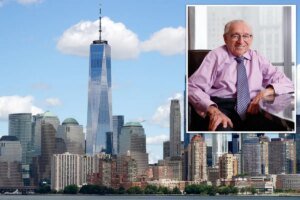

Lower Manhattan has experienced significant growth and revitalization as it moves forward, marking a notable rebound since the challenges of 9/11 and the pandemic. According to the Downtown Alliance, the district reported exceptional leasing activity in 2025, with total office leasing reaching 4.75 million square feet, a substantial increase from the previous year and the highest since 2019. The area’s residential population also surpassed 70,000 for the first time, driven by numerous conversions of outdated office buildings into apartments.

In the fourth quarter alone, 1.57 million square feet of new leasing deals were completed. Major transactions included Jane Street Capital’s expansion at 250 Vesey Street and BNY Mellon’s significant 192,915-square-foot lease at One World Trade Center. The report also highlighted a notable decrease in office vacancy rates, down to 22.2%, and a surge in interest from new tenants totaling 592,000 square feet leased.

The district’s growth may be further bolstered by a potential lease for American Express at Two World Trade Center, which could catalyze long-planned development in the area. However, industry insiders express caution after previous deals fell through, preferring to remain discreet until finalized.

Additionally, hotel occupancy reached a peak of 90% across 41 properties, reflecting a strong recovery in the hospitality sector. Noteworthy also is the auction of 350,000 square feet of air rights above the Fulton Center transit hub, indicating ongoing development potential in the region.

Why this story matters:

- Downtown Manhattan’s revival signals positive economic momentum post-pandemic.

Key takeaway:

- The area has seen a significant uptick in office leasing and residential population growth, indicating strong demand.

Opposing viewpoint:

- While growth is promising, some experts remain skeptical about the sustainability of this momentum amidst economic uncertainties.