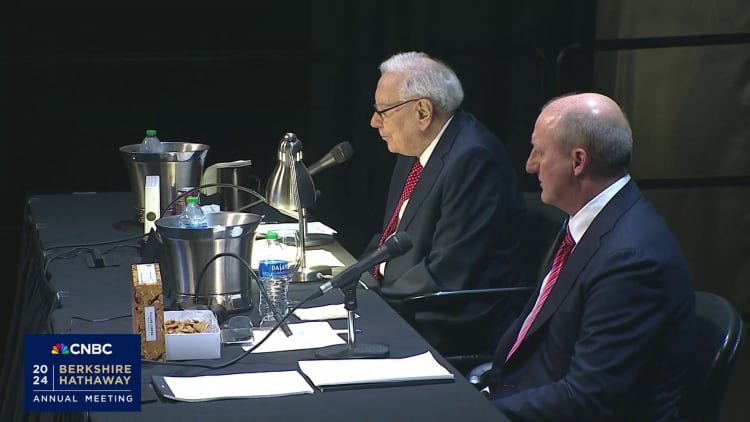

OMAHA, Nebraska — Warren Buffett stated Saturday his designated successor Greg Abel can have the ultimate say on Berkshire Hathaway’s investing selections when the Oracle of Omaha is not on the helm.

“I would depart the capital allocation to Greg and he understands companies extraordinarily nicely,” Buffett informed an area stuffed with shareholders at Berkshire’s annual assembly.

Abel, 61, grew to become referred to as Buffett’s inheritor obvious in 2021 after Charlie Munger inadvertently made the revelation on the shareholder assembly. Abel has been overseeing a significant portion of Berkshire’s sprawling empire, together with power, railroad and retail.

Buffett supplied the clearest perception into his succession plan so far after years of hypothesis concerning the precise roles of Berkshire’s prime executives after the eventual transition. The investing icon, who’s turning 94 years outdated in August, stated his resolution is influenced by how massive Berkshire’s property have grown.

“I used to suppose in a different way about how that may be dealt with, however I feel that accountability must be that of the CEO and no matter that CEO decides could also be useful,” Buffett stated. “The sums have grown so massive at Berkshire and we don’t wish to try to have two folks round which can be managing a billion every. It simply would not work.”

Berkshire’s money pile ballooned to just about $189 billion on the finish of March, whereas its gigantic fairness portfolio has shares value a whopping $860 billion based mostly on at present’s market costs.

“I feel what you are dealing with the sums that we are going to have, you have to suppose very strategically about the best way to do very massive issues,” Buffett added.

Whereas Buffett has made clear that Abel could be taking up the CEO job, there have been nonetheless questions on who would management the Berkshire public inventory portfolio, the place Buffett has garnered an enormous following by racking up big returns by means of investments within the likes of Coca-Cola and Apple.

Berkshire investing managers, Todd Combs and Ted Weschler, each former hedge fund managers, have helped Buffett handle a small portion of the inventory portfolio (about 10%) for concerning the final decade. There was hypothesis that they might take over that portion of the Berkshire CEO position when he’s not in a position.

However it appears by Buffett’s newest feedback that Abel can have closing resolution on all capital allocation, together with inventory picks.

“I feel the chief govt must be any person that may weigh shopping for companies, shopping for shares, doing all types of issues which may come up at a time when no one else is prepared to maneuver,” Buffett stated.

Abel is thought for his sturdy experience within the power business. Berkshire acquired MidAmerican Vitality in 1999 and Abel grew to become CEO of the corporate in 2008, six years earlier than it was renamed Berkshire Hathaway Vitality in 2014.