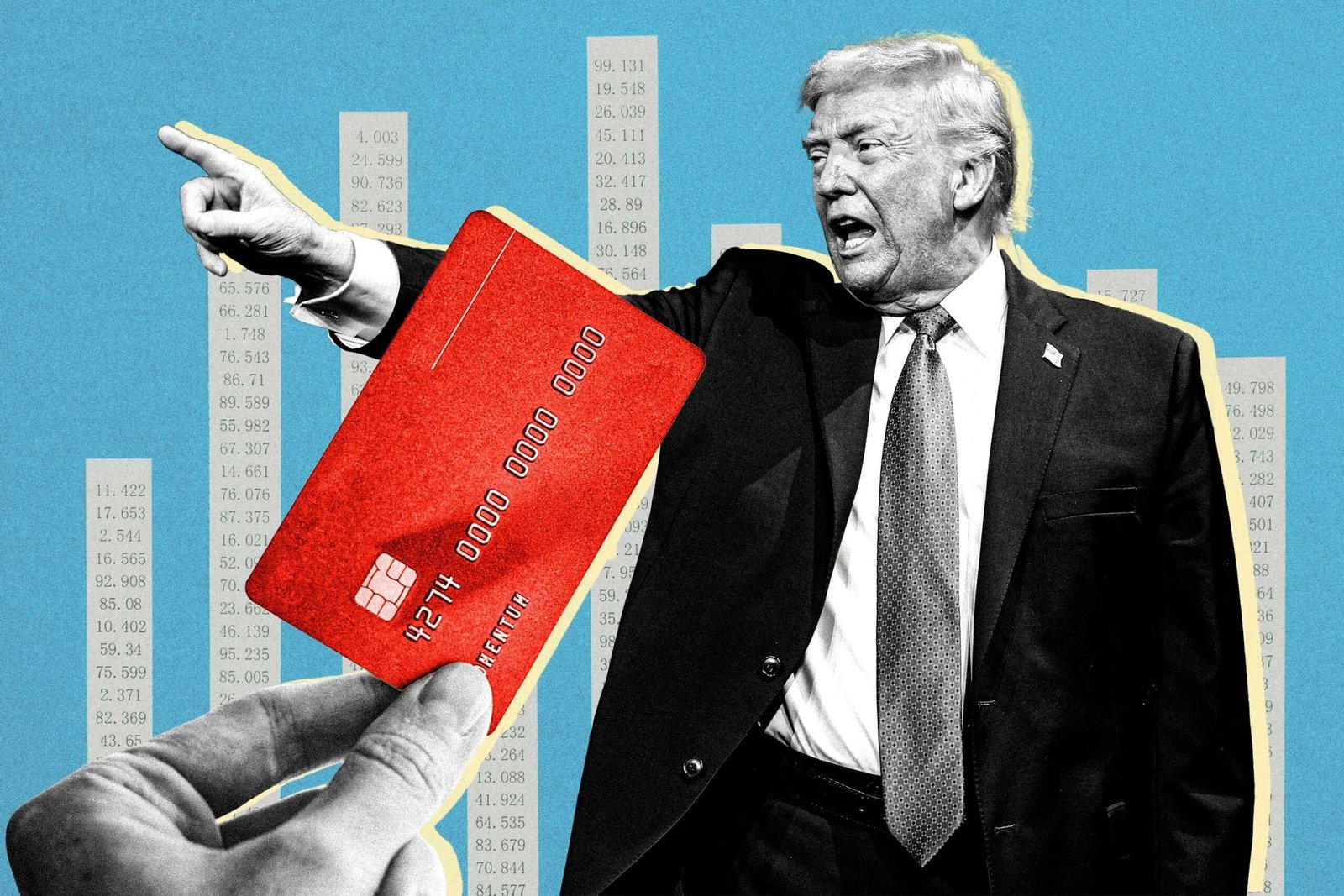

On Friday, President Donald Trump proposed capping credit card interest rates at 10% for one year, announcing on Truth Social that consumers are being “ripped off” by credit card companies. While this idea has garnered bipartisan interest among lawmakers in past discussions, bringing it to fruition presents significant challenges.

The current average annual percentage rate (APR) for credit cards stands at 22.3%, with typical borrowers owing around $6,700, according to data from the Federal Reserve and Experian. However, implementing a cap on rates would not be straightforward. Experts indicate that such changes would require legislative action rather than executive orders, which could prompt legal challenges from banks.

Danielle Zanzalari, an assistant professor of economics at Seton Hall University, highlights that existing regulations provide banks considerable freedom in setting rates. Although lawmakers have previously attempted to legislate credit card caps, none have succeeded thus far.

The prospect of interest rate caps has already influenced the stock market; shares of major banks like JPMorgan Chase and Bank of America declined following Trump’s announcement. Banks depend on higher rates to manage the risk of unsecured lending, and limits on those rates may jeopardize their business model.

Additionally, while a cap could save consumers up to $100 billion annually, it is likely to lead banks to slash rewards programs. Such actions would reduce credit access for many Americans, especially those with lower credit scores, as lending institutions often tighten borrowing limits in high-risk scenarios.

Overall, if Trump’s proposal were implemented, the implications for credit access and borrowing costs could extend beyond the initial one-year cap.

Why this story matters: The proposal could significantly impact millions of Americans struggling with credit card debt.

Key takeaway: Capping interest rates may provide short-term relief, but lenders could respond by tightening credit access.

Opposing viewpoint: Critics argue that such caps could restrict borrowing and negatively affect lower-credit borrowers the most.