David Ellison, CEO of Paramount Skydance, has found himself in an unexpected position regarding the acquisition of Warner Bros. Discovery (WBD). Initially, in September, Ellison advocated for a merger between Paramount and WBD, proposing various offers to acquire the latter. His efforts initiated a formal sale process that ultimately attracted the interest of Netflix and Comcast, leading to a significant increase in WBD’s stock value.

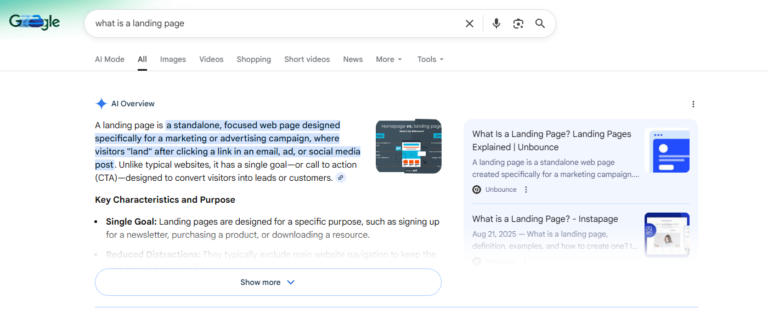

On October 6, Netflix agreed to purchase HBO Max and the Warner Bros. studio for $27.75 per share, valuing WBD at approximately $72 billion. Following the announcement, WBD revealed plans to separate its pay-TV networks, including CNN and TNT Sports, prior to finalizing the deployment of Netflix’s acquisition.

Instead of bolstering Paramount’s market position, Ellison’s attempts inadvertently enhanced Netflix’s influence, removing a potential target for both Paramount and Comcast’s NBCUniversal. This sale has proven lucrative for WBD CEO David Zaslav and shareholders, with the stock more than doubling since Paramount’s initial bid became public.

As Paramount continues to pursue WBD, the company has raised concerns about the sale process, alleging it favored Netflix. Paramount insists its all-cash offer of $30 per share was not given due consideration. Additionally, they argue the potential for tax efficiencies and lower regulatory risks under their proposal compared to Netflix’s.

Paramount is deliberating its next steps, which may involve presenting an enhanced bid to shareholders.

Why this story matters:

- The dynamics of media mergers significantly impact industry competition and shareholder value.

Key takeaway:

- Paramount’s initial pursuits resulted in a major acquisition that favored Netflix, altering the competitive landscape in the entertainment industry.

Opposing viewpoint:

- Paramount argues that the bidding process was unfair, suggesting that their proposal offered better value and strategic advantages.