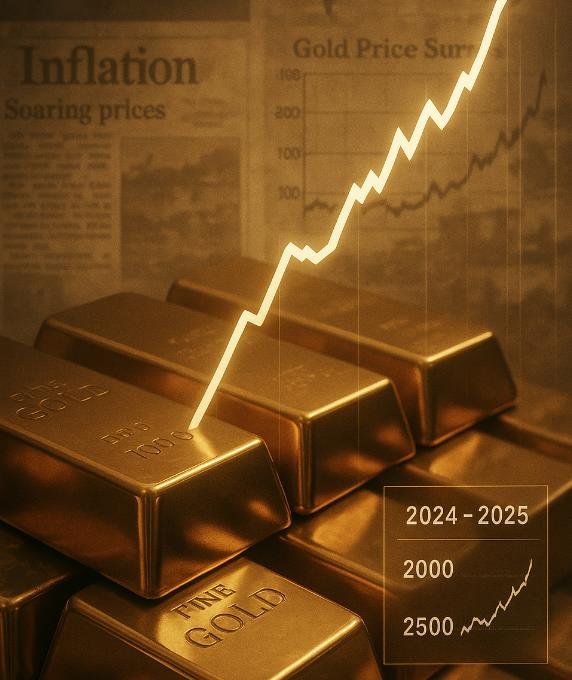

Gold prices have surged to record highs in 2025, showing a remarkable increase of over 20% since the start of the year. This surge raises important questions regarding its comparison to previous rallies and the unique market conditions that characterize the current environment. U.S. Money Reserve, a prominent distributor of government-issued precious metals, is closely monitoring these trends.

Historically, gold has experienced notable price increases, particularly during significant economic periods such as the 1970s and the financial crisis from 2008 to 2011. However, today’s rally is driven by several distinct factors, including geopolitical tensions, changing monetary policies, and ongoing supply constraints. The World Gold Council noted that gold prices reached new record highs 40 times in 2024, highlighting the interaction between limited physical availability and increased strategic demand.

Philip N. Diehl, president of U.S. Money Reserve, emphasizes that the rising cost of newly mined gold is pushing prices higher as mines face greater extraction challenges. Geopolitical instability further complicates mining operations, with rising tariffs and trade tensions contributing to market anxiety.

In April 2025, gold prices topped $3,400 per ounce amid concerns surrounding trade policies and Federal Reserve monetary strategies. Unlike past price spikes driven primarily by monetary factors, the ongoing increase reflects both supply-side limitations and traditional demand dynamics.

Gold has historically served as a safeguard against inflation and economic uncertainty, often performing well during downturns. Current portfolio strategies must consider these structural supports in light of gold’s longstanding value proposition. The limited recycling of gold amidst rising prices indicates strong retention among holders, distinguishing today’s market from historical patterns.

Why this story matters:

- It highlights the evolving dynamics of the gold market amid geopolitical and economic uncertainties.

- It underscores gold’s role as a stable asset during times of financial instability.

Key takeaway:

- The current gold rally is notable for its persistence against traditional market expectations and reflects complex supply-demand mechanics.

Opposing viewpoint:

- Some analysts argue that high interest rates may limit gold’s appeal as an investment compared to other assets, such as equities.