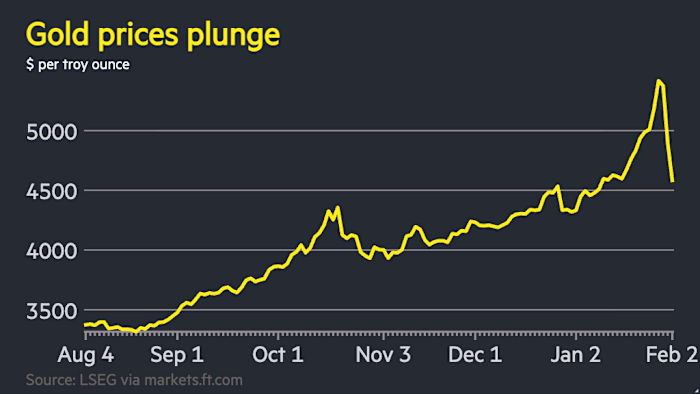

Gold and silver prices experienced significant declines on Monday, marking the continuation of a two-week reversal following a record-breaking rally in precious metals. Gold prices dropped by up to 9%, reaching $4,403 per troy ounce, before recovering slightly to close at $4,714, a 3% decline. Silver saw an even steeper fall, plummeting 15% to $71.33 before bouncing back to approximately $82.

The decline spurred a broader sell-off in global equity markets. Futures for the S&P 500 and Nasdaq 100 fell by 0.6% and 0.9%, respectively, as fund managers moved to reduce riskier investments amid increased market volatility. The volatility has prompted concerns regarding margins in precious metal trades, according to Hao Hong of Lotus Asset Management, who noted that investors faced challenges in managing their positions.

Recent geopolitical tensions and concerns about U.S. monetary policy had previously driven investors towards gold and silver as safe havens. However, the nomination of Kevin Warsh, a former Federal Reserve governor, by U.S. President Donald Trump, eased anxieties over potential shifts in inflation policy, which had contributed to the rally in precious metals.

European stock indices remained flat, while Asian markets, particularly South Korea’s Kospi, suffered significant losses, closing down 5.3%. In commodities, Brent crude oil fell by 4.2% to $66.40 per barrel, and industrial metals copper and aluminum were down by 2%.

As the market adjusts to these developments, traders are cautious about the role of leverage in the declines seen in precious metals. Analysts, however, suggest that current gold prices may still present an opportunity for investors amidst ongoing economic uncertainties.

Why this story matters:

- The fluctuation in precious metals affects global markets and investor sentiment.

Key takeaway:

- The easing of inflation concerns may signal a turning point for gold and silver prices, impacting investment strategies.

Opposing viewpoint:

- Some analysts believe that the potential for further monetary easing and ongoing geopolitical tensions still warrant a focus on gold as a safe asset.