(Bloomberg) — Shares and bonds retreated as knowledge exhibiting US enterprise exercise accelerated amid a pickup in inflation strengthened hypothesis the Federal Reserve will stay on maintain.

Most Learn from Bloomberg

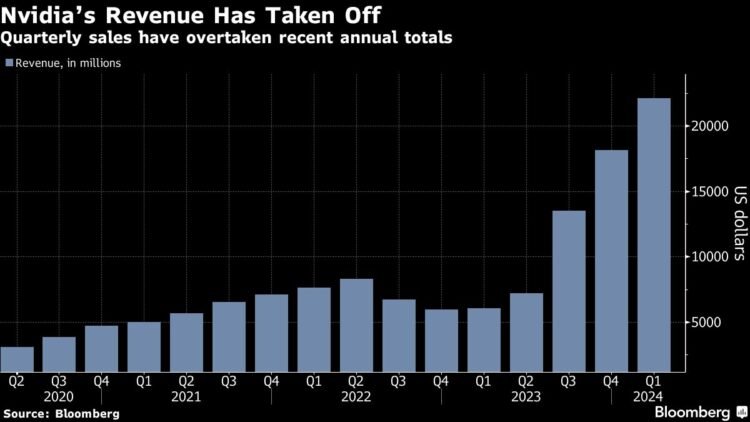

The S&P 500 dropped under 5,300, with all megacaps down besides Nvidia Corp. The large chipmaker jumped 9% on a strong outlook, topping the historic $1,000 mark. The Dow Jones Industrial Common misplaced 1.5%, led by a plunge in Boeing Co. — which stated it would proceed to burn money this quarter and within the full yr. Treasury yields climbed, with the transfer led by shorter maturities.

10-12 months TIPS Demand Weakens at Could $16 Billion Reopening Public sale

Swaps now absolutely value in a full quarter-point price minimize in December, versus November a day earlier. Development in exercise at service suppliers this month was the quickest in a yr and manufacturing output expanded at a faster tempo. Such resilience is making it troublesome for inflation to chill, serving to clarify why the Fed is intent on retaining charges increased for longer.

“Fed members have indicated they need to see extra progress on inflation – happily the US economic system nonetheless appears strong sufficient to take an prolonged price pause,” stated Don Rissmiller at Strategas Securities. “We proceed to search for the primary Fed price minimize in September.”

Treasury two-year yields climbed six foundation factors to 4.92%. The greenback edged up. Bitcoin fell 2%. Oil and gold retreated.

US policymakers earlier this month coalesced round a need to carry charges increased for longer and “many” questioned whether or not coverage was restrictive sufficient to convey inflation right down to their goal, based on Fed minutes launched this week.

“The minutes are a reminder that whereas the Fed doesn’t see one other price hike as possible — and positively doesn’t see it as a base-case — it won’t rule out hikes if inflation doesn’t behave,” stated Chris Low at FHN Monetary.

Meantime, one other spherical of blowout earnings from artificial-intelligence darling Nvidia and the economic system’s regular advance imply the S&P 500 possible has additional room to rise, based on JPMorgan Chase & Co.’s buying and selling desk.

“With the AI-theme nonetheless delivering and the macro speculation intact, we’re more likely to proceed to make new all-time highs,” the workforce together with Head of US Market Intelligence Andrew Tyler wrote in a word to shoppers.

Key occasions this week:

-

Japan CPI

-

Canada retail gross sales

-

Germany GDP

-

US sturdy items, client sentiment, Friday

-

Fed’s Christopher Waller speaks, Friday

Some market strikes:

Shares

-

The S&P 500 fell 0.9% as of two:56 p.m. New York time

-

The Nasdaq 100 fell 0.7%

-

The Dow Jones Industrial Common fell 1.6%

-

The MSCI World Index fell 0.7%

Currencies

-

The Bloomberg Greenback Spot Index rose 0.2%

-

The euro fell 0.2% to $1.0805

-

The British pound fell 0.2% to $1.2687

-

The Japanese yen was little modified at 156.90 per greenback

Cryptocurrencies

-

Bitcoin fell 3% to $67,324.51

-

Ether rose 0.7% to $3,775.65

Bonds

-

The yield on 10-year Treasuries superior 5 foundation factors to 4.47%

-

Germany’s 10-year yield superior six foundation factors to 2.60%

-

Britain’s 10-year yield superior three foundation factors to 4.26%

Commodities

-

West Texas Intermediate crude fell 0.9% to $76.91 a barrel

-

Spot gold fell 1.8% to $2,335.76 an oz

This story was produced with the help of Bloomberg Automation.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.