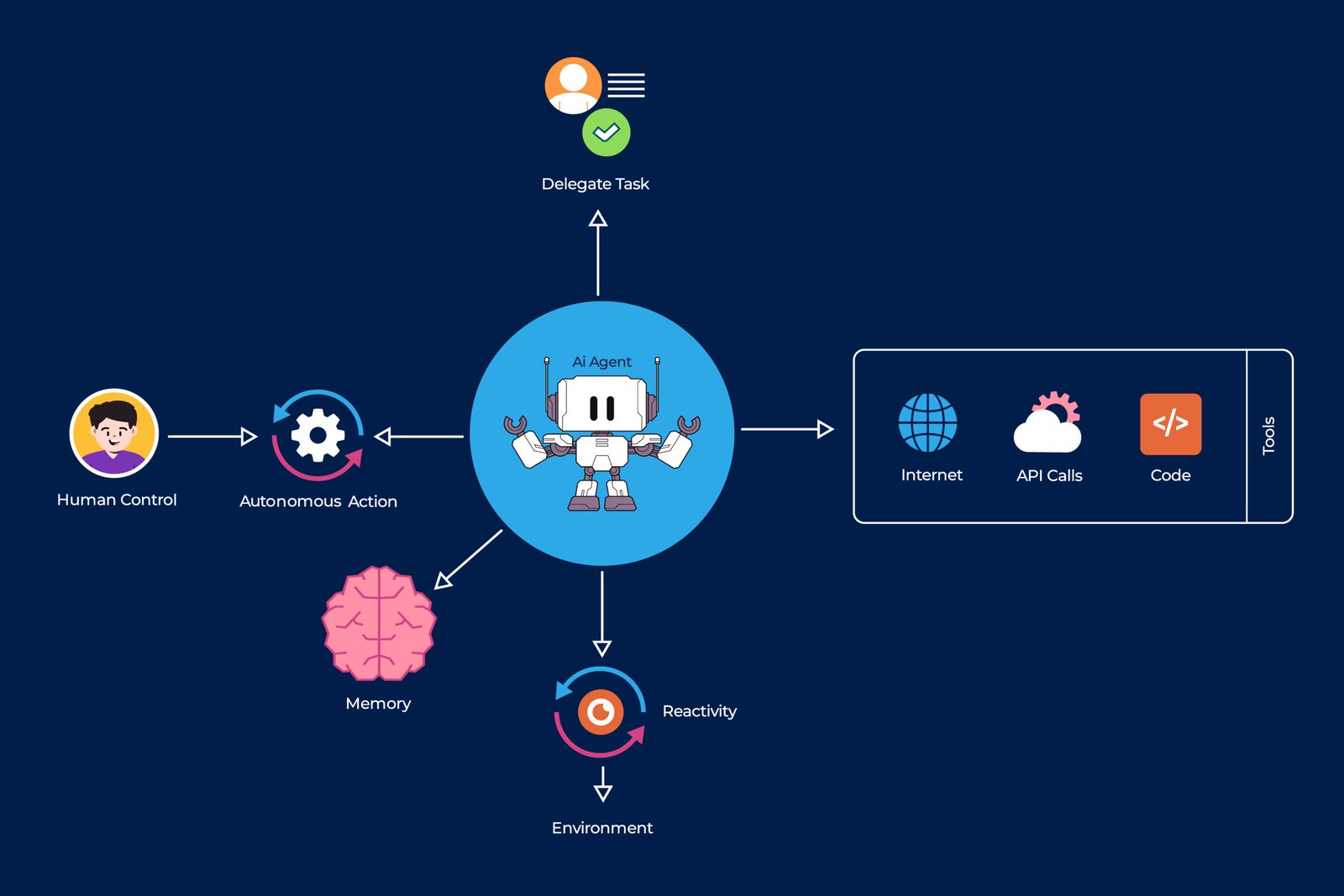

Investment management is experiencing a significant transformation as firms increasingly adopt Artificial Intelligence (AI) agents in their operations. These advanced AI systems surpass traditional large language models like ChatGPT by not only providing responses but also observing, analyzing, and making decisions within established parameters. Investment firms now grapple with how to define and govern these AI tools, essential for effective implementation.

To address this need for clarity, researchers from DePaul University and Panthera Solutions have proposed a multi-dimensional classification system for AI agents tailored for the investment sector. This framework assists practitioners, boards, and regulators in evaluating AI systems based on key criteria, such as autonomy, function, learning capacity, and governance. Establishing a common language around AI classification is crucial for optimizing technology utilization and ensuring responsible oversight.

Currently, investment managers tend to view AI either as a functional toolkit or as an integral component of the investment decision-making process. The functional approach improves efficiency but does not fundamentally alter decision-making dynamics. Conversely, a systemic approach positions AI agents as engaged participants in investment strategies, leading to a smarter organization. Integrating AI into every phase of the investment process—from idea generation to monitoring—enhances accountability and decision-making quality.

As AI technology continues to evolve, forthcoming regulations like the EU AI Act are expected to enforce accountability and transparency in AI operations. This classification system not only serves as a risk-control mechanism but also functions as a strategic framework for investment firms.

By aligning AI implementations with decision architecture rather than merely algorithm efficacy, firms can better enhance market adaptability and optimize capital allocation.

Why this story matters:

- The integration of AI in investment management represents a pivotal shift in operational strategies.

Key takeaway:

- Establishing a clear classification system for AI agents is vital for effective governance and utilization.

Opposing viewpoint:

- Some may argue that stringent classification could stifle AI innovation and flexibility in investment strategies.