (WMT)

6. Visa (V)

Blue Chip Shares with Dividends

It is vital to notice that whereas blue chip shares are typically thought of to be much less dangerous, they’re nonetheless topic to market fluctuations and the efficiency of the precise firm. As with all funding, it is vital to do your individual analysis and seek the advice of with a monetary advisor earlier than making any funding choices.

Share Buybacks vs Dividends

An organization might use its income to purchase again its personal inventory or pay out dividends to shareholders as a option to return worth to shareholders.

A share buyback, often known as a inventory buyback, is when an organization repurchases its personal shares from the market, which may enhance the worth of remaining shares by lowering the general variety of excellent shares. This could additionally enhance the corporate’s earnings per share (EPS) ratio, which may make the inventory extra enticing to traders.

A dividend, however, is a distribution of a portion of an organization’s income to its shareholders. Dividends are usually paid out on an everyday schedule (comparable to quarterly or yearly) and may present a steady supply of revenue for shareholders.

Each share buybacks and dividends are methods for corporations to return worth to shareholders, however they work otherwise. Share buybacks can enhance an organization’s inventory value by rising earnings per share, whereas dividends present an everyday supply of revenue to shareholders. Some corporations might select to do each, whereas others might concentrate on one or the opposite.

Firms with Inventory Buybacks

There are lots of corporations which have engaged in inventory buybacks. A few of the bigger corporations which have lately introduced or accomplished buyback packages embody:

-

Apple

-

Cisco Methods

-

Basic Electrical

-

IBM

-

Microsoft

-

Oracle

-

Procter & Gamble

-

Qualcomm

-

Wal-Mart

Take into account, that is only a small pattern of corporations which have introduced or accomplished buybacks lately, and lots of different corporations additionally have interaction in buybacks. The frequency and dimension of buybacks can change relying on an organization’s monetary efficiency, money reserves, and different components.

Moreover, the businesses listed above may not be at the moment doing buybacks, they’re simply examples of corporations which have finished so previously.

Backside Line

In abstract, understanding dividend terminology is essential for making knowledgeable funding choices and evaluating the efficiency of an organization’s inventory. Familiarizing oneself with phrases comparable to dividend yield, payout ratio, and ex-dividend date may also help traders make extra strategic choices and probably enhance their returns.

Advisable Articles on Inventory Market:

Easy methods to learn Earnings Report? Are they nonetheless vital?

3 Greatest Portfolio Building Methods it’s essential to know in 2023

The three Horsemen. Inflation, Deflation, and Stagflation. All working after your Portfolio