Investing in rental properties using home equity can be a strategic approach for new real estate investors looking to expand their portfolios. The process typically involves accessing the equity accrued in an existing property through options such as a cash-out refinance or a home equity line of credit (HELOC).

In a recent discussion, Ashley Kehr and Tony J. Robinson addressed common queries from nascent investors about best practices for utilizing home equity. One individual shared their experience of having approximately $110,000 in equity in a property currently undergoing renovations, alongside aspirations of investing in vacation rentals. They were particularly interested in determining whether the BRRRR strategy (Buy, Rehab, Rent, Refinance, Repeat) would be suitable, considering the potential for upswings in rental income.

The investors stressed the importance of accurately assessing equity, suggesting clarity on how equity figures were calculated. Additionally, they recommended exploring avenues such as commercial lines of credit for rental properties, given that refinancing options differ for non-owner-occupied homes. Understanding the current interest rates on existing mortgages is also crucial before making financial decisions.

Ashley and Tony recommended leveraging tools to estimate rental prices and emphasize the significance of having a backup plan for income fluctuations. They also highlighted the vital role of hiring a competent cleaning service for short-term rentals, as these workers often serve as the first and last line of defense in property maintenance.

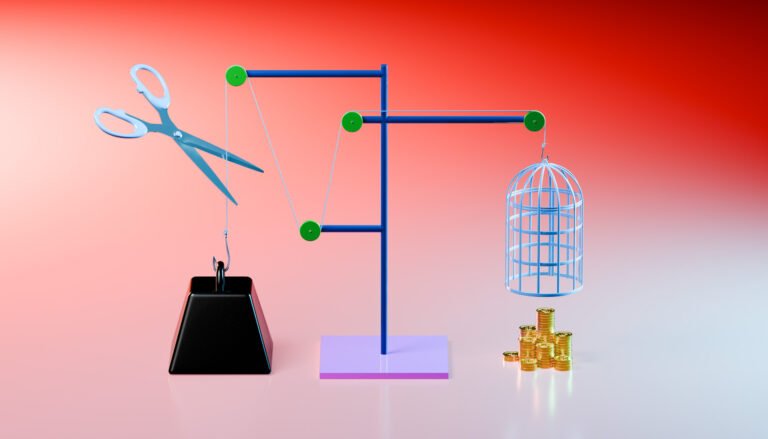

Why this story matters: Home equity can accelerate investment opportunities, providing a pathway for financial growth in real estate.

Key takeaway: Understanding available financial options and correctly estimating rental income are crucial for new investors.

Opposing viewpoint: Some warn against using home equity for investments, as it can lead to over-leveraging and increased financial risk.