If you happen to’re aiming for extra worth and cost-efficiency, you would possibly discover it stunning that choosing a dearer residence over a median-priced one might be the way in which to go. Whereas it might appear counterintuitive, let me clarify.

Since buying a pricier residence within the fourth quarter of 2023, my household and I’ve been grappling with the budgetary constraints it has caused. Nonetheless, as a substitute of constant to concentrate on the negatives, I might prefer to now concentrate on the positives of proudly owning an costly residence. The thought got here to me after talking with a number of actual property brokers.

In 2024, bidding wars have made a comeback, fueled by a sturdy labor market, a thriving financial system, pent-up demand, decrease mortgage charges, and hovering inventory costs. The draw back of a bull market is that securing a positive deal on a house turns into more and more difficult. As individuals develop into wealthier, they have an inclination to splurge on big-ticket gadgets like vehicles and houses.

In case your purpose is to save cash, you would possibly need to keep away from shopping for a house that falls inside the median worth vary. As an alternative, attempt to flee what I’ve dubbed the “frenzy zone,” which encompasses properties priced as much as 150% of the median worth in your metropolis.

When you enterprise into the territory of properties priced 50% increased than the median, demand tends to drop considerably. As you progress additional above the median worth level, you will sometimes discover higher offers.

Conversely, the nearer you get to the median worth or under, the more durable it turns into to safe a positive deal. It’s because there is a bigger pool of people with family incomes ample to afford properties inside this vary. Everyone likes to go eat at 12 midday and wait in line as a substitute of eat at 1 PM and save time.

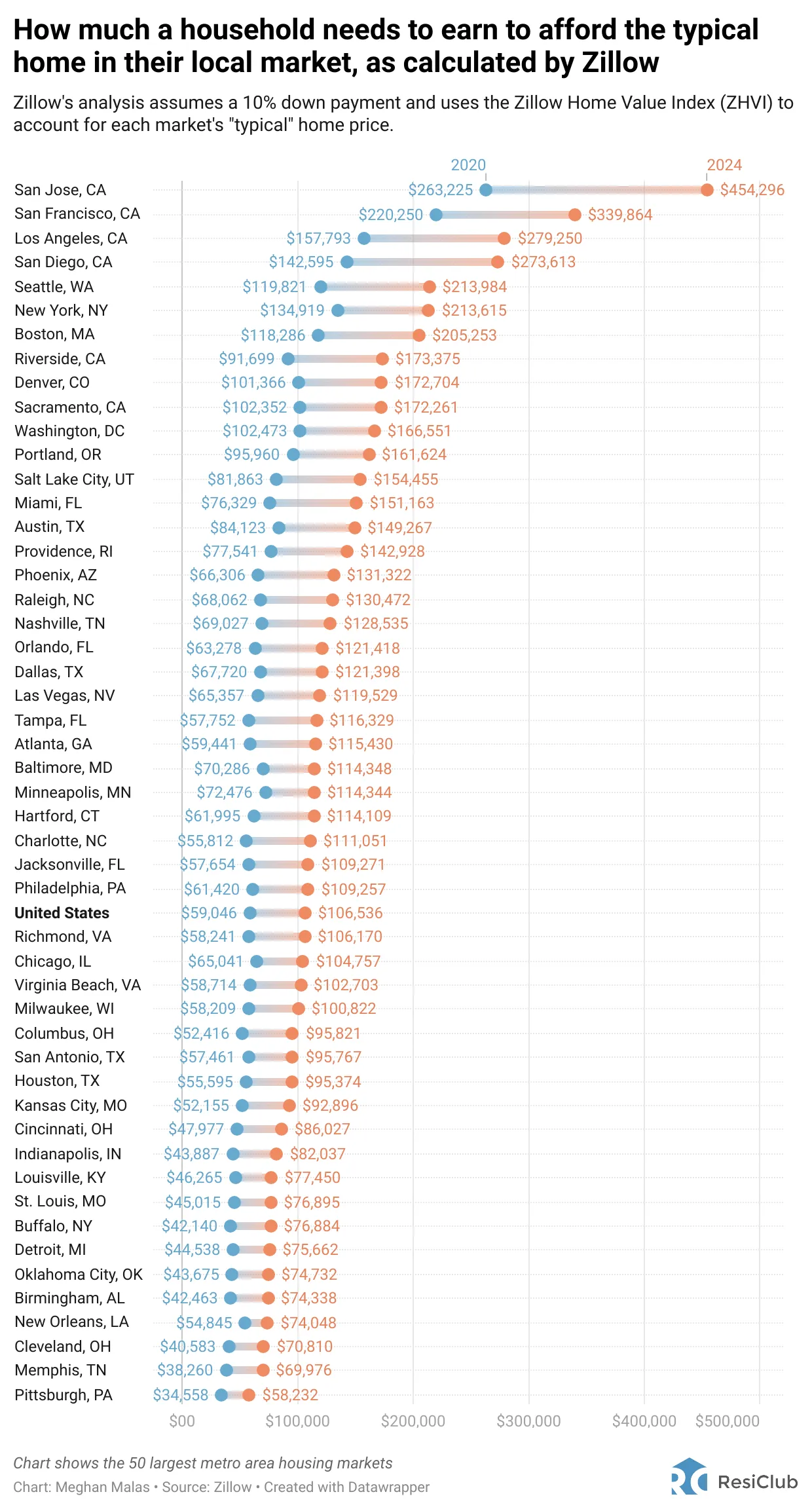

As a refresher, the chart under outlines the family revenue wanted to afford a typical residence (median-priced) in 50 cities, in line with Zillow. To flee the frenzy zone and lead a extra economical life, you will have to earn a minimum of 50% greater than the family revenue figures for 2024 to afford a house priced 50% increased than the median.

Let’s contemplate the general United States determine of $106,536 required to buy a median-priced residence of round $420,000. To flee the frenzy zone and lower your expenses, you will have to discover properties priced above $620,000, necessitating an revenue of $160,000 or extra or a bigger down fee.

Whereas I am unable to present particular examples of how median-priced properties are promoting throughout the nation, I can supply insights into the west aspect of San Francisco primarily based on my analysis and discussions with high actual property brokers specializing within the space.

Properties priced on the median degree or under (beneath $1.7 million) on San Francisco’s west aspect are seeing strong demand partially due to the energy in tech and synthetic intelligence. Listed here are a number of examples of properties that hit the market and rapidly garnered a number of gives, usually promoting nicely above the asking worth.

Examples Of Median-Priced Or Beneath Properties Promoting Means Above Asking

- 2455 twenty second Ave: Acquired 32 gives in only one week, promoting for over $450k above the checklist worth. This 3-bedroom, 2-bathroom property spans 1,380 sqft, with a worth per sq. foot of $1,200.

- 1335 twenty eighth Ave: Offered in a single week for over $550k above the checklist worth, with 21 gives. This 3-bedroom, 2-bathroom residence covers 1,300 sqft, with a worth per sq. foot of $1,277.

- 1755 eleventh Ave: Spent two weeks in the marketplace and offered for over $300k above the checklist worth. This 2-bedroom, 1.5-bathroom property spans 1,250 sqft, with a worth per sq. foot of $1,295.

- 1736 eleventh Ave: Offered in two weeks for $195k above the asking worth. This 2-bedroom, 1-bathroom residence covers 1,075 sqft, with a worth per sq. foot of $1,325.

These examples spotlight the development of modest properties attracting a number of gives and fetching excessive costs per sq. foot. It is arduous to think about competing towards 10 and even 32 different gives. No marvel some patrons really feel compelled to bid nicely above the market worth.

In such a fiercely aggressive bidding atmosphere, having an skilled purchaser’s agent by your aspect is essential to forestall potential monetary losses. Regardless of the NAR settlement possible hurting the revenue of purchaser’s brokers, do not overlook the significance of discovering an excellent one to characterize you when you lack expertise.

Whereas median-priced properties are cheaper in absolute {dollars} in comparison with luxurious properties, they usually show dearer when seen from a worth standpoint, significantly on a price-per-square-foot foundation.

Within the examples supplied earlier, the value per sq. foot ranged from $1,200 to $1,325, which is 20% to 32% increased than San Francisco’s median worth per sq. foot of round $1,000.

Typically, the extra you pay for a house, usually, the extra worth you’ll get from a worth per sq. foot foundation (pay a cheaper price). The rationale why is as a result of individuals pay essentially the most for requirements and fewer for luxuries or nonessentials.

As an example, the primary full rest room in a house sometimes holds extra worth than the eighth full rest room. Similar goes for the primary bed room versus the tenth bed room.

Now let’s take a look at why smaller properties price extra on a worth per sq. foot from a value perspective. The most costly components of a home, per sq. foot, are kitchens and baths. The smaller the general sq. footage of the home, the higher the proportion of sq. footage is baths and the kitchen. This drives up the value per sq. foot.

Economies of scale additionally performs a job in why bigger properties are usually cheaper on a worth per sq. foot foundation. When establishing a bigger residence, the price per sq. foot could lower on account of shared partitions, plumbing, the roof, and different infrastructure.

Greater Rental Yields With Smaller Properties

Whereas the value per sq. foot for buying a smaller residence is often increased, a minimum of smaller properties usually yield increased rental returns when you plan to hire them out. Moreover, there’s sometimes increased investor demand for smaller properties, which additional contributes to their comparatively increased costs.

Take into account renting out a 1,500-square-foot, 3-bedroom, 2-bathroom single-family residence in a Sunbelt metropolis, which could yield an 8% cap charge. In distinction, an 8,000-square-foot, 7-bedroom, 7-bathroom single-family residence in the identical metropolis would possibly yield solely a 4% cap charge. Then, when you take the mansion and drop it in an costly coastal metropolis, its cap charge would possibly solely be 2%.

By specializing in shopping for properties priced 50% or extra above the median, you are more likely to encounter much less competitors and a decreased threat of coming into bidding wars. Moreover, these higher-priced properties usually commerce at a cheaper price per sq. foot, providing potential financial savings in the long term.

Simply ensure that when you plan to pay for a pricier residence, you do not find yourself too home wealthy money poor. In that case, you would possibly put your family’s funds in danger through the time you are attempting to construct again your liquidity.

We’re Seeing A Sturdy Center Class

You would possibly assume that increased mortgage charges would hit the median family revenue earner or decrease the toughest, as they sometimes have to borrow essentially the most and consequently pay the very best mortgage curiosity bills. Nonetheless, the strong demand for median-priced properties in San Francisco, and certain in different cities too, suggests in any other case.

The energy in demand signifies a number of issues:

- The median family could also be extra financially wholesome than we notice.

- It is simpler to build up a smaller down fee via private financial savings and household help.

- There’s growing upward pricing strain constructing for properties within the subsequent phase up.

When the center class exhibits confidence within the housing market, it bodes nicely for the financial system in comparison with when solely the highest 1% are bullish. It’s because the center class constitutes a bigger portion of the inhabitants with higher spending capability, thus exerting a extra vital impression on GDP.

Subsequently, it is clever to begin contemplating properties priced above 150% of the median. In San Francisco, the place the median residence worth is roughly $1.7 million, aiming for properties within the $2.55+ million vary is sensible. Right here, you will encounter much less competitors and obtain higher worth by paying a cheaper price per sq. foot.

Over time, because the wave of households buying median-priced properties and people as much as 50% increased progressively seeks to maneuver as much as the following tier, the median worth per sq. foot of those pricier properties may also rise. And when the high 1% lastly get as bulled up as the center class, luxurious residence costs will explode increased as soon as extra.

The value per sq. foot of a home varies relying on elements corresponding to location, finishes, age, architectural fashion, view, and lot dimension. Typically, the higher these elements are, the extra you would be keen to pay per sq. foot.

Personally, I am inclined to pay far more for a totally reworked home with scenic views and ample outside area. After enduring a grueling 2.5-year intestine renovation through the pandemic, I vowed by no means to undertake such a venture once more. The Reworked properties ought to promote for higher premiums going ahead given how tough they’re to finish.

With younger kids, having a big and safe lot the place they will play freely is invaluable to me. In costly cities, it’s actually the land that’s valued essentially the most. If you could find a home on a triple-sized lot or higher, you have discovered your self a unicorn the place it is best to attempt to lock it down.

Discovered Higher Worth In An Costly Home

Regardless of paying a considerable quantity for my new residence, I managed to safe it at a cheaper price per sq. foot in comparison with the examples talked about earlier, although my property is significantly nicer. This makes me really feel like I obtained glorious worth relative to the market.

I did not interact in a bidding battle to accumulate my residence. As an alternative, I exercised persistence and waited for 2 earlier gives to fall via. Reality be advised, I’d have been keen to pay the unique asking worth if I had the funds on the time.

Then, I waited one other yr earlier than submitting my very own supply, which was 14% under the asking worth and included inspection contingencies. Following this, we spent two and a half months meticulously inspecting each side of the property and guaranteeing that the vendor addressed any vital repairs or updates earlier than our move-in.

If you understand one thing as providing nice worth, it tends to really feel extra inexpensive than its precise worth. Positive, my residence’s worth might completely go decrease. Nonetheless, it can take a big decline to erode my notion of the house’s worth as I additionally really feel the immense satisfaction of offering for my household.

The 14% financial savings I secured via luck and persistence might cowl our household’s bills for a few years. Adopting this angle helps me really feel extra comfy with the excessive absolute worth I paid.

Instance Of Nice Worth If You Can Afford The Worth

Beneath is an instance of an costly residence in Presidio Heights the place the customer received an excellent deal. It was initially listed for $9,800,000 on February 13, 2023. Only a few households want 7 bedrooms, 7 baths and over 6,100 sqft ft of area. Maybe even fewer households can afford $9,800,000.

After a month with no gives, the vendor lowered the asking worth to $8,900,000. Two weeks later, the vendor lowered the asking worth once more to $6,995,000, when it lastly offered for $7,340,000.

At $1,203/sqft, the house is nice worth for a purchaser who might afford such a hefty absolute worth. Presidio Heights is taken into account probably the most prime neighborhoods in all of San Francisco. In the meantime, this residence’s structure and construct high quality are superior to the median-priced properties above, which all offered for a better worth/sqft.

Sure, I acknowledge shopping for in Might 2023 was higher than shopping for in March 2024, for the reason that backside of this actual property cycle appears to be in 3Q 2023. However the worth continues to be there if this home had been to promote right this moment.

Look For Higher House Bargains Up The House Worth Curve

Given that each one smart homebuyers buy inside their monetary means, buying an costly residence could really feel cheaper than it’d for somebody who received right into a bidding battle to purchase a median-priced residence. I do know no one who outbids 20 different bidders who then thinks they received a discount.

As long as you comfortably purchase a house lower than what you suppose it is value, your life will really feel extra inexpensive. The value saving distinction between what you paid and what you suppose your own home is value can be utilized to pay for lots of life’s bills.

Go up the value curve if you wish to discover a higher deal on a house. Be affected person as you earn and save extra. If you happen to discount arduous sufficient, you would possibly simply have the ability to discover what you are on the lookout for.

Reader Questions And Recommendations

Have you ever ever felt your life received extra inexpensive since you bought a dearer residence? Why do not extra individuals go up the value curve to search out higher offers on a house by ready longer, incomes extra, or borrowing extra?

Please present some colour on how median-priced properties are promoting in your metropolis. I might like to get a really feel of how actual property demand is on the lookout for median-priced properties across the nation.

For these concerned about passive actual property funding, contemplate exploring Fundrise. Managing over $3.3 billion, Fundrise focuses totally on residential and industrial actual property investments within the Sunbelt area. With decrease valuations and better yields, the Sunbelt presents an interesting prospect on account of demographic shifts catalyzed by expertise and distant work tendencies.