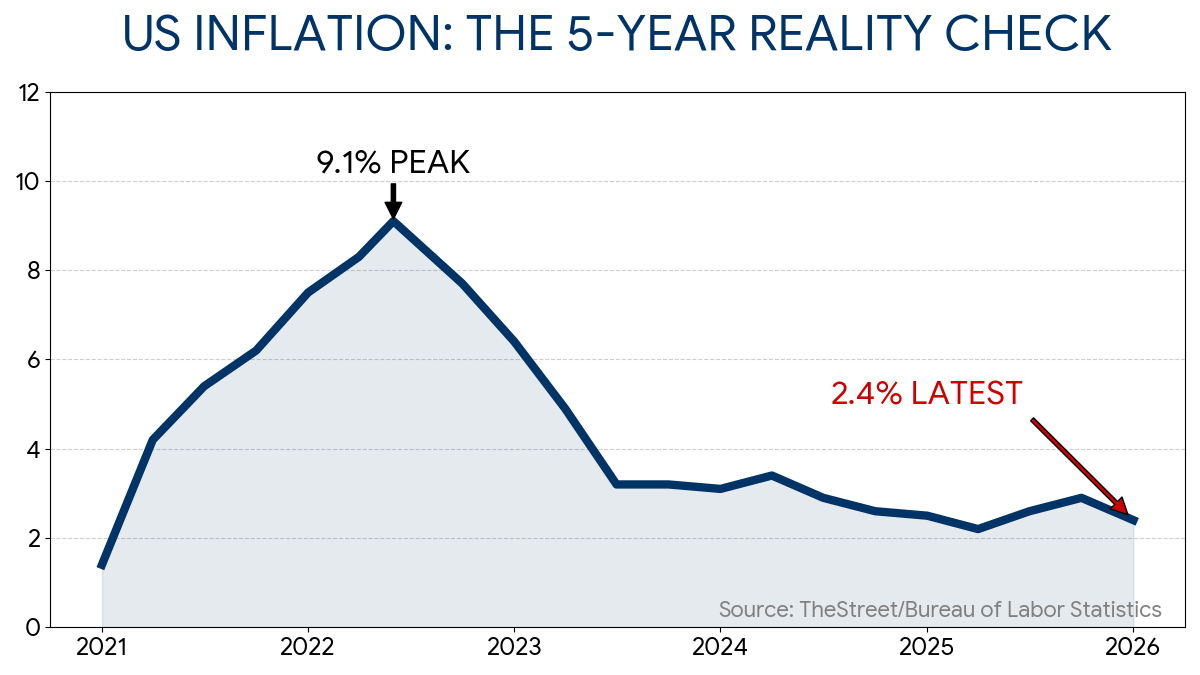

Inflation levels have decreased, as indicated by the Consumer Price Index (CPI) data for January, which revealed an inflation rate of 2.4%, the lowest since May of the previous year. This figure surprised Wall Street analysts, who had anticipated a rate of 2.5%. Despite this welcome downturn, attention has shifted toward the Personal Consumption Expenditures (PCE) inflation rate, which the Federal Reserve closely monitors.

January’s CPI data prompted Goldman Sachs to adjust its PCE outlook, forecasting a month-over-month increase of 0.40%, slightly above prior expectations. This projection is influenced by rising prices in consumer electronics and IT commodities, which carry more weight in the PCE calculation compared to the CPI. While CPI saw relief from decreased used-car prices, PCE accounts for these items differently, suggesting that PCE inflation could remain elevated.

Goldman expects headline PCE to reflect a slight uptick to 2.81%, with core PCE, which excludes volatile food and energy prices, projected to increase to 3.05%. Since the Fed’s inflation target for interest rate policy hinges on core PCE, this increase may catch investors off guard.

The Federal Reserve operates under a dual mandate of promoting low unemployment and stable inflation, often facing challenges in balancing these goals. Although the unemployment rate has fallen to 4.3% as of January, the Fed has been cautious in making adjustments to interest rates. The market currently predicts a low likelihood of a rate cut in the near future, with less than a 10% chance for the March meeting, and a 26% chance for April.

Why this story matters:

- It highlights the complexities of inflation measures and their impact on monetary policy.

Key takeaway:

- While CPI shows declining inflation, PCE metrics suggest potential upward pressures that could influence the Federal Reserve’s interest rate decisions.

Opposing viewpoint:

- Some analysts argue that the declining CPI should prompt the Fed to consider rate cuts, regardless of PCE trends.