On the planet of small enterprise, not everybody plans on having angel traders or working with Enterprise Capitalists. That’s simply not reasonable for everybody, proper?

Nevertheless, it nonetheless takes cash to generate income.

So how does a small enterprise get funding earlier than it turns into worthwhile? Ought to it use loans, or bank cards, or perhaps crowdfunding choices?

Right here’s the reality: There are numerous methods to assist get your monetary footing once you’re simply beginning out. However discovering one of the best match for your enterprise goes to rely in your wants.

Let’s check out a number of attainable choices.

Small Enterprise Administration (SBA) Mortgage

A fundamental 7(a) SBA mortgage is likely one of the most typical technique of funding when companies are simply beginning out. They can be utilized to buy gear, renovate a constructing, inventory stock, and extra.

Nevertheless it’s not as straightforward as simply going to the collaborating financial institution and asking for X quantity of {dollars}. You’ll have to have your geese in a row first.

Right here are some things to have prepared earlier than heading to the financial institution:

-

Monetary data (Revenue & Loss Assertion and Projected Monetary Statements)

-

Enterprise certification and/or license

-

Revenue tax returns

-

Resume

-

Enterprise overview or marketing strategy

Profit:

Low rate of interest.SBA-guaranteed loans on $150,000-$700,000 (for multiple 12 months) have a mean rate of interest of three%, whereas loans greater than $700,000 common about 3.5% curiosity.

Draw back:

Gradual turnaround.Usually, you’ll have to attend 60-90 days for the approval course of to be accomplished.

Credit score Playing cards

Utilizing bank cards to fund your new enterprise might be useful—however may also turn into harmful shortly. Many bank cards have a 13-15% rate of interest, which may add up as your spending will increase.

Nevertheless, when used correctly, bank cards are one option to fill the hole in your small enterprise—and a few playing cards supply important perks for paying with plastic. Whether or not it’s a refund on a share of your purchases, or reductions for particular purchases—bank cards might be leveraged for his or her advantages.

Simply bear in mind: Use warning and make your funds on time.

Profit:

Fast supply of funds with added perks to be used.

Draw back:

With excessive rates of interest, bank card balances can spiral uncontrolled for those who get behind on funds.

Crowdfunding or Pre-orders

Don’t have the funding you want for your enterprise concept? Take it to the general public!

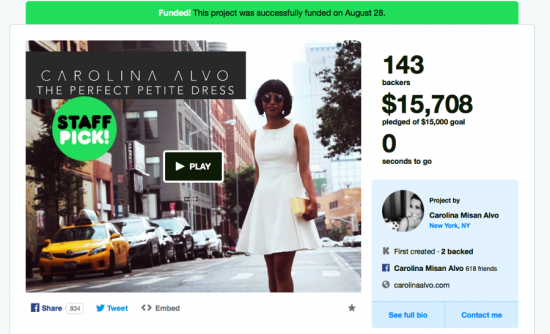

Many small companies have gotten their begin by way of on-line crowdfunding platforms like Kickstarter or IndieGoGo.

The way it works: You arrange a marketing campaign objective, marketing campaign finish date, and supply rewards for various ranges of funding dedication. You’ll customise the marketing campaign with the main points of your enterprise, a video, pictures and extra. Then, it’s as much as you to unfold the phrase!

Instance: Carolina Alvo, a petite clothes model, just lately executed a profitable Kickstarter marketing campaign for a brand new line of custom-made items.

Profit:

Many companies supply pre-orders of their product at a selected funding stage—so that you’re assured to have orders earlier than you make a full-fledged launch.

Draw back:

Many platforms make it in order that for those who don’t attain your funding objective, you don’t get any of the funding you raised except you pay the platform a share of your complete.

Promoting an Asset

It won’t be essentially the most interesting concept to make a life-style change with a view to begin your enterprise. Top-of-the-line components of being your individual boss is creating the life you need, proper?

That’s true—however at first, issues are going to be lean. By promoting an additional automobile, downsizing your private home, or liquefying a few of your property, you’re releasing up the required money you’ll have to get your enterprise up and working.

Profit:

Supplies a considerable amount of money shortly (and curiosity free!)

Draw back:

You’ll must half with a big-ticket merchandise.

Getting a Accomplice (or two)

Going right into a enterprise enterprise alone might be financially daunting. However once you be a part of forces with a associate, you share the burden of getting your enterprise began.

When in search of a very good associate, preserve a number of issues in thoughts:

-

Your abilities ought to complement one another

-

You must have sturdy, open communication

-

There needs to be a basis of belief and understanding

-

Your contributions and duties needs to be evenly break up

Check out the connection by taking a two or three day retreat collectively to collaborate on a small mission. If the check run goes easily, it’s time to proceed.

Draw up a proper settlement that outlines the main points of your partnership, and make it a legally binding contract.

Advantages:

Monetary and day-to-day obligations are break up up, taking the strain off a sole proprietor.

Draw back:

When you and your associate aren’t a very good match, it might probably break your enterprise.

Contemplating Grants

Except your small enterprise is doing analysis and improvement, federal grants might be exhausting to return by. Nevertheless, some rural financial improvement workplaces supply micro-grants by USDA for companies fostering job creation.

However there are different locations to search for grants, too.

Some corporations like Chase and Intuit have created contests for small enterprise homeowners—with the prizes being grants for his or her small companies. Usually there’s a voting course of concerned, so the enterprise proprietor would want to do some severe legwork in rounding up voters.

Profit:

Grants supply a supply of start-up cash that you just don’t must pay again.

Draw back:

There’s typically a major quantity of labor required within the course of, and also you’re not at all times assured to see a return in your exhausting work.

You Don’t Want Enterprise Capital or Traders

There are such a lot of monetary alternate options to enterprise capital and angel traders on the planet of small enterprise—you simply must know the place to start out wanting!

Whether or not it’s by way of a mortgage or a life-style change (or perhaps even a mixture of some issues), you may make your small enterprise come to life.

Your Flip: What different monetary options do you have got for small companies seeking to get began?