India’s renewable vitality shares have loved a scorching rally for the previous two years as retail consumers pile in, however their prolonged valuations are flashing warning indicators.

Article content material

(Bloomberg) — India’s renewable vitality shares have loved a scorching rally for the previous two years as retail consumers pile in, however their prolonged valuations are flashing warning indicators.

SG Mart Ltd., a Gujarat-based photo voltaic and wind vitality producer, has soared over 5,800% since November 2021 — when Prime Minister Narendra Modi introduced that India aimed to spice up clear vitality to greater than two-thirds of total capability. Gensol Engineering Ltd. has rallied greater than 3,200%, Zodiac Power Ltd. 1,000% and Waaree Renewable Applied sciences Ltd. 1,800% in that very same interval.

Commercial 2

Article content material

Article content material

“Individuals are following the hype cycle fairly than fundamentals,” stated Rajeev Thakkar, chief funding officer at PPFAS Asset Administration Pvt. Ltd., stated through telephone. “We’re solely watching the area and haven’t invested” within the shares, he stated, citing poor return ratios for some corporations within the sector.

The skyrocketing share costs of those small shares are actually dealing with a actuality test, as surging manufacturing capability weighed on costs and earnings are struggling to maintain up with the tempo of positive aspects. That is harking back to a US growth, which drove up valuations earlier than a collapse despatched the GS US Renewables basket of corporations benefiting from renewable-energy transition down 43% from a excessive in February 2021.

Photo voltaic module costs fell to document lows this month, forcing main Chinese language tools maker TCL Zhonghuan Renewable Power Know-how Co. final week to subject a revenue warning.

“Plummeting costs throughout the photo voltaic provide chain in China and Southeast Asia will frustrate onshoring ambitions in Europe, India and the US,” Lara Hayim and Jenny Chase of BloombergNEF wrote in a notice. Installations are rising, however some producers will promote at a loss this 12 months, they stated.

Article content material

Commercial 3

Article content material

‘Loopy’ valuations

The most important inventory winners in India’s renewable sector are actually all dealing with the problem from minuscule earnings, which has despatched valuations by means of the roof.

SG Mart, for instance, reported internet gross sales of 15.6 million rupees ($190,000) and internet revenue of two million rupees within the newest full fiscal 12 months, however instructions a market worth of $720 million, information compiled by Bloomberg confirmed. The founders of SG Mart have offered a few of their holdings within the firm to retail and wealthy traders amid the rally. Comparable patterns might be seen in Gensol and Waaree Renewable.

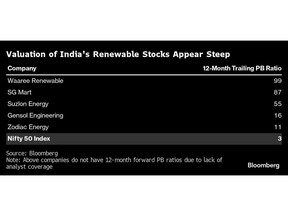

Waaree Renewable and SG Mart now command price-to-book values 99 occasions earlier 12-month earnings and 87 occasions, respectively — a lot greater than the Nifty 50 index’s 3 times.

Mothers and pops are those diving in. Over the previous 12 months, retail traders — outlined as these with investments of as much as 200,000 rupees — raised their holdings in many of the prime gainers together with Waaree Renewable, Gensol, Taylormade Renewable and Zodiac Power, in response to newest filings.

“I don’t assume traders are doing the suitable factor by chasing narratives,” Amit Doshi, portfolio supervisor at Care Portfolio Managers Pvt., stated. “Making distinctive returns turns into tough if you happen to pay over the percentages” to personal corporations, he stated. Institutional traders like Doshi have largely stayed away from a number of the huge winners within the sector, citing untenable valuations and low free floats.

Commercial 4

Article content material

To make sure, as the federal government invests billions by means of state-owned enterprises, and supplies incentives for varied renewable tools manufacturing and helps adoption of electrical automobiles, the business has loads of development potential. Finance Minister Nirmala Sitharaman additionally introduced funding plans Thursday to help the usage of renewable vitality. However the dangers for these small shares could also be too excessive to disregard.

Aniket Shah, New York-based head of world ESG for Jefferies Group LLC, stated that sluggish development in new capability addition and lack of help from western economies on financing and expertise switch are issues which are holding him “up at evening.” Buyers are taking huge expertise and buyer demand dangers they usually’re “going to wish to get compensated for that,” he stated.

Article content material