The usage of synthetic intelligence (AI) programs within the cybersecurity trade is rising at a pleasant clip. Final 12 months, AI-focused cybersecurity spending stood at an estimated $24 billion, however this determine is predicted to be practically $134 billion in 2030, based on a forecast by Statista.

As such, now could be a very good time for traders to purchase shares of cybersecurity firms which are aggressively integrating AI instruments into their platforms. Fortinet (NASDAQ: FTNT) is one such firm, leveraging AI to drive stronger development in its enterprise.

Fortinet’s income pipeline is enhancing because of AI

Fortinet introduced in $5.3 billion in income in 2023, a rise of 20% over the earlier 12 months. Nevertheless, its deferred income elevated at a quicker tempo of 24% to $5.74 billion. Deferred income refers back to the cash collected prematurely by an organization for companies that will probably be rendered at a later date. It is acknowledged as income solely after the companies are delivered.

So, the quicker development within the firm’s deferred income is a sign that demand for its subscription-based cybersecurity companies is strong. That is additionally evident from the truth that Fortinet’s companies income was up 28% in 2023 to $3.38 billion, accounting for 64% of its prime line.

Fortinet credited the stable development in its companies enterprise to the sturdy demand for its subscriptions associated to safety operations and safe entry service edge (SASE) choices. It’s value noting that the corporate has built-in AI into each these platforms. For example, Fortinet’s AI-focused safety operations platform permits clients to rapidly detect and reply to threats. What’s extra, Fortinet administration factors out that it has been utilizing AI to boost its choices for a very long time.

As CEO Ken Xie stated on the This autumn convention name:

We’ve invested closely in AI throughout each perform and product. For over a decade, Fortinet has used machine studying and AI to supply superior risk intelligence throughout greater than 40 merchandise from community, finish level and software safety. Our options apply AI and ML throughout the expanded digital assault floor routinely containing and remediating incidents inside seconds, the place the trade averages for detection and remediations takes a number of days.

Even higher, the corporate has began utilizing generative AI to bolster its cybersecurity platform. It launched a generative AI cybersecurity assistant in December with the intention of serving to organizations “make higher choices, quickly reply to threats, and save time on even essentially the most advanced duties.”

All this explains why Fortinet is witnessing a pleasant enchancment within the variety of cybersecurity offers it is inking. In 2023, the corporate struck 13 offers value $10 million or extra, a 160% soar over the earlier 12 months. Moreover, it landed 474 offers value $500,000 or extra within the fourth quarter of 2023, up considerably from the 367 such offers it struck within the third quarter.

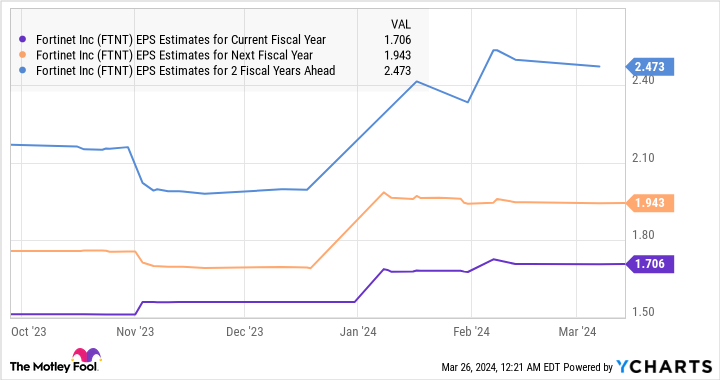

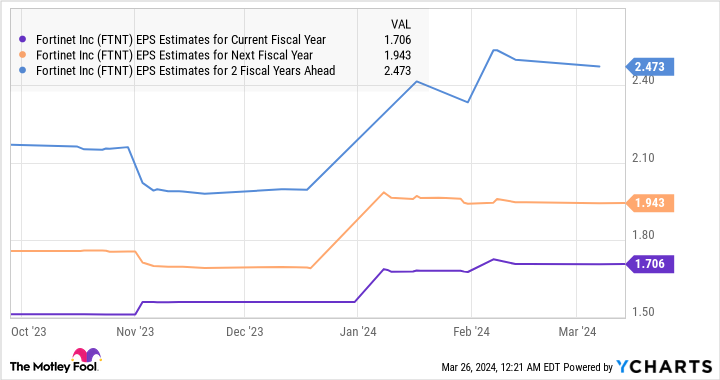

On condition that Fortinet expects its whole addressable market to leap to $208 billion in 2027 from $150 billion this 12 months, its deal momentum ought to stay sturdy, particularly contemplating its concentrate on utilizing AI to enhance its companies. Not surprisingly, analysts expect its bottom-line development to speed up in 2025 and 2026 following this 12 months’s forecast soar of simply 4% from 2023 ranges of $1.63 per share.

Buyers can count on extra upside from this cybersecurity play

Fortinet inventory has gained 16% thus far in 2024. It’s presently buying and selling at 46 instances earnings, which is a reduction to its five-year common earnings a number of of 56. Its ahead earnings a number of of 42 factors towards an enchancment in its backside line this 12 months, and is decrease than its five-year common of 44.

Nevertheless, Fortinet’s earnings development is predicted to enhance in 2025 and 2026, which explains why the market might be rewarding it with a premium valuation. But when Fortinet delivers $2.47 per share in earnings in 2026, as analysts predict, even when it trades after three years at simply 40 instances earnings, its inventory worth may hit $99. That will be a forty five% improve from present ranges, which is why traders ought to contemplate shopping for this cybersecurity inventory now.

Do you have to make investments $1,000 in Fortinet proper now?

Before you purchase inventory in Fortinet, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Fortinet wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of March 25, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Fortinet. The Motley Idiot has a disclosure coverage.

1 Synthetic Intelligence (AI) Inventory to Purchase Hand Over Fist Earlier than It Jumps 45% was initially revealed by The Motley Idiot