Kamada Kaori/iStock by way of Getty Photos

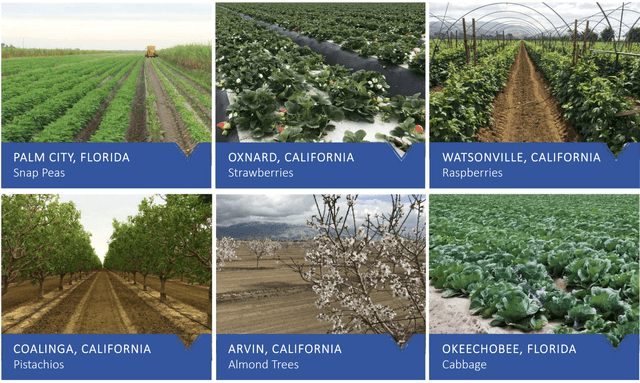

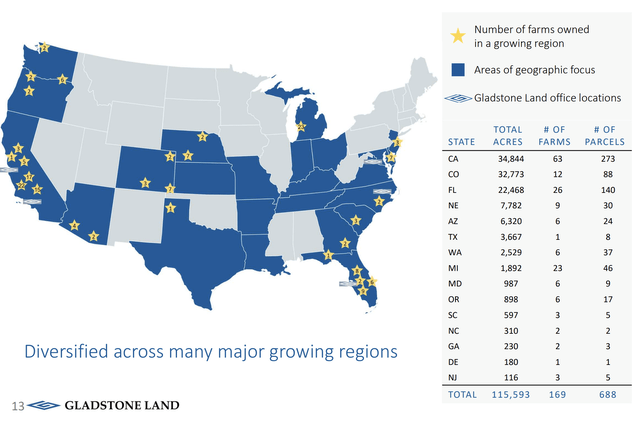

Gladstone Land (NASDAQ:LAND) has dipped 22% year-to-date and is down round 8% from once I final lined the ticker. The farmland REIT is now buying and selling for 21x its value to annualized FFO for its latest fiscal 2023 third quarter. While this a number of is greater than most fairness REITs, Alexandria Actual Property (ARE) is at present buying and selling at an 11.5x value to annualized FFO, it compares favorably to look REIT Farmland Companions (FPI). FPI has recorded damaging FFO for its final two quarters however is buying and selling palms for roughly 74x occasions its forecasted ahead FFO. LAND owns US farmland leased on a triple-net foundation to farmers rising fruits, greens, and nuts. The REIT owns 116,000 acres on 169 farms and about 45,000 acre toes of banked water. Critically, essentially the most putting a part of LAND’s bullish thesis is its numbers for the underlying worth of its property.

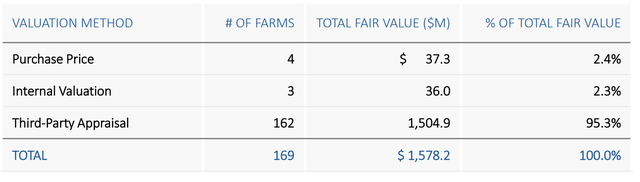

And collectively, they’re valued at roughly $1.6 billion for each the land and the water.

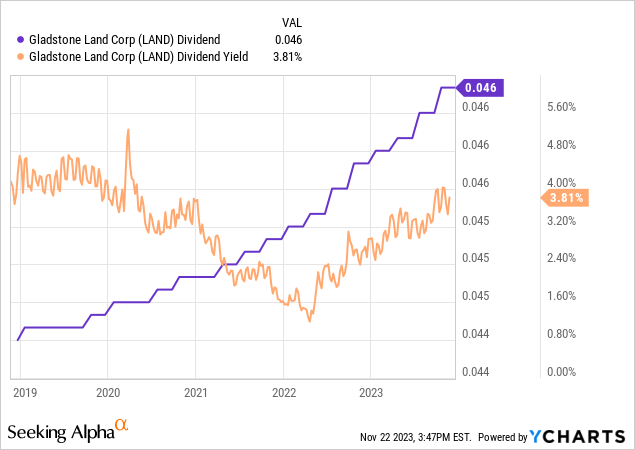

This estimate was offered by LAND’s CEO in the course of the third quarter earnings name. The REIT is at present buying and selling at a $520 million market cap, roughly a 3rd of this estimate. LAND is diversified with its farmland leased to round 90 completely different tenant farmers rising 60 various kinds of crops. The REIT pays out its dividend each month, final paying $0.0464 per share, unchanged sequentially and for a 3.8% annualized dividend yield.

Operations, Tenant Points, And Dividend Protection

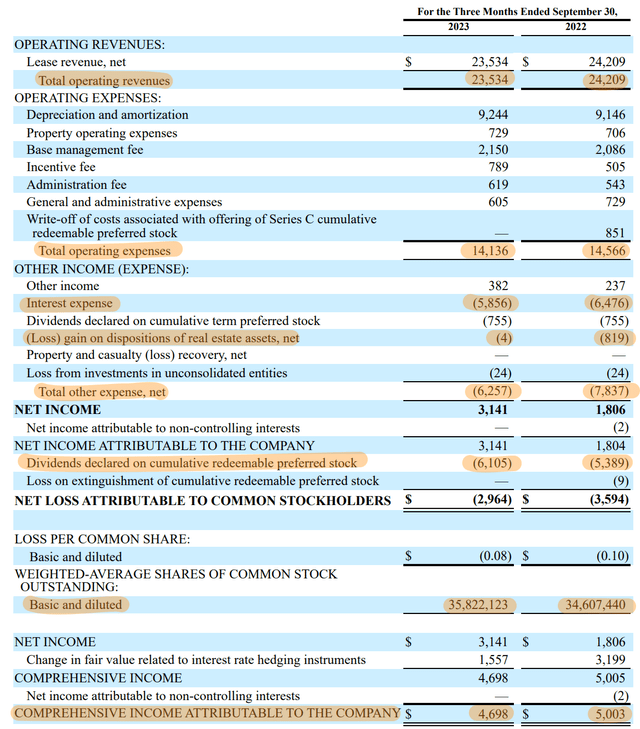

LAND has raised its dividend by a 3-year compound annual development charge of round 1%. The REIT recorded third-quarter income of $23.53 million, down 2.8% over its year-ago comp and a beat by $2.11 million on consensus estimates. Whole working bills at $14.14 million have been down by round $430,000, or 3%, over the year-ago interval. The dip in working income got here with 12 farms at present being operated by a third-party administration firm and one other three farms being vacant.

LAND Fiscal 2023 Third Quarter Kind 10-Q

The REIT recorded a third-quarter adjusted FFO of $5.6 million, round $0.15 per share, down roughly 6 cents from the year-ago interval. Therefore, the REIT at present covers the 3-month combination of its dividend by 109%, a 92% payout ratio. Essentially the most putting determine from LAND’s operations is that curiosity expense at $5.86 million fell from $6.48 million within the year-ago interval regardless of the Fed fund’s charge being hiked to a 22-year excessive at 5.25% to five.50% by way of the interval. Additional, the REIT’s weighted common shares of frequent inventory excellent rose over its year-ago comp by 3.5% to 35,822,123. While LAND has to optimize its capital stack by issuing new fairness, doing so while buying and selling at a reduction to acknowledged intrinsic worth is dilutive. 3.5% is not horrible although however not excellent.

American Farmland On The Low cost

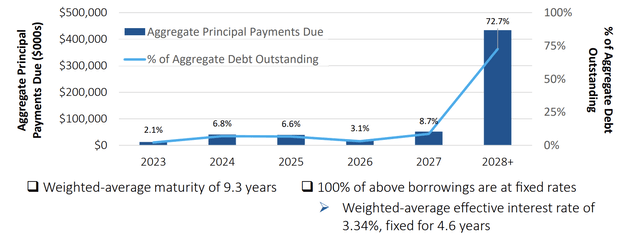

LAND August Presentation (Debt Maturities)

The REIT held a complete debt stability of $644 million on the finish of the third quarter, with 100% of this being at a hard and fast charge. This was with a weighted common efficient rate of interest of three.34%, remarkably fastened for 4.6 years. Additional, it is extremely properly laddered with 72.7% of the stability solely coming due previous 2028. Therefore, LAND has been comparatively immune to the impression of rising charges on its operations. FPI has a considerably extra floating charge portfolio which has triggered its latest FFO numbers to be damaging and for the REIT to be compelled to promote a few of its farm properties to bridge its liquidity hole and meet dividend funds.

Is LAND a purchase? It relies upon. Traders shopping for for diversification have obtained a ticker that is tracked the broader REIT market decrease during the last yr regardless of a closely fastened stability sheet. Nonetheless, 2024 stands to supply some constructive upside catalysts towards REIT sentiment with the CME’s 30-Day Fed Funds futures pricing information putting the percentages of any additional rate of interest hikes at near zero. While any future cuts wouldn’t have a fabric impression on LAND’s current operations resulting from its long-dated maturity and low fixed-rate debt, it will enhance underlying investor sentiment and will drive some constructive upward share value strikes. This is able to additionally assist its Collection B (NASDAQ:LANDO), Collection C (NASDAQ:LANDP), and Collection D (NASDAQ:LANDM) preferreds to again to their $25 par worth.

Administration’s $1.6 billion ballpark determine for the underlying worth of their property kinds the core motive for an extended place within the REIT. This is able to be a case for buying US farmland and water property for round 33 cents on the greenback. The REIT is down round 65% from its all-time excessive in early 2022 earlier than charges began rising markedly. LAND at present doesn’t fill a distinct segment with its dividend yield lower than what you would get on a certificates of deposit which is at present providing charges of as much as 5.75%. Therefore, LAND will proceed to commerce considerably flat like different REITs till the Fed begins reducing charges and the dividend yield seems extra enticing. The ticker is a maintain.