brightstars

A Purchase Score for Aris Mining Company

This evaluation assigns a Purchase ranking to shares of Aris Mining Company (TSX:ARIS:CA), a Canadian gold producer in Colombia.

The Development Prospects for Aris Mining

This can be a gold mining operator that would have given a major increase to its future progress thanks to 2 milestones achieved within the final 18 months, basically as follows:

- The addition of the constant money circulation generator of the Segovia gold mine (132 km northwest of Medellin, Colombia) to the corporate’s portfolio of mineral growth tasks, together with the big undeveloped Soto Norte gold venture (7 km northwest of California, Colombia), following the merger of Aris with GCM Mining, a widely known mid-sized gold mining firm in Latin America, in September 2022. Though not directly, Aris Mining Company totally owns the Segovia underground gold mine.

- In July 2023, the firm obtained the inexperienced gentle from the native regulatory authority to construct the Marmato Decrease Mine, which is able to present entry to wider porphyry mineralization. This extra gold ore useful resource is situated under present higher mine operations and as soon as operational, will improve the manufacturing profile of the Marmato mine, situated 85 km south of Medellin, Colombia, which means the power will produce 5 occasions its present manufacturing and will ship gold ounces for greater than twenty years. Though not directly, Aris Mining Company totally owns the Marmato underground gold mine.

Aris Mining subsequently believes that gold manufacturing in Colombia can attain round 400,000 ounces, which undoubtedly represents a pointy improve of greater than 70% in comparison with the roughly 235,000 ounces of gold in 2022.

But it surely’s not over but. Relating to the event of the Soto Norte venture, ought to Aris Mining Company train an choice to extend its shareholding within the three way partnership (JV) from 20% to 50%, Soto Norte has the potential to make an additional robust contribution to Aris future ounces within the order of fifty% of an estimated annual gold manufacturing of 450,000 ounces. The Soto Norte venture is being developed by Aris Mining Company in a three way partnership with Mubadala Funding Firm – an entirely owned funding car of the Authorities of Abu Dhabi – with the UAE associate holding 80% of the JV. The venture is now awaiting environmental approval from the Colombian regulatory company, which should give the inexperienced gentle for mining growth to proceed.

As well as, there’s the Toroparu Undertaking, situated 213 km west of Georgetown, Guyana, with its complete Measured and Indicated Mineral Useful resource of roughly 5.4 million ounces of payable gold grading 1.45 grams of gold per ton of mineral, in keeping with the technical report dated March 31, 2023. This gold ounce potential is vital because it presents many probabilities for the corporate to develop additional sooner or later and though no monetary viability has been demonstrated as they have to be upgraded to reserves first, they bode effectively for Aris Mining Company’s robust progress plan. At present, Aris Mining Company, which owns 100% of the Toroparu Undertaking, albeit not directly, is engaged in research geared toward updating and optimizing the event plan for the Guyana asset.

Nonetheless, the mineral tasks closest to the primary deliberate progress milestone in Aris Mining Company’s pipeline are the optimization and enchancment of the Segovia mine together with the enlargement of the capability of a processing plant, and the event of the decrease zone of the Marmato mine.

These tasks will allow Aris Mining Company to attain its annual manufacturing progress goal of 400,000 ounces. Nonetheless, this won’t occur till 2026 on the earliest, because the decrease zone of the Marmato mine means that the first gold can’t be poured till the third quarter of 2025.

Which means regardless of recognizing the expansion potential, which, as soon as realized, will permit Aris’ share worth to comply with the underlying constructive pattern of the gold worth rather more faithfully than at this time, the shares stay, for now, totally uncovered to fluctuations within the worth of gold.

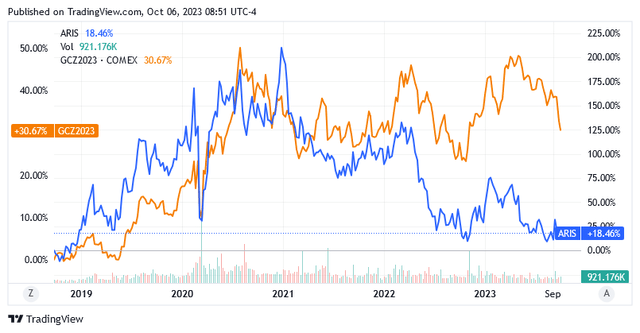

The Constructive Correlation Between Aris Mining and Gold Costs

This may be noticed within the chart under: Though the 2 belongings within the chart are positively correlated, Aris Mining Company shares have solely seen an 18.5% improve over the previous 5 years. This pattern has not been sufficient for ARIS to keep away from an underperforming pattern in opposition to gold futures, a benchmark for the gold worth that, then again, confirmed an underlying pattern that was resolutely projected upwards. The gold worth thus exceeded ARIS.TO and recorded a rise of greater than 30%.

Supply: Looking for Alpha

Holding a place pending the conclusion of progress tasks and subsequently whatever the growth of the gold worth exposes the funding to the next dangers.

There’s a danger of loss if the investor urgently wants his a reimbursement and the share worth has been dampened by a pointy decline within the worth of gold. Or that buyers are lacking out on the chance to put money into different belongings which have change into so enticing that, compared, persevering with to carry gold and gold-backed belongings like Aris Mining is simply an uncompetitive means of using cash.

As a substitute, buyers ought to contemplate Aris Mining Company to profit from the robust features that gold costs expertise now and again, making the most of the marked constructive correlation that exists between the inventory worth and the worth of the yellow metallic.

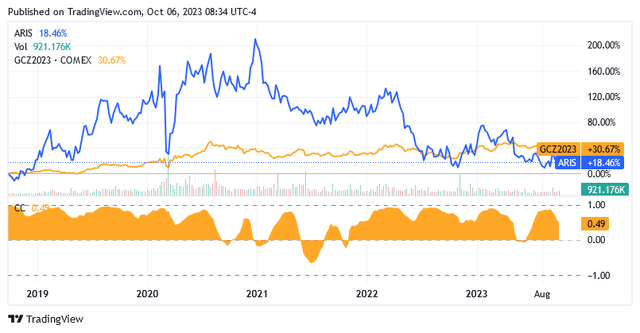

The chart under illustrates this constructive correlation between the two belongings.

Supply: Looking for Alpha

This constructive correlation, represented by the yellow space graph, can also be very robust, as the realm was nearly all the time above zero and near the higher restrict of the -1 + 1 correlation coefficient vary. Which means when the worth of the yellow metallic rises, so does the share worth. The reader could also be confused by the truth that the share worth has elevated a lot lower than the worth of gold in recent times. Nonetheless, these performances are the results of the distinction between costs 5 years in the past and present costs and clarify nothing in between. They’re subsequently not a measure of the connection that exists between the worth of gold and the worth of Aris Mining’s inventory.

The correlation between the securities is undoubtedly constructive, though Aris Mining Company’s inventory worth on the x-axis has a a lot smaller slope than the dear metallic worth on the x-axis. This pattern comes as Aris Mining Company has fallen a lot sooner than the gold worth through the bearish sentiment across the treasured metallic. As beforehand talked about, buyers ought to concentrate on this danger if they’re significantly contemplating holding shares on this firm for the long run, effectively forward of the corporate’s 2026 manufacturing progress goal.

Within the chart above from Looking for Alpha, gold futures (GCZ2023) are the benchmark for gold.

The Excessive Beta Gold

If the investor as a substitute needs to think about Aris Mining Company to realize publicity to the subsequent rally within the gold worth, which guarantees to be pushed by a robust catalyst, as defined under, then his technique will likely be positioned to profit from a excessive beta-gold coefficient.

Gold beta measures how a lot the inventory worth of Aris Mining Company might rise if the gold worth will increase by a sure share.

For this function, the final 52 weekly ARIS inventory worth returns are the output, whereas the 52 weekly gold futures returns are the enter to a linear mannequin that produced the next outcomes. Though the estimate of the beta gold coefficient must be handled with warning given the comparatively low worth of the coefficient of willpower R2 of the hypothetical relationship between gold costs and inventory costs, a beta gold worth of 1.7 means that the inventory worth might doubtlessly rise sharply throughout a robust restoration of the gold worth. R2 is 17%.

As for the R2, which is 17%, this may be elevated if extra enter variables are added to the mannequin and/or the mannequin is run for an extended interval than 52 weekly returns. The mannequin takes under consideration weekly returns from the final 52 weeks and never additional previously, based mostly on the concept markets sooner or later will look extra like they did within the final 52 weeks than in earlier years as sure macroeconomic and geopolitical elements proceed to be the case. These are elevated inflation, restrictive financial coverage, conflicts in Ukraine, and geopolitical tensions.

Now gold, which has misplaced a major 6.2% per ounce over the previous month, is beneath robust downward strain from an increase in U.S. Treasury yields and the robust U.S. greenback following the Federal Reserve’s “greater for longer” coverage. The value per ounce is more likely to stay subdued for some time as a result of identical elements, however thereafter there must be a robust restoration as an example someday in late 2023/early 2024.

The Upside Catalyst for the Value of Gold

The catalyst for a pointy rise in gold costs might come from the anticipated financial recession as early as 2024 as a result of the robust headwinds from the worsening cycle will strengthen gold’s safe-haven qualities, which buyers view as a safety for his or her portfolios.

The recession ought to comply with a major deterioration in shopper demand, which alone accounts for almost 70% of US GDP.

US shopper demand is weakening as a result of it displays US shoppers’ views on their incomes, companies, and labor market situations within the close to future, and this view is now not optimistic. US shoppers gave the three parts simply talked about a rating of 70. That is low and has traditionally been related to a recession inside a 12 months of the survey.

US shoppers, or 70% of the US GDP, are combating this downside: greater borrowing prices, which have to remain “greater for longer” perhaps even after the Fed Funds price reaches the anticipated peak of 5.6% this 12 months, mixed with core inflation nonetheless effectively above the two% goal, weighs like loopy on the buying energy of US households.

That demand can also be weighed down by a document $1 trillion in excellent bank card balances with stellar rates of interest and greater than $1.7 trillion in federal pupil mortgage debt, and it seems now not capable of depend on extra financial savings accrued through the COVID-19 disaster.

This week new indicators of financial recession have emerged:

- September 2023 noticed the lowest personal sector job progress since January 2021, which additionally fell wanting expectations.

- New orders progress is dropping momentum as excessive labor prices and rising inflation proceed to dampen shopper demand, which in flip impacts enterprise exercise. If costs cease rising so rapidly, the providers sector will probably stagnate or shrink. This interpretation of the ISM providers index is confirmed by S&P’s World US providers PMI studying in September which indicated:

“the weakest efficiency within the providers sector since January, as enterprise exercise stagnated amid weak demand situations”.

This example of excessive inflation/excessive borrowing prices is anticipated to persist, growing the probability of a pointy financial slowdown, at the same time as analysts of enormous banks proceed to recommend a delicate touchdown.

This example of excessive inflation/excessive borrowing prices is anticipated to persist, growing the probability of a pointy financial slowdown, at the same time as banking analysts proceed to recommend a delicate touchdown.

Inflation threatens to worsen on account of the strain on the oil provide. OPEC+’s coverage of lowering the provision of barrels of oil is now getting a lift from Russia in retaliation for the West’s intervention to help the Kyiv authorities in opposition to the Russian invasion.

Relating to borrowing prices, because the labor market stays at traditionally tight ranges, the probability that the Federal Reserve might want to decrease core inflation by additional aggressive financial coverage on rates of interest will increase considerably.

Consequently, an financial recession is predicted by Duke professor and Canadian economist Campbell Harvey and extra not too long ago Michael Pearce, chief US economist at Oxford Economics, mentioned:

“a sharper slowdown in consumption and the broader financial system”, in a analysis observe on Thursday, September 26, 2023.

A recession as early as 2024 will end in buyers looking for the protected haven of gold as a type of safety in opposition to the danger of devaluation of their belongings.

Buying and selling Economics analysts predict a regularly greater worth per ounce of the dear metallic of $1,869.26 by the tip of this quarter, and $1,933.95/oz in twelve months.

The Inventory Valuation and the Threat of Investing in Aris Mining Corp

For buyers contemplating Aris Mining Company in gentle of the anticipated robust restoration within the gold worth, on the time of writing, shares of ARIS had been buying and selling on the Toronto Inventory Trade at a market worth of CA$3.17 every, giving it a market capitalization of CA$422.57 million.

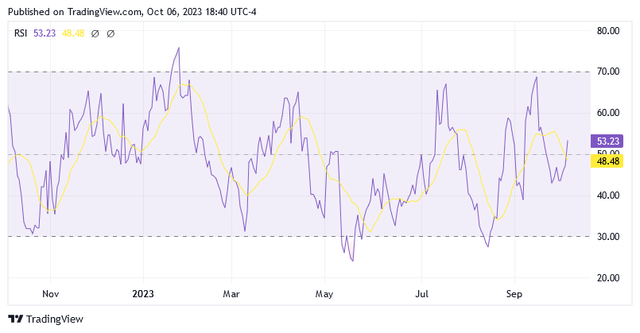

Shares are considerably under the center level of CA$3.255 within the 52-week vary of CA$2.77 to CA$3.68. Shares had been buying and selling under the 200-day easy shifting common of CA$3.62 however barely above the 50-day easy shifting common of CA$3.09.

Supply: Looking for Alpha

The Fed’s “greater for longer” financial coverage will proceed to place downward strain on gold costs because the excessive yield setting doesn’t bode effectively for the yellow metallic and Aris shares ought to create decrease entry factors than present ones attributable to their constructive correlation with the yellow metallic.

The chart illustrating the 14-day Relative Power Indicator means that ARIS shares have taken a pause as a result of bearish sentiment surrounding the dear metallic. The shares don’t look like oversold but, so there’s loads of room for a great probability for extra enticing market valuations.

Supply: Looking for Alpha

For the retail investor, it is smart to attend slightly longer earlier than shopping for shares of Aris Mining Company, because the highlighted impression of Fed coverage on gold costs provides the chance to allocate much less cash when investing on this inventory.

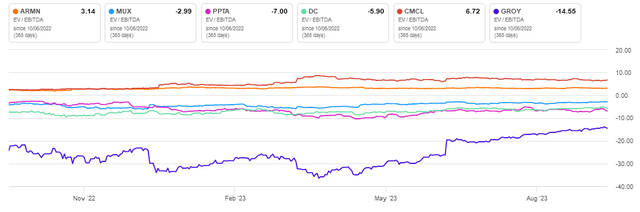

In the meanwhile, Aris Mining Company shares don’t appear costly in any respect, additionally based mostly on the next indicator, which is used to check the profitability of Aris Mining’s enterprise with its most direct opponents.

Supply: Looking for Alpha

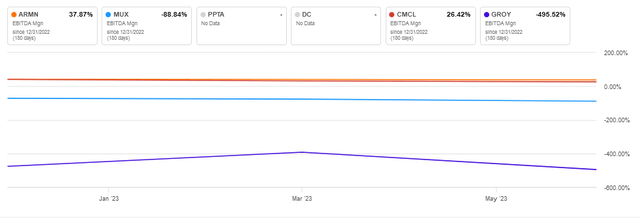

In actual fact, Aris Mining Company has a 12-month EV/EBITDA ratio of three.14 versus McEwen Mining Inc. (MUX)’s -2.99x, Perpetua Sources Corp. (PPTA)’s -7x, Dakota Gold Corp. (DC)’s -5.90x, Caledonia Mining Company Plc (CMCL)’s 6.72x, and Gold Royalty Corp. (GROY)’s -14.55x.

Aris Mining Company is significantly better positioned than its opponents, lowering the danger of publicity to the gold worth ought to the gold worth rally not happen or be a lot much less intense than anticipated. Nonetheless, if the gold worth setting improves dramatically, a positive comparability in EV/EBITDA phrases can even improve the probabilities of a great margin of return through the gold bull market, piquing merchants’ curiosity.

A inventory comparability based mostly on the EV/EBITDA ratio makes a variety of sense in keeping with this evaluation as a result of buyers closely contemplate EBITDA when assessing the profitability of a capital-intensive business like a gold mining firm.

The ratio is calculated based mostly on Aris Mining Company’s 12-month EBITDA, which was $152.8 million as of June 30, 2023.

The EBITDA stems from the next monetary and operational measures:

- 12-month complete revenues of $403.5 million as Aris Mining Company bought roughly 308,087 ounces of gold at a realized gold worth that was roughly $1,778/oz in H2-2022 and $1,888/oz in H1-2023. The gold worth in H2-2022 is an estimate from the full 12 months 2022 minus H1-2022 monetary outcomes.

Nonetheless, this estimate and subsequent estimates of trailing 12-month manufacturing and prices are affected by the merger of the previous Aris Gold Company with GCM Mining, which fashioned the present enterprise of Aris Mining Company, 100% oblique proprietor of the Segovia operation.

- 12-month All-In Sustaining Price of roughly $1,144/oz from the manufacturing of 305,449 ounces, as:

Segovia contributed 90% of complete H1-2023 manufacturing of 104,906 ounces, at an attributable AISC/oz of $1,225, whereas Marmato higher zone for the remainder of manufacturing. Within the case of Segovia, ounces additionally come from the actions of artisanal and small-scale miners within the surrounding space, so the mine operated by Aris Mining introduced in 52,732 ozs at AISC/oz of $1,007, whereas small companions delivered 41,663 ozs on the facility of the corporate and AISC/oz was estimated at $1,236.

H2-2022 manufacturing was roughly 200,543 from full-year 2022 manufacturing of 215,373 ozs at an AISC/oz of $1,128 much less H1-2022 ante Aris Gold Company-GCM Mining merger manufacturing of 14,830 ozs at an AISC/oz of $1,487.

The corporate has issued full manufacturing and price steering for 2023, with the Segovia operation anticipated to be 195,000 to 210,000 ounces at an AISC/oz of $1,125 to $1,175, with attributable AISC/oz to be $1,000 to $1,050 with regard to the mine operated by the corporate whereas $1,250 to $1,300 with regard to the manufacturing that’s anticipated to be provided by small unbiased miners.

The Marmato Higher Zone will proceed to contribute to Aris Mining Company’s complete manufacturing for the total 12 months 2023, with an anticipated manufacturing of 20,000 to 30,000 ounces.

Within the Segovia mining district, Aris Mining Company is presently engaged in efforts to optimize and enhance gold processing, which prompted a document manufacturing of 19,406 ounces in August 2023, or a rise of 24% in comparison with the common for the primary seven months of 2023. Whereas the invention of 32 completely different mineralized vein constructions within the fast neighborhood of the principle lively mine bodes effectively for Aris’ progress technique.

The corporate can even proceed to construct the Marmato decrease zone mining operation, work on the Soto Norte gold venture, and improve the Toroparu measured and indicated mineral assets.

Based mostly on the funds allotted within the first half of 2023 for the upkeep and growth of ongoing actions and progress tasks, Aris Mining Company wants about $90-95 million per 12 months. The corporate appears to have the ability to afford this allocation of funds based mostly on the next indications:

- Greater gold manufacturing from Segovia attributable to operational enhancements, particularly following the enlargement of the processing facility, which must also have a constructive impression on prices.

- Gold costs are anticipated to stay supportive as the dear metallic features momentum attributable to its safe-haven properties in an more and more unsure macroeconomic and geopolitical world setting.

- A suitable monetary place regardless of internet debt of $165.8 million (= money and equivalents of $214.3 million much less complete debt of $380.2 million as of June 30, 2023), as an curiosity protection ratio of three.87x means that the corporate can simply repay the curiosity expense with the working earnings. The curiosity protection ratio is calculated as the trailing 12-month working earnings of $118.5 million divided by the trailing 12-month curiosity expense of $30.6 million. Buyers count on this ratio to be no less than 1.5x to imagine that the corporate has the power to repay its excellent money owed.

This Makes Aris Mining Significantly Appropriate as a Catalyst for a Greater Gold Value

Aris Mining Corp has a trailing 12-month EBITDA margin of 37.87%, considerably outperforming all of its closest opponents, as illustrated by the chart under. As profitability is likely one of the principal drivers of share worth within the inventory market, a better margin signifies that the rise within the gold worth (the upside catalyst) will likely be transmitted to ARIS’ share worth rather more successfully than its opponents. The upper EBITDA margin ought to in principle drive most merchants’ curiosity in Aris Mining relatively than its rivals when gold is again in an uptrend mode.

Supply: Looking for Alpha

Extra About The Threat

The chance of holding shares in Aris Mining Company comes from nation danger and low buying and selling volumes, which buyers are suggested to observe going ahead by the next data.

Mines in Colombia usually are not with out accidents, and it appears that evidently even these beneath common permits are in danger, as a lot of chances are you’ll do not forget that an explosion final March prompted 21 fatalities in 5 coal mines within the village of Peñas de Cajón, in a rural space of Sutatausa within the Cundinamarca Division.

Moreover, a good portion of the inhabitants lives in financial situations of maximum poverty with a meals deficit, which doesn’t have good repercussions on the Latin American nation’s financial system.

After which the mining areas are additionally uncovered to geophysical danger, as a result of not too far-off within the Andes is the turbulent Nevado del Ruiz volcano, which frequently forces the authorities to declare a state of alarm.

Sprott’s Mining Threat Warmth Map 2023 assigns Colombia a average danger, which summarizes all highlighted nation danger elements.

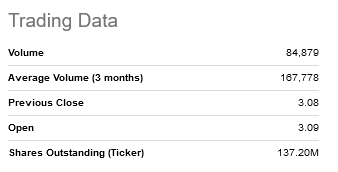

As well as, Aris Mining Company inventory is characterised by low buying and selling volumes as illustrated by the next charts. So if there are too many shares of this inventory within the portfolio, it might be troublesome to melt the place rapidly sufficient to keep away from losses from falling gold costs.

The typical quantity (3 months) must be no less than 4 occasions the amount wanted for the place.

On the Toronto Inventory Trade:

Supply: Looking for Alpha

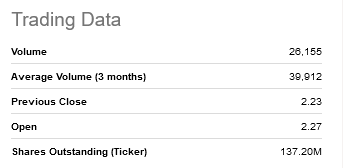

Since mid-September 2023, shares of Aris Mining Company have additionally been listed on the US inventory alternate of the NYSE American beneath the image ARMN:

Supply: Looking for Alpha

On the US inventory alternate, beneath the (ARMN) image, shares had been buying and selling at $2.33 per unit as of this writing for a market cap of $318.30 million. Shares are buying and selling considerably under the 200-day easy shifting common of $2.69 however above the 50-day easy shifting common of $2.29.

Shares are under the center level of $2.815 within the 52-week vary of $1.96 to $3.67. Moreover, the 14-day RSI’s pattern of 44.4 means that shares have loads of room for draw back in a high-interest price setting, creating extra enticing share costs.

The Truthful Worth

Contemplating how Aris Mining Company’s inventory worth might carry out if gold turns bullish on the upside catalyst of the financial recession, present inventory costs look like pretty valued.

Let’s have a look at why: the inventory consists of 137.2 million shares excellent, which equates to about 227,500 ounces of gold or midway of the 2023 manufacturing steering. One frequent share is anticipated to characterize roughly 0.00167 ounces of gold. Ought to gold attain $1,916.63 inside 12 months (up 3.7% from present ranges), Aris Mining Corp. shares will likely be value $3.18 apiece on the US alternate and $4.34 CAD apiece on the Toronto Inventory Trade at present alternate charges.

In comparison with present share worth ranges, the anticipated return is over 40%. This margin can even improve as a result of Fed’s persistent “greater for longer” coverage creating extra downward strain on present inventory worth ranges. This anticipated margin of return compares favorably with the anticipated decline of 10.3% in the USA Inventory Market Index 500 (presently 4,304.33 factors in comparison with the 12-month goal of three,861.71 factors).

Conclusion

This evaluation views Aris Mining Company inventory as an attention-grabbing car to realize publicity to gold costs which are set to expertise a robust restoration. Because the financial system enters recession, there’ll probably be a bull marketplace for the yellow metallic, as robust headwinds from the cycle’s deterioration will reinforce gold’s safe-haven qualities that buyers look to as a hedge for his or her portfolios.

Aris Mining Company’s inventory has a robust constructive correlation with the gold worth as the corporate’s gold manufacturing in Colombia is on monitor to develop considerably in 3 years.

Shares usually are not costly relative to the expansion outlook, however with the inventory worth doubtlessly turning into even cheaper as a result of Fed’s “greater for longer” stance on rates of interest, this evaluation recommends ready a bit for extra enticing entry factors to kind earlier than shopping for the shares.