How we suppose impacts our funding returns.

Some buyers are reasonably stunned by this. They imagine income consequence from shopping for low and promoting excessive. However it’s truly their pondering that determines whether or not costs are low or excessive.

As an previous dealer as soon as informed me: “Costs are numbers on a display. They aren’t excessive or low. We commerce traits, not worth.”

It is a easy market fact. However many people struggle it. We need to imagine we all know when costs are excessive or low. That’s as a result of our biases about market motion.

Final week, I wrote about anchoring. This psychological bias influences purchase selections. You might even see a inventory buying and selling at a brand new 52-week low and suppose it’s low cost. Your impression of worth is anchored on the 52-week excessive.

Satisfied that worth is low, you purchase. The inventory retains falling. You maintain your shares. Now you are attempting to keep away from the ache of a shedding commerce, which I wrote about two weeks in the past.

These attention-grabbing concepts could seem impractical at first.

However once we look extra fastidiously, we see they actually do have sensible functions to the market. How buyers really feel is a very powerful issue defining inventory costs. And there’s even a method that explains precisely how this works…

Investor Opinions Set the Worth

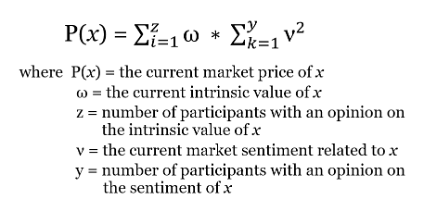

Within the method proven beneath, worth (P(x)), is the same as the intrinsic worth of a inventory multiplied by the sq. of bullishness or bearishness of the typical investor. Squaring the opinions makes that a very powerful issue within the equation.

This method is sensible. If sentiment is extraordinarily bullish, we could also be in a bubble with costs fully disconnected from fundamentals. In environments the place sentiment is extraordinarily bearish, every thing would possibly seem like a cut price, though it looks as if nobody is shopping for.

Let’s take a look at a selected instance. Say a inventory has an intrinsic worth of $42.08. You realize that since you accomplished a reduced money circulate evaluation of the corporate. You estimated gross sales, working prices, the price of capital, rates of interest and plenty of different variables. Your work seems to be sound.

However the inventory’s not buying and selling at $42.08.

It could be buying and selling at $29.04. That’s a 31% low cost to the intrinsic worth. This implies the inventory is undervalued to you, so you purchase.

Discover that phrase “to you” within the earlier sentence. The intrinsic worth is your opinion. Different buyers have a unique opinion. It’s secure to say the bulk imagine the worth is decrease than $42.08, in any other case the inventory can be priced larger.

Earlier than shopping for, it is best to ask a vital query: Why is the inventory undervalued?

Some buyers by no means ask this. They purchase undervalued shares and watch the inventory get extra undervalued. They consider this as a shopping for alternative. But when the inventory retains falling, it’s not value shopping for.

Or the inventory simply doesn’t transfer. That’s additionally dangerous. A inventory that doesn’t transfer is “lifeless cash.” It’s cash that’s not incomes cash. Since most of us have restricted capital, so we are able to’t afford lifeless cash. We have to personal shares which might be going up reasonably than shares that ought to go up.

Merely excited about why the inventory is undervalued may assist keep away from some losses or lifeless cash.

Observe the Market Sentiment to Income

The method above helps us perceive the rationale why shares are undervalued.

Numerous buyers have a bearish opinion on the inventory. They aren’t shopping for that inventory, in order that makes it unattainable for the value to go up.

Bear in mind, in that method, opinions are squared. This makes emotions in regards to the inventory the dominant issue figuring out a inventory’s worth. Till opinions change, an undervalued inventory can’t go up.

Alternatively, if opinions are bullish, the inventory may very well be overvalued.

Chances are you’ll take a look at a inventory’s worth and realize it’s not value that a lot. But it retains going up. In these instances, you’re proper — the inventory is overvalued.

However you aren’t being profitable in that inventory since you allowed your opinion to overrule the market motion.

With these easy examples, you see that opinions actually are a very powerful consider pricing. That’s an important funding lesson.

In July 2007, Charles Prince III (then CEO of Citigroup) defined how his financial institution was dealing with the apparent bubble in subprime mortgages. He stated: “When the music stops, when it comes to liquidity, issues will probably be difficult. However so long as the music is taking part in, you’ve obtained to rise up and dance. We’re nonetheless dancing.”

In shares, market sentiment is the music. Whether or not it’s bullish or bearish, it is best to hearken to the market’s music and dance like nobody’s watching.

Regards, Michael CarrEditor, Precision Income

Michael CarrEditor, Precision Income

The Greatest Time to “Purchase and Maintain”

The S&P 500 is up round 20% this 12 months. That’s a improbable run, significantly after a brutal 2022.

You realize me. I’m by no means going to let you know to not commerce. In case you suppose you may make cash, go for it. That’s what markets are for.

However I’ll repeat that this can be a dealer’s market. By all means, trip this factor larger. However don’t purchase, maintain and pray.

And right here’s why:

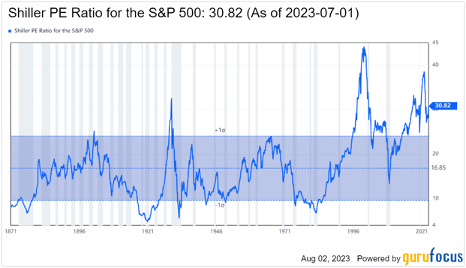

The cyclically adjusted worth/earnings ratio (CAPE) is most actually not a market timing mannequin. If you’re in search of an indicator that may let you know when to get in or out of a market commerce, this isn’t it.

However the CAPE is efficient at supplying you with a “fast and soiled” estimate of what to anticipate from buy-and-hold returns over the following 8 to 10 years.

When the CAPE is close to the underside of the blue zone, or ideally, beneath it, shares are priced to ship improbable returns. That is whenever you actually can purchase and maintain with confidence.

However when the CAPE is priced above the blue zone you see within the chart, returns over the next decade are usually weaker. And as we speak, the CAPE is effectively exterior of these bounds. The great people at GuruFocus ran the numbers, and calculated that returns within the ballpark of three.5% per 12 months are what we should always count on at beginning valuations like these.

Now, I don’t imagine for one minute that returns will probably be precisely 3.5%. It is a broadsword, not a surgical scalpel. Which means, this assumes that valuations revert to one thing resembling the long-term common. Maybe returns find yourself being a number of factors higher than that … or perhaps considerably worse. Solely time will inform.

However in my view, this isn’t a great time for a buy-and-hold technique. When the anticipated return on shares is definitely decrease than what’s at present obtainable in risk-free bonds, it suggests there are higher options.

My recommendation?

When you’ve got a core of long-term inventory holdings you propose to maintain for years and even many years, you don’t have to run out and promote them. However hold a detailed eye in your decrease conviction holdings and know whenever you plan to get out.

And with the majority of your portfolio, take into account being extra energetic — equivalent to with a short-term buying and selling technique.

Now, a short-term commerce isn’t assured to outperform. However let’s simply say I like your odds higher in an energetic method, no less than till market valuations come down somewhat.

If you wish to be taught extra about the simplest short-term trades to your portfolio, that is the place Mike Carr can information you. Take a look at what he’s doing in his Commerce Room proper now.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge