(Bloomberg) — Heading into this yr, Wall Road’s prime prognosticators had been virtually universally anticipating additional ache for the inventory market after 2022’s catastrophe. Solely a handful noticed a rebound coming.

Most Learn from Bloomberg

It seems these few had been spot on.

A yr in the past, carefully watched forecasters like JPMorgan Chase & Co.’s Marko Kolanovic and Morgan Stanley’s Mike Wilson had been saying greater rates of interest and an eventual financial downturn would set off extra losses.

However some ever-bullish counterparts, together with Fundstrat International Advisors LLC’s Tom Lee, Oppenheimer Asset Administration’s John Stoltzfus, and Brian Belski at BMO Capital Markets projected a restoration, citing extreme pessimism. Carson Group Holdings LLC’s Ryan Detrick anticipated financial resilience would propel shares. In the meantime, Financial institution of America Corp.’s Savita Subramanian led a wave of forecasters turning constructive at mid-year.

“We talked concerning the market perhaps making new highs and other people thought we had been loopy,” stated Detrick, chief market strategist at Carson Group. “However we had been shocked on the overwhelming negativity that was on the market. It’s essential for folks to keep in mind that the market had priced in a number of unhealthy information.”

Learn extra: Strategists’ S&P 500 Index Estimates for 12 months-Finish 2024

Now, with the S&P 500 Index factors away from a report excessive, these bulls can declare a measure of vindication after failing to foretell final yr’s rout. For 2024, they see extra energy because the labor market stays strong and conviction about Federal Reserve fee cuts rises.

Beneath is a breakdown of how they approached the market in 2023 and their outlook for 2024. At round 4,768 factors as of Tuesday’s shut, the S&P 500 is up 24% this yr.

Tom Lee, Fundstrat

With a goal of 4,750 firstly of 2023, Lee, co-founder and head of analysis, got here closest to predicting the trajectory of the S&P 500 amongst strategists tracked by Bloomberg.

His evaluation confirmed the prospect of a 20% rally was double following the index’s 19% hunch in 2022. He noticed three important drivers: His analysis indicated inflation was going to ebb sooner than most anticipated; corporations had been ready to deal with greater charges, given the Fed’s warnings; and volatility was extremely elevated.

“It’s not possible for markets to remain at that stage of hysteria, and when inflation diminishes — which is what occurred — then shares truly levitate as a result of the promoting stress is ending,” he stated.

Lee stays among the many most bullish forecasters for subsequent yr, with an S&P 500 goal of 5,200.

Brian Belski, BMO

Coming into this yr, Belski, the agency’s chief funding strategist, had a goal of 4,300 for the US inventory benchmark, one of the bullish forecasts amongst strategists monitored by Bloomberg earlier than he and others upgraded their calls later within the yr to maintain up with the market’s advance.

He noticed market sentiment as excessively unfavourable on the finish of 2022, which he stated would spur demand for liquidity-driven and “opportunistically oversold” property.

“Shares lead earnings, which lead the economic system, and it’s completely ridiculous after I hear folks saying ‘I’m going to attend, the recession will inform us when to purchase shares.’ No, it gained’t. Shares let you know after we’re going to have a recession,” he stated. “Folks have turn into too formulaic and caught of their methods.”

For 2024, Belski expects a resilient labor market, easing consumer-price pressures and fee cuts within the second half of the yr to drive the S&P 500 to five,100.

John Stoltzfus, Oppenheimer

Heading into 2023, Stoltzfus, the agency’s chief funding strategist, noticed the S&P 500 closing the yr at 4,400. On the time, his name was one of many rosiest on the road.

The forecaster stated inflation trending decrease supported sentiment, and whereas bears deemed earnings estimates too optimistic, he known as them “right-sized.”

“The markets grew to become grossly oversold within the strategy of the selloffs that occurred in 2022,” he stated. “Bear markets are all the time oversold, after which it’s acknowledged that they’re oversold, and also you get some sort of a rally.”

He’s staying optimistic, predicting the S&P 500 will hit 5,200 earlier than 2024 is out.

Savita Subramanian, Financial institution of America

Subramanian, head of US fairness and quantitative technique, emerged as one in every of this yr’s winners because of a mid-year name to show constructive on shares.

Though she entered 2023 with a downbeat view, with a name of 4,000, she shifted in Could to a bullish stance, and a wave of sell-side forecasters adopted swimsuit. She upgraded her year-end goal on the S&P 500 twice, to 4,600.

“It felt like a troublesome message to ship to shoppers,” she stated. Coming after the regional banking tumult, “there was a way that this was the start of the tip and all the things was going to go the best way of 2008.” When it feels troublesome to make a name, “these are the occasions that you simply’re in all probability going to be extra seemingly proper than flawed,” she stated.

Subramanian stays bullish heading into 2024, with a goal of 5,000. She sees a smooth touchdown and corporations and shoppers adapting to greater charges as causes equities can advance.

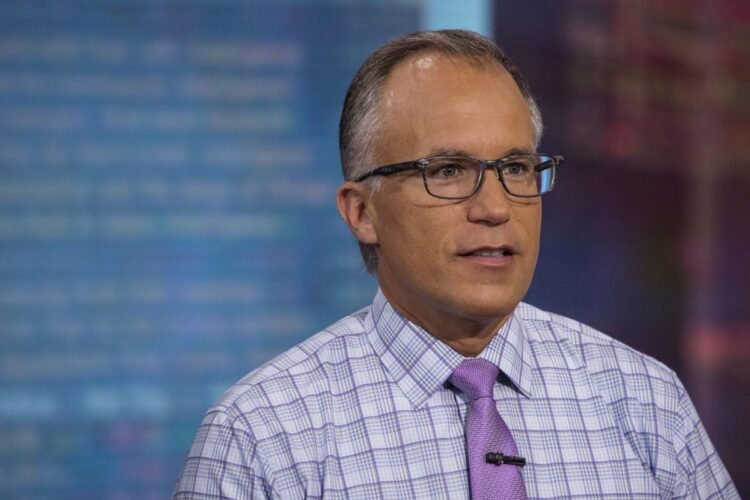

Ryan Detrick, Carson Group

Detrick anticipated the US economic system to keep away from a recession this yr. He additionally wager inflation would cool ahead of the market was anticipating. The strategist added publicity to shares in the course of the banking turmoil in March and because the S&P 500 sank in October.

“The March selloff was fairly scary,” Detrick stated. “However we stated then it was only a few unhealthy actors and it wasn’t going to be systemic.”

The strategist doesn’t anticipate a recession subsequent yr both, and expects a few of this yr’s laggards — fairly than the so-called Magnificent Seven know-how shares — to energy “low double-digit” returns in equities. “Small-caps, mid-caps and financials — these are our three favorites.”

–With help from Jessica Menton, Matt Turner, Kate Seaman and Lu Wang.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.