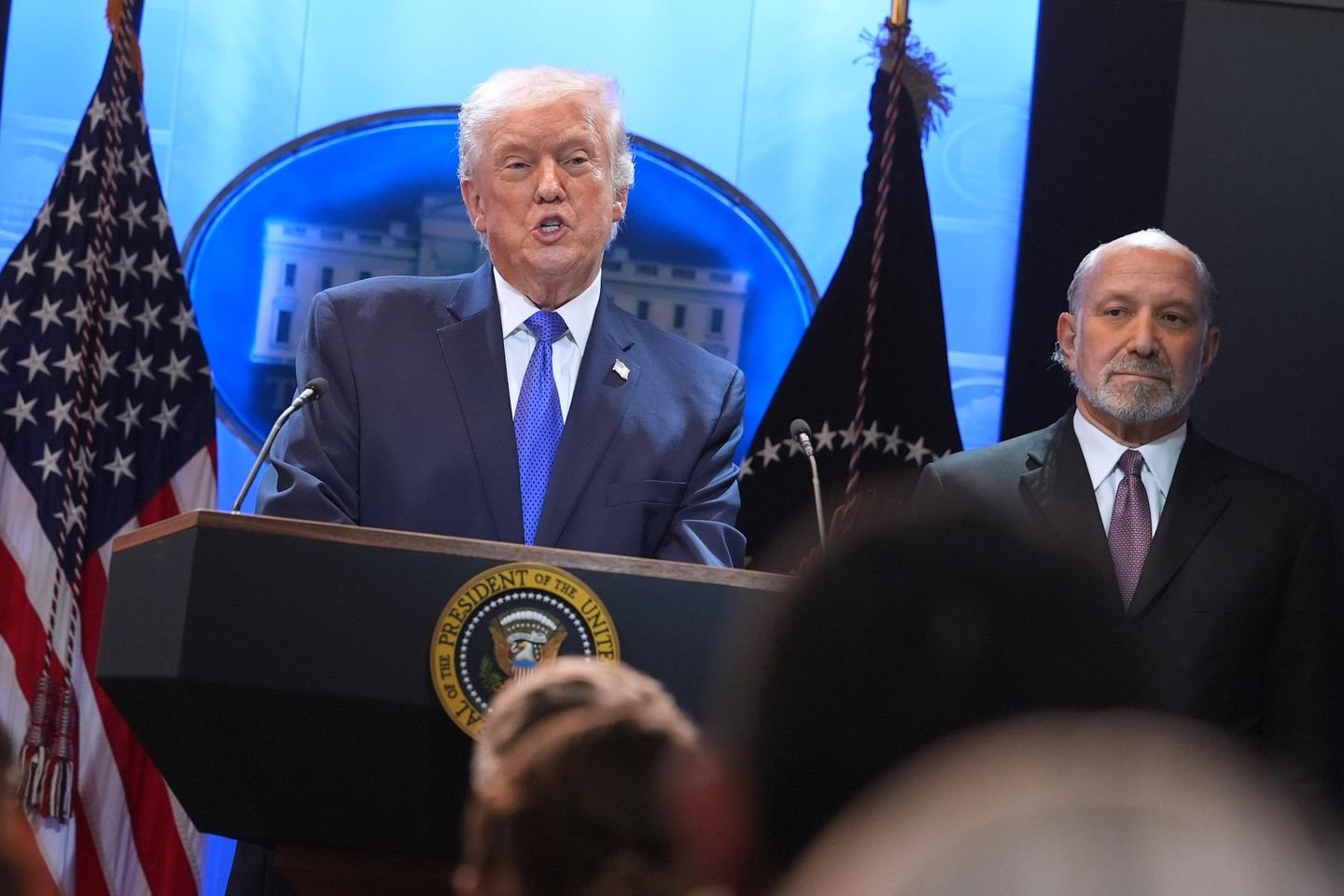

JPMorgan Chase has publicly confirmed that it closed the bank accounts belonging to former President Donald Trump and several of his associated businesses. This action occurred in the wake of the political and legal ramifications following the January 6, 2021, attack on the U.S. Capitol. This development represents a significant moment in the ongoing discussions surrounding “debanking,” the practice of financial institutions severing ties with clients due to political or legal concerns.

The closures highlight the increasingly complex relationship between financial institutions and their clients in the context of political events and public sentiment. JPMorgan’s decision reflects broader trends in the banking sector regarding the scrutiny of clients based on their public profiles and actions.

This incident adds to the ongoing discourse surrounding the role of banks in navigating political sensitivities and underscores the potential implications for individuals and businesses connected to high-profile or controversial figures.

Why this story matters

- The closure of accounts could set a precedent for other banks grappling with similar issues.

Key takeaway

- JPMorgan’s actions illustrate the intersection of finance and politics, impacting both individual clients and the broader banking landscape.

Opposing viewpoint

- Critics argue that such actions by banks can lead to financial discrimination based on political beliefs, raising questions about freedom and fairness in banking practices.