Once you run a small enterprise, you wish to give attention to following your ardour. Sadly, all of these pesky back-office duties nonetheless want consideration.

Ugh.

Preserving your accounts balanced is the one most essential factor you are able to do for what you are promoting, so do not neglect it. After getting an ideal system, you may be in your technique to success.

All the steps beneath take lower than 5 minutes:

Minute #1: Seize These Receipts

You get a receipt for a key enterprise expense, and you retain it in your bag, pockets, or binder to file later, proper? Mistaken!

Use a receipts software to right away retailer your receipts on-line. Principally, you can snap a photograph of a receipt along with your telephone and ship it in. This fashion, your receipts might be organized by date, and searchable. [pullquote]It’ll prevent (or your accountant) hours that will have been spent looking and organizing.[/pullquote]

Members of the Wave Professional Community, our community of accountants and bookkeepers, continuously share tales of small enterprise homeowners coming in with the dreaded shoebox stuffed with receipts. Since these receipts lack key particulars, akin to what the expense was purchased for, they might be miscategorized. The time spent categorizing receipts can price enterprise homeowners considerably— cash that will have been higher spent getting insightful monetary recommendation from that very same accountant.

If you happen to’re trying to actually streamline your processes, you should utilize a receipt software that pairs with an accounting software. This fashion, you may categorize your receipt on the spot, when you nonetheless keep in mind why you made the acquisition. Your receipts may even be tied proper into your accounting information for simple entry, in case of an audit.

Minute #2: Give Your Accounting a Jumpstart

In case your accounting system depends on hours pouring over a spreadsheet, or getting pissed off along with your accountant on the finish of the 12 months when he asks questions on your post-it notes, baggage of receipts and financial institution statements, there’s a greater manner.

Join your checking account to a web based accounting system. Then, watch because the magic occurs. Your whole bills will load mechanically.

That is notably essential should you’re not within the behavior of downloading an editable financial institution assertion each month. Some banks will solely launch as much as three months of historic information. Which means that should you wait till the tip of the 12 months to prepare your monetary data, it’d develop into a problem simply to entry the data.

The opposite key right here is that should you do decide to obtain financial institution statements, they need to at all times be in an editable format. PDF’s can’t be plugged into software program or spreadsheets, that means you’ll spend hours copying that data over unnecessarily.

Once you join your on-line banking to a web based accounting system, your data will already be proper the place you want it. Meaning you’re properly in your technique to organized accounting — in solely two minutes.

Minute #3: Create Observe-able Invoices

So that you’ve taken step one, and began creating invoices on your prospects as an alternative of simply asking for a test. Good? Completely, however you are able to do extra.

If you happen to’re utilizing an invoicing template builder, you’re heading in the right direction — skilled trying invoices are key. Sadly, with template builders you’re nonetheless liable for monitoring all the things associated to your bill. Have you ever collected a deposit? If you happen to’re amassing partial funds, when are they paid? And the way are you alerting your self if the bill turns into overdue?

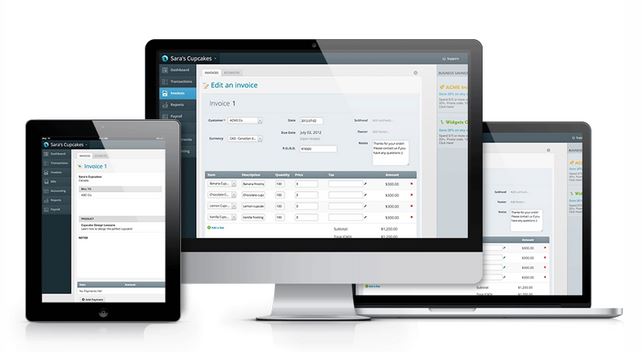

As an alternative of utilizing a template builder, use correct invoicing software program. You’ll nonetheless get skilled trying invoices, however you’ll additionally simply be capable of preserve monitor of these invoices and get higher insights into who’s paid, when funds have been made, what invoices are overdue, and with some software program you may even see in case your buyer has seen the bill.

To go the additional mile, discover an invoicing software that integrates with an accounting software. This fashion, your accounting might be mechanically up to date when invoices are paid.

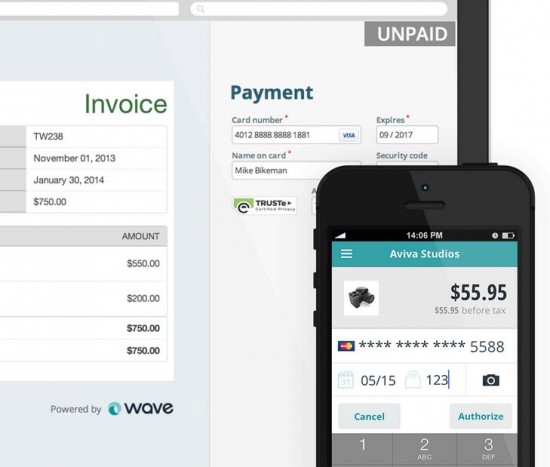

Minute #4: Begin Accepting Credit score Playing cards

A number of years in the past, excessive charges and irritating set-up processes barred small companies from accepting bank cards. Now, it’s by no means been simpler.

Whether or not you promote merchandise on-line or in individual, there are answers designed to make accepting bank cards simple for anybody. Charges have constantly dropped, and it’s now extremely inexpensive to just accept bank cards, so long as you’re employed with a bank card processor that retains small enterprise homeowners in thoughts.

In actual fact, accepting bank cards has develop into really easy that you would be able to now have your utility to just accept bank cards accomplished in lower than 4 minutes!

Minute #5: Manage Your Transactions

One step left — manage your transactions. Soar into that on-line software program you related your checking account to, and manage your bills.

Once you manage transactions early, you received’t find yourself caught, making an attempt to recollect if a restaurant invoice was for date night time, or a gathering with a brand new shopper. Do that each few weeks, and also you’ll save your self hours of time and frustration come tax time.

Free Software program That Can Assist

All these duties appear daunting, however there are a selection of instruments that may assist. Free of charge software program that does all of this and extra, take a look at Wave at WaveApps.com.