Final week, I wrote in regards to the ache of losses. Now we have mathematical proof exhibiting that painful emotions of losses cloud our selections.

If we overcome that concern of ache, we might obtain higher outcomes as merchants.

However shrinking from the ache of losses is only one manner our feelings can negatively affect our portfolio.

Behavioral finance consultants have recognized dozens of the way we will go mistaken in deciding when to purchase and promote. Their knowledge exhibits that all of us have biases that drive errors.

Let’s check out three main biases you may be carrying that would drag down your portfolio…

Are These 3 Biases Killing Your Earnings?

Let’s begin with salience. This is a vital bias to grasp. It means we are likely to deal with the mistaken issues.

As buyers, we could obese the newest information. For instance, let’s say we see that inflation rose 0.1% final month. That’s an enormous decline from six months in the past. We count on inflation to remain low and begin shopping for shares aggressively.

The newest report is salient info. If solely we had been to dig deeper, we might see that dwelling costs are reported with a lag. Simply that one issue would possibly drive inflation to 0.3% subsequent month.

This requires an in depth evaluation, however many buyers don’t dig deep. They take a single knowledge level and run with that.

Analysis exhibits we’re comfy doing that. It’s straightforward to make selections with out detailed evaluation.

It’s additionally straightforward to do what everybody else is doing. If we discover that inflation is about to rise whereas everybody believes it’s going to fall, we’re uncomfortable. That’s the herding intuition, our pure need to be a part of the in-crowd. For buyers, herding implies that as an alternative of going in opposition to the gang, we ignore knowledge and observe our mates.

The tendency to disregard knowledge is very widespread when the info contradicts what we need to consider. This is named the anchoring bias.

Typically we anchor on earlier costs. It’s widespread to anchor on latest highs. We count on costs to succeed in these highs once more. Low costs imply we’re getting a cut price.

We overlook the truth that decrease costs might imply gross sales are falling. Or revenue margins are shrinking. Most of the time, low costs imply dangerous information quite than an opportunity to purchase at a cut price.

Anchoring means buyers ignore the newest info. They deal with one thing that confirms what they need to consider.

Whereas there are analysis papers on these biases (and plenty of others) the true world isn’t as exact as tutorial analysis. Biases typically work together and amplify one another, and GameStop (NYSE: GME) is an efficient instance of that taking place in the true world…

The Excellent Storm for Biases Working Amok

GameStop hit the information in January 2021. Merchants on a Reddit message board began shopping for. They wished to show Wall Road brief merchants a lesson or one thing.

Their shopping for pushed the value up. The hedge fund they focused did endure losses. Ultimately, the supervisor shut the fund down. Poor man. He’s in all probability enthusiastic about the teachings he realized in his $44 million Miami dwelling.

As people piled into the GME commerce, they had been pushed by the salient info that Redditors had discovered a technique to make thousands and thousands. In actuality, few really made massive income within the commerce. There are rumors that among the largest hedge funds did revenue from the buying and selling frenzy. That’s in all probability true.

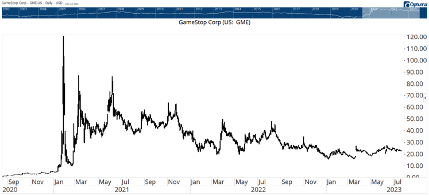

A lot of the shopping for resulted from misguided anchors. Many buyers anchor on info they prefer to consider. They purchased GameStop at $60 a share in early 2021. They anchored on the latest excessive of $120 a share. They had been getting a 50% low cost of their thoughts.

They believed the inventory would double — or extra. The argument was that it was $120 at one time, so it will absolutely attain that degree once more.

Shopping for additionally allowed buyers to be a part of the herd. Tens of millions of people had been shopping for. They had been on-line congratulating one another for getting. However sadly, many by no means profited.

The chart under exhibits that GME by no means reached its outdated excessive. Though the inventory has been unstable, it’s typically been in a downtrend for greater than two years.

GME By no means Returns to Outdated Highs

Rational buyers prevented GME. The corporate was (and nonetheless is) dropping cash. Administration described the corporate’s state of affairs within the 2022 annual report:

In the beginning of 2021, GameStop had burdensome debt, dwindling money, outdated methods and expertise and no significant stockholders within the boardroom. The corporate was in misery and had an unsure future.

None of this was a secret on the time. Everybody might see that the corporate was in bother. The one purpose the inventory went up was as a result of merchants believed they might “stick it” to Wall Road by shopping for. And that’s what drove the shopping for.

If you happen to purchased GME in early 2021, you had been a part of the group (herding). You believed the value might high $100 a share as a result of it had performed that earlier than (anchoring). And it was one thing you stored seeing within the information (salience).

In hindsight, it was a trifecta of errors that led many to losses in the course of the GME frenzy.

Herding, anchoring and salience biases will virtually at all times result in errors.

Recognizing that you may make these errors is step one towards avoiding them. It’s a step that would make it easier to keep away from hundreds of {dollars} in losses sooner or later.

Regards, Michael CarrEditor, Precision Earnings

Michael CarrEditor, Precision Earnings

Add Recency and Availability Biases to the Listing

For many years, the prevailing knowledge on Wall Road was that the market was “environment friendly,” and that buyers rationally analyzed all out there knowledge and priced shares appropriately.

After all, that’s absurd. Examine after examine proved the environment friendly market speculation mistaken. Our personal Adam O’Dell included a few of these “anomalies” into his market-beating Inventory Energy Scores system.

Nevertheless it took two nonfinancial psychologists to clarify why the market isn’t environment friendly.

Daniel Kahneman and Amos Tversky successfully rewrote the finance and financial textbooks with their examine of behavioral finance. Truly, I can’t say that they “studied” behavioral finance. They invented it.

Mike talked about salience, herding and anchoring as cognitive biases that may lead us to make poor selections. To those, I might add two extra intently associated biases: recency and availability.

What Is Recency Bias?

Recency bias is precisely what it feels like. It’s the tendency to place undue weight or significance on latest info when making selections in regards to the future.

In plain English, it’s the error of assuming the longer term goes to seem like the latest previous.

You don’t must be a market wizard to grasp why that will be harmful. The market rips greater … till it doesn’t. Or massive caps outperform small caps … till they don’t. Or a short-squeezed meme inventory is a “can’t lose” funding … proper till it loses.

You get the thought!

What Is Availability Bias?

Availability bias is analogous. It’s the tendency to make selections primarily based on examples that come to thoughts, actually because the examples are excessive or traumatic.

For instance: Since you remembered seeing a airplane crash on TV, you would possibly draw the conclusion that air journey is unsafe and select to journey by automotive … though you’re way more more likely to expertise an auto accident than a airplane crash.

Combating Your Biases

Recency bias typically pushes buyers to make “greed-based” errors. They assume no matter development they’re following will final without end.

In the meantime, the supply bias will typically push buyers to make “fear-based” errors, avoiding worthwhile alternatives due to horror tales they’ve heard previously.

And naturally, generally recency and availability work collectively to pressure fear-based errors.

For instance, the horror of the 2008 meltdown led to each recency and availability biases. That monetary disaster pushed buyers out of the market at precisely the time it was poised to get pleasure from an epic rally.

So what’s the takeaway right here?

The theme for many of 2023 has been the resurgence of tech on the expense of just about each different sector. Considerably, all the good points of the S&P 500 within the first half of the yr had been because of the efficiency of the highest six largest tech shares.

However then a humorous factor occurred. The rally began to broaden. Non-tech shares lastly began to take the lead.

As merchants, we’d like to pay attention to our biases in order that we will higher conquer them.

Mike Carr is somebody who focuses on the info on the subject of investing smarter and extra effectively. So if you wish to study extra about how he trades (and get his experience), try his Commerce Room immediately.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge