Wirestock

The Federal Reserve has talked and acted powerful with respect to inflation over the previous 18 months. Rates of interest have soared from the repressed ranges that prevailed for the last decade following the Nice Recession. Throughout these years, buyers remained detached to the disposition of their quick time period investments as close to zero rates of interest had been provided in a broad swath of bond markets.

That interval of indifference has ended decisively. Our central financial institution has hiked the federal fund price in 11 of its final 12 conferences. Actually, the Fed Funds futures price hovers round 5.4% for the month of December. As bond costs have fallen, bond yields have elevated to the purpose the place their anticipated return beats inflation expectations.

Buyers at the moment are evaluating completely different segments of the mounted revenue market reminiscent of tax-exempt municipal bonds. Particular person buyers proceed to carry the plurality of the $4.1 trillion municipal market, accounting for 2 fifths of the float by direct holdings. After all, extra is held by funds.

Break Even Tax Charges

The municipal market is skewed to the extra credit score worthy finish of the rankings spectrum. About 85% of its points are rated A or higher. Cumulative default charges for investment-grade municipal bonds whole 0.09% over ten-year intervals, on common. This compares with 2.17% for the worldwide company market—properly over twenty instances that of municipals in line with Moody’s knowledge as of December 31, 2021. it is price taking a more in-depth take a look at the advantages of municipal bonds.

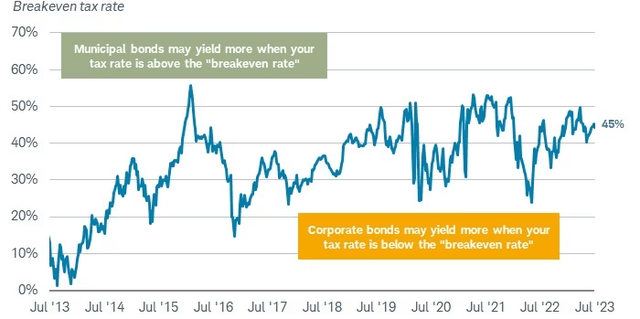

Each municipal and taxable yields have elevated however which market is best for whom? One fundamental standards for analysis is to check the breakeven tax price for each points. This comparability has produced diverse outcomes over time.

In 2016, for example, most buyers in intermediate bonds can be higher served by tax exempt choices. Breakeven tax charges hovered round 20% whereas most buyers had been taxed at ranges above 20% on the margin. Over the previous 12 months, nonetheless, the breakeven price has exceeded 40%. Only a few buyers pay taxes at that price.

Bloomberg, weekly knowledge as of seven/14/2023. Bloomberg Municipal Bond 7-year (6-8) Index (LM07TR Index) and Bloomberg U.S. Intermediate Company Bond Index (LD06TRUU Index)

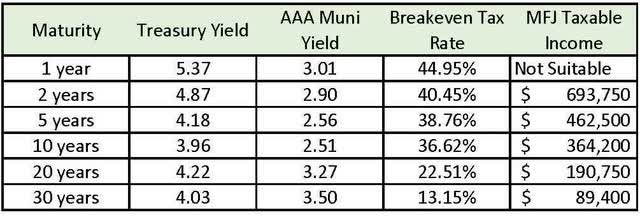

The relative attractiveness of munis varies throughout the maturity spectrum. As we speak’s AAA bond market yields favor taxable points at each the quick and intermediate components of the yield curve. The highest federal revenue tax price is 40.8% (together with the Obamacare tax) As a sensible matter, few buyers pay this price. Quick and intermediate municipal bonds are favorable solely to these buyers at or close to the highest Federal tax price. On the lengthy finish of the yield curve, nonetheless, municipal bonds swimsuit a a lot wider array of buyers. Breakeven tax charges fall beneath properly into the revenue vary of the center class.

The desk beneath describes the breakeven tax price above which municipal bonds supply a greater return. The rightmost column cross-references the revenue degree at which a married couple pays tax above that price on the margin.

Breakeven Tax Charges and Earnings Ranges (Raymond James and the Tax Basis, 07-31-23)

For instance, A typical 1 yr municipal bond yields solely 55.05% of a comparable treasury. An investor must be taxed at a 44.95% tax price to be detached to treasuries. That is greater than the highest federal revenue tax price.

On the 10 yr maturity, it is a considerably nearer name as munis there supply yields roughly 65% of treasury securities. At 30 years, the yield ratio expands to 87%. Most taxable people can profit from lengthy dated municipal bonds on an after tax foundation. Why?

In contrast to the U.S. Treasury yield curve, the tax-exempt municipal curve stays upward-sloping, with 30-year muni yields nearly 100 foundation factors greater than 5-year yields. Actually, 30 yr top quality munis have yielded nearly 90% of comparable maturity treasuries. They’re priced attractively on the lengthy finish of the yield curve. Along with potential return from unfold compression, buyers may benefit from worth appreciation as longer-dated bonds “roll down” the comparatively steep tax-exempt curve.

Deviating from the Easy Evaluation

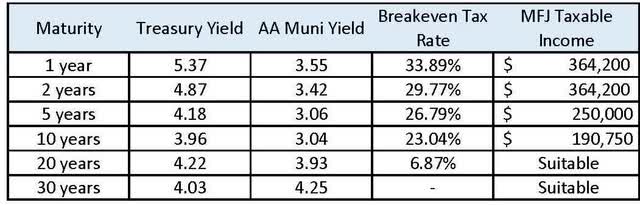

Traditionally, the default expertise of Municipal bonds has been superior to company bonds, even adjusting for his or her credit standing. AA Munis nearly by no means default. The ten-year common default price for AAA rated munis is 0.00%, whereas AA rated bonds stand at 0.02%. A portfolio of AA municipal bonds suffers nearly no degradation from default. Some contemplate them an inexpensive credit score proxy for Treasuries.

If AA Munis are primarily equal in credit score high quality to Treasuries, the breakeven tax and revenue ranges fall. Contemplate the breakeven evaluation in opposition to the AA muni yield curve.

Breakeven Tax Charges and Earnings Ranges for the AA Muni House (Raymond James and the Tax Basis, 07-31-23)

The fact is that municipal bonds seldom carry out this “cleanly”. There are quite a few sensible issues with their tax benefit. One principal instance is the state revenue tax. Curiosity on Treasuries is exempt from state revenue taxes whereas buyers should pay state tax on bonds issued outdoors their state of residence. For residents in states reminiscent of New York and California, that is a cloth shortcoming of municipal bonds.

There are different exceptions. Rates of interest have risen significantly. As such, many municipal bonds have been buying and selling at a major low cost to their face worth. The IRS taxes accretion of reductions as abnormal revenue. For years, this coverage was irrelevant as falling rates of interest pushed municipal bond costs above par. There have been no reductions.

Nevertheless, in 2022, the surge in rates of interest cratered the municipal market. Many bond costs sunk properly beneath par. Buying and selling quantity dried up in these points as fund managers prevented them – for concern of producing taxes for his or her finish buyers. At greatest, these points traded at an additional low cost to compensate buyers for his or her implied tax legal responsibility.

Municipal bonds have rallied a bit in 2023 thus depleting the ranks of municipal bonds with embedded tax legal responsibility. However, it is an issue that looms over the tax-exempt market within the occasion of one other surge in rates of interest. New patrons of muni bonds should navigate the market and alter their after tax calculations with the data that some fraction of their whole return shall be taxed as abnormal revenue.

Muni bonds may also underperform if rates of interest fall. In contrast to Treasuries, over 85% of municipal bonds are callable. For instance, most long run municipal bonds enable the issuer to name the bond away at some worth above par worth (e.g. 105.00). Within the occasion of a market rally, municipal bonds will underperform taxable product as their issuers have the choice to name the bonds at a capped worth.

The choice-adjusted yield in a municipal bond suffers in a unstable mounted revenue market. Tax points and name choices impair on worth efficiency as these bonds transfer away from par worth. Right here is a straightforward graphic instance beneath.

Bond Efficiency as Curiosity Charges Change (Ready by the Writer)

Many sorts of municipal bonds are topic to the choice minimal tax (AMT). Earnings from non-public exercise municipal bonds, people who fund stadiums, airports or extra businesslike enterprises—is likely to be topic to AMT. If one has to pay AMT and maintain such a bond, curiosity revenue would typically be taxed at an AMT price of 26% or extra. For instance, Vanguard’s excessive yield muni bond fund (VWALX) paid nearly one sixth of its curiosity final yr from non-public exercise bonds. This curiosity was topic to the AMT.

Retirees additionally face distinctive challenges holding municipal bonds. Earnings from such bonds is included in modified adjusted gross revenue (MAGI) when figuring out how a lot of 1’s Social Safety profit is taxable. If half of your Social Safety profit plus different revenue, together with tax-exempt municipal bond curiosity, quantities to greater than $44,000 for a joint return, as much as 85% of your Social Safety advantages could also be taxable.

Month-to-month premiums on Medicare components B and D are additionally scaled by revenue. Curiosity from municipal bonds might enhance the quantity paid for these insurance coverage premiums. When you’re married submitting collectively and your MAGI is greater than $194,000, you can be required to pay a further quantity for Medicare Half B and Medicare prescription drug protection. As we speak, most retirees pay $165 month-to-month however this could enhance to over $500 for greater revenue ranges.

There are quite a lot of ifs, ands, or buts to the tax shelter properties of municipal bonds. Particular person buyers must tread fastidiously.

Finest Practices

Whereas the municipal market has its pitfalls, skilled municipal bond administration is out there to particular person buyers by a wide selection of mutual funds and ETFs. The managers of those funds are able to steer away from the tax traps implicit within the municipal market. They’ll supply bonds exempt from the AMT and issued by a single state, for example.

People ought to keep away from holding particular person muni bonds. The tax-exempt bond market is much less liquid than the US Treasury market – some particular person bonds have bid/ask spreads of 1.0% or extra.

Going ahead, we’re prone to see that some funds shrink back from discounted points as properly. All this comes at a price, nonetheless. Municipal markets are moderately environment friendly. Bonds that keep away from these tax pitfalls commerce at greater costs in equilibrium and that negates a few of their tax benefit.

It is troublesome to assign exact values to the structural points with the municipal market. A lot of the drag on municipal securities relies on the precise scenario of the investor. Furthermore, the attractiveness of the general municipal market itself are fairly fluid. Our first chart indicated that fundamental breakeven tax charges differ significantly over time.

Are there some guidelines of thumb? Virtually definitely. Buyers in excessive tax states like New York and California ought to steer clear of municipals until they’ve entry to house state muni bond funds. Equally, retirees ought to seek the advice of with a tax advisor earlier than investing in municipals. Curiosity revenue from these bonds can cut back the worth of Social Safety and Medicare advantages.

Asset location performs a serious position within the dimension of a tax-exempt portfolio. Most buyers contemplating municipal bonds are people. These people have already got tax-sheltered accounts reminiscent of 401ks and IRAs. Finest apply means that taxable bonds be positioned in these accounts the place tax on curiosity might be deferred. As taxable bonds nearly all the time supply greater yields, the general return to the investor is maximized by finding bonds right here first.

To the extent that bonds should be held in taxable accounts, it is smart to incorporate municipal bonds representing the lengthy finish of the yield curve. In immediately’s market, the benefit of tax-exempt mounted revenue is maximized at maturities in extra of ten years

Contemplate this instance. John has a $1.2 million portfolio which consists of a $800,000 particular person account and a $400,000 IRA. His anticipated marginal tax price in 2023 is 30%. After session with a monetary advisor, he agrees to a balanced asset allocation of fifty% shares and 50% bonds. We have to purchase him $600,000 in bonds. For the sake of argument, we’ll restrict long run bond purchases of any variety to $100,000 attributable to considerations about rate of interest actions.

Our first step is to construct the bond portfolio by populating the IRA with quick and intermediate time period taxable bonds. That leaves $200,000 in bond purchases for the person account. The relative worth of the municipal market on the lengthy finish of the yield curve means that our lengthy bonds ought to be tax-exempt. At shorter maturities, we’ll proceed to make use of taxable bonds for the rollout. The final technique would appear to be this in graphic phrases.

Pattern Rollout of Muni Bonds (Ready by Writer)

Municipal bonds can play a constructive position in a person’s funding portfolio. Macroeconomic situations do drive the fundamental suitability of tax-exempt points. The tax-exempt yield curve immediately provides extra worth at longer maturities. That mentioned, nuances within the taxation of muni bonds impression every investor in a different way. It is best to make the most of skilled administration to implement a municipal bond technique. The investor’s private scenario performs an elevated position within the choice and sizing of his municipal bond holdings.