Article content material

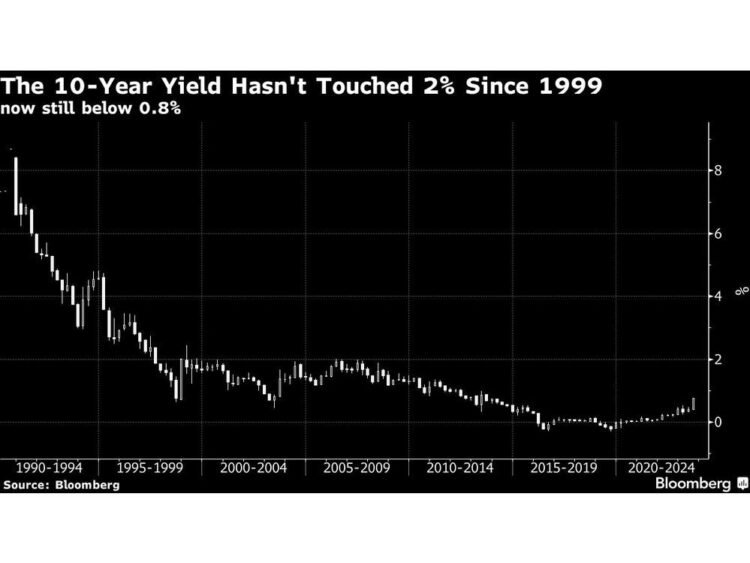

(Bloomberg) — Buyers want to organize for Japan’s benchmark 10-year bond yield rising to round 2% if the central financial institution’s inflation aim is realized and it ends its negative-rate coverage, in response to a former analysis chief on the Financial institution of Japan.

Whereas monetary markets have moved towards factoring within the lifting of the short-term detrimental charge within the January-March quarter, they might be caught out by a spike in longer-term charges, mentioned Toshitaka Sekine, a professor at Hitotsubashi College’s Graduate Faculty of Worldwide and Public Coverage and former head of the BOJ’s Analysis and Statistics Division.

Article content material

“They must preserve these ranges in thoughts someplace or they are going to be in hassle,” Sekine mentioned in an interview on Thursday.

Sekine mentioned he’s been stunned by an information set from the interior affairs ministry exhibiting the buyer worth index, excluding meals and power costs, rising at 2.7% in August from a yr in the past. The identical goes for labor ministry figures exhibiting July’s 2.4% achieve within the mounted salaries of strange employees. “I’ve not often seen such numbers,” he mentioned.

The BOJ’s outlook report launched in April confirmed the year-on-year achieve in one other measure of costs, excluding contemporary meals and power, possible at 1.8% within the fiscal yr beginning April 2025. “I used to be horrified on the shut proximity to 2%,” he mentioned. “I felt that if this have been the case, the BOJ would have modified its coverage.”

Share this text in your social community