Sundry Images

Guidewire Software program: Funding Thesis

Since my December 2023 article, “Guidewire Software program: Time To Take Some Cash Off The Desk,” the Guidewire Software program, Inc. (NYSE:GWRE) share value has elevated by 46.44%, whereas the S&P 500 (SP500) has elevated by 22.93%. So, I’m reminded once more, Mr. Market can present a lack of knowledge of things affecting the intrinsic worth of a inventory for lengthy intervals of time. And within the case of Guidewire Software program, I’m not overly stunned at Mr. Market’s lack of knowledge.

Underlying earnings development is powerful, and this may be anticipated to proceed. The stability sheet can be robust, with nearly no internet debt and invested funds to offer backup. These are causes to be actually obsessed with this inventory.

What Mr. Market seems to be lacking is the opposite main stakeholder on this enterprise. This different main stakeholder is receiving what quantities to most well-liked dividend distributions, whereas the frequent inventory stakeholders are receiving no distributions out of earnings. Dividends on most well-liked inventory are handled as a deduction from entity earnings to reach at earnings attributable to frequent stockholders. And that’s what must be taking place with worker inventory compensation, which is successfully a type of most well-liked distribution out of earnings to worker stakeholders within the firm. Deduction of worker inventory compensation is each applicable and essential to arrive at Guidewire Software program earnings attributable to Guidewire frequent inventory shareholders. When that adjustment is acknowledged, there may be nonetheless a path to profitability via persevering with robust development. However the path might be longer and the earnings might be lower than what, I consider, is at present perceived by Mr. Market.

I contemplate the share value is at present nicely above intrinsic worth, and I keep a Promote score for Guidewire Software program inventory. However, the corporate’s 4th quarter and 2024 full-year outcomes are due out post-market on Thursday, Sep. 5, 2024, and one other robust headline end result may see an extra enhance within the share value. Simply bear in mind, Mr. Market is thought for sudden and sudden modifications in angle and route.

Beneath I present detailed analyses displaying stability sheet energy, revenue efficiency, and the affect on frequent inventory shareholders of the popular distributions to worker stakeholders via share points, with money outlays on repurchase of shares to offset these points.

A Lot to Like About Guidewire Software program’s Steadiness Sheet

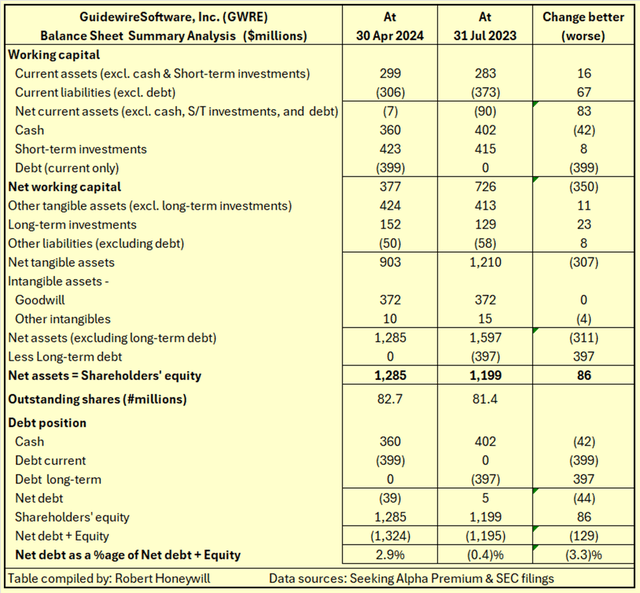

Desk 1

SA Premium and SEC filings

Desk 1 reveals Guidewire Software program has enough working capital even when it have been to repay present debt with out drawing down alternative borrowings. The present debt is in relation to 1.25% Convertible Senior Notes due 2025. I can’t discover something on the intentions of the corporate in relation to conversion to fairness, compensation in money at maturity, or an extra convertible observe situation, however any of those choices would possible not be a difficulty for the corporate.

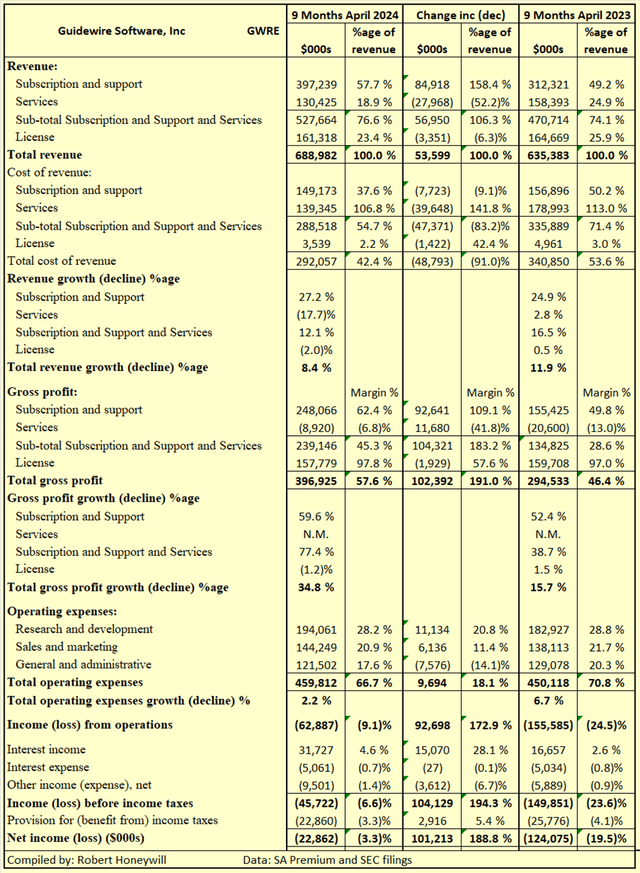

Desk 2.1 Guidewire Software program GAAP outcomes 9 months 2024 and 2023

SA Premium and SEC filings

The development in outcomes for the 9 months ended 2024 in comparison with the corresponding interval for the prior 12 months is spectacular. Of the three segments, cloud-based Subscription and Assist is the expansion driver and excessive margin. The License phase is secure and has the best margin. Passing on low-margin service income to companions has resulted in a decline in income for this phase, however a good larger discount in prices, decreasing working loss interval on interval. It’s fairly outstanding that incremental income of $53.6 million was achieved with a decrement of $48.8 million in Price of income, leading to incremental GAAP gross revenue of $102.4 million. Working bills embrace Analysis and Improvement, Gross sales and Advertising and marketing, and Common and Administrative. These are all giant value facilities totaling $459.8 million in comparison with a complete of $292.1 million for Price of income for 9 months ended Apr. 30, 2024.

These prices seem nicely managed and are additionally benefiting from income development, falling to 66.7% of income in 2024 in comparison with 70.8% of income in 2023. Earnings from operations improved by $92.7 million, with Loss from operations reducing from $155.6 million in 2023 to $62.9 million in 2024. GAAP Web loss improved by $101.2 million from $124.1 million loss in 2023 to $22.9 million loss in 2024. It might not shock to see the corporate report a constructive full-year GAAP end result at its earnings launch post-market on Thursday, Sep. 5.

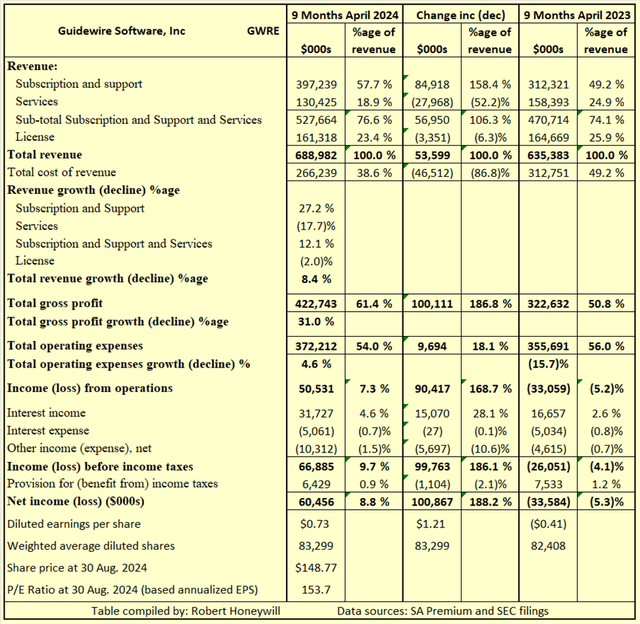

Desk 2.2 Guidewire Software program non-GAAP outcomes 9 months 2024 and 2023

SA Premium and SEC filings

Desk 2.2 reveals the corporate’s outcomes adjusted for non-GAAP objects, the foremost one in all which is stock-based compensation. The non-GAAP P/E ratio could be very excessive at 153.7, however this may be anticipated to lower in succeeding intervals because of the excessive earnings development potential of the corporate.

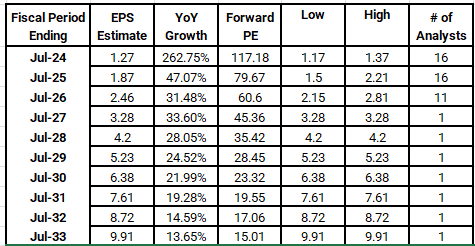

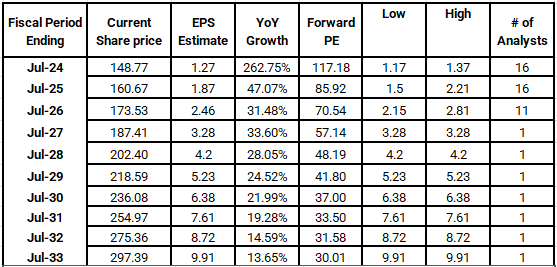

Determine 1 beneath reveals analysts’ non-GAAP EPS estimates from SA Premium. It additionally tasks P/E ratios out to Jul. 2033 based mostly on analysts’ consensus EPS and the present share value of $148.77. Whereas Determine 1 reveals the P/E Ratio coming all the way down to a reasonably regular degree of 15.01 by 2033, the share value would want to stay unchanged on the present $148.77 for that to be achieved.

Determine 1

SA Premium

Determine 2

SA Premium and creator

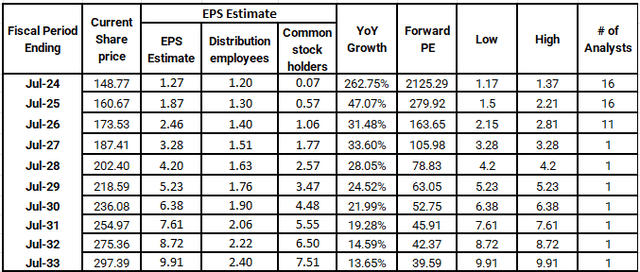

Determine 2 reveals the identical knowledge as in Determine 1, besides the share value is elevated at 8% per 12 months, to offer a return on the funding. On this case, the P/E ratio stays excessive, and probably an unacceptably excessive 30.01 at July 2033.

Determine 3

SA Premium and creator

In Determine 3, I present the affect on ahead P/E ratios of the distribution of a share of earnings to workers by the use of inventory compensation. The corporate is repurchasing on common round $100 million per 12 months by worth of shares to offset shares issued for inventory compensation. This money outflow just isn’t being thought-about in arriving at non-GAAP earnings and EPS. It’s definitely decreasing shareholders’ fairness and accordingly is decreasing funds accessible for distribution to shareholders. I’ve elevated the distribution to workers by 8% per 12 months consistent with the assumed enhance of 8% per 12 months in share value.

Based mostly on the assumptions in Determine 3, the P/E ratio in July 2033 would nonetheless be at a excessive of 39.59. To scale back that to a extra affordable ~20.0 would require a discount in share value development assumptions from 8% to underneath 1.5% per 12 months via July 2033. That’s not a really engaging proposition.

Abstract and Conclusions

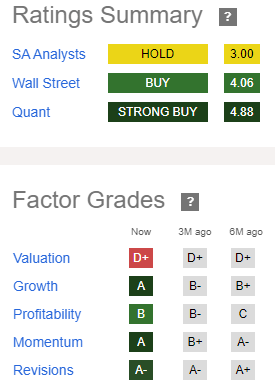

Guidewire Software program, with its explosive development in income and even quicker development in earnings, definitely excites the creativeness. It’s comprehensible why there may be robust sentiment in direction of the corporate. SA Quant measures each sentiment and fundamentals and has the inventory as a Robust Purchase as per Determine 4 beneath.

Determine 4

SA Premium

SA Quant acknowledges valuation is stretched, but in addition acknowledges sentiment measured throughout the opposite 4 issue grades stays a robust driver of the share value. From the perspective of fundamentals, I consider valuation is greater than stretched. There’s an outdated truism, regardless of how good a inventory, you’ll be able to nonetheless pay an excessive amount of for the shares. At $148.77, I consider the share value is an excessive amount of, and therefore the Promote score. However Mr. Market’s enthusiasm won’t die rapidly, so future share value route stays extremely unsure.