Jason Ader, a hedge fund manager previously recognized for his role as an activist investor, has recently filed for personal bankruptcy in Miami amid serious financial troubles, including a lawsuit from his mother over an unpaid mortgage. Ader, 59, is facing over $1 million in debts, which include significant claims from his estranged wife and mother after he defaulted on a $13 million loan secured against the family’s Manhattan townhouse.

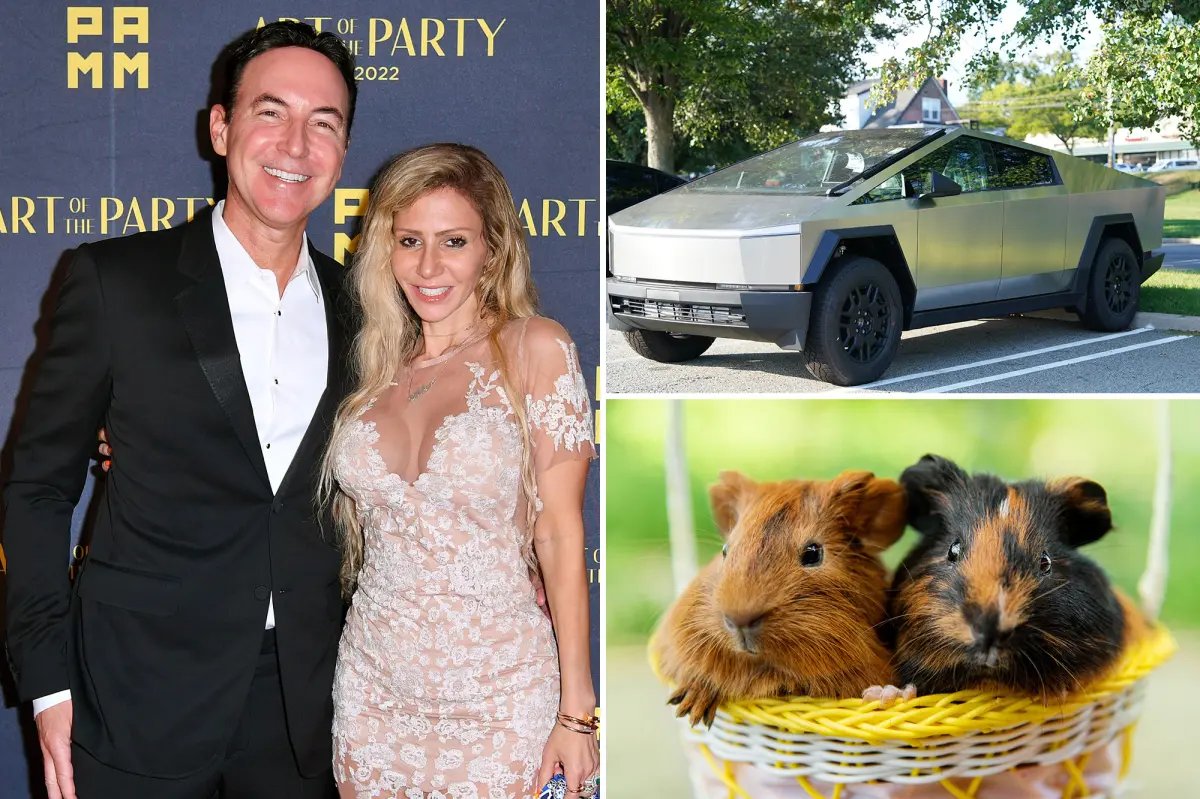

Court filings reveal Ader’s assets are valued at only $239,000, and include various items such as $10,000 in clothing and a $70,000 Tesla Cybertruck. His financial woes intensified after a failed $2.5 billion takeover of a casino in the Philippines, resulting in additional debts to the IRS and multiple creditors. Despite these challenges, Ader continues to reside in a luxurious $6 million condo in Miami, which he asserts is owned by one of his companies, shielding it from the bankruptcy proceedings.

During a recent court appearance, Ader attributed his financial difficulties to a combination of family disputes, divorce proceedings, and tax liabilities. He has also claimed to have already provided substantial housing support for his family. The bankruptcy filing comes after reports highlighted Ader’s extensive spending on lavish vacations, raising concerns over his financial management.

Despite the seriousness of the situation, Ader maintains that he is cooperating with ongoing legal matters and is committed to resolving the issues through the court system. His bankruptcy marks a significant decline for a figure once prominent in financial news and investment circles.

Why this story matters: The case illustrates the complexities of personal finance, legal disputes, and the potential pitfalls of high-profile investment careers.

Key takeaway: Ader’s struggles highlight the consequences of financial mismanagement, even among successful investors.

Opposing viewpoint: Some sources suggest Ader’s bankruptcy may be a strategic move to mitigate legal claims against him.