Several companies are making headlines as trading begins.

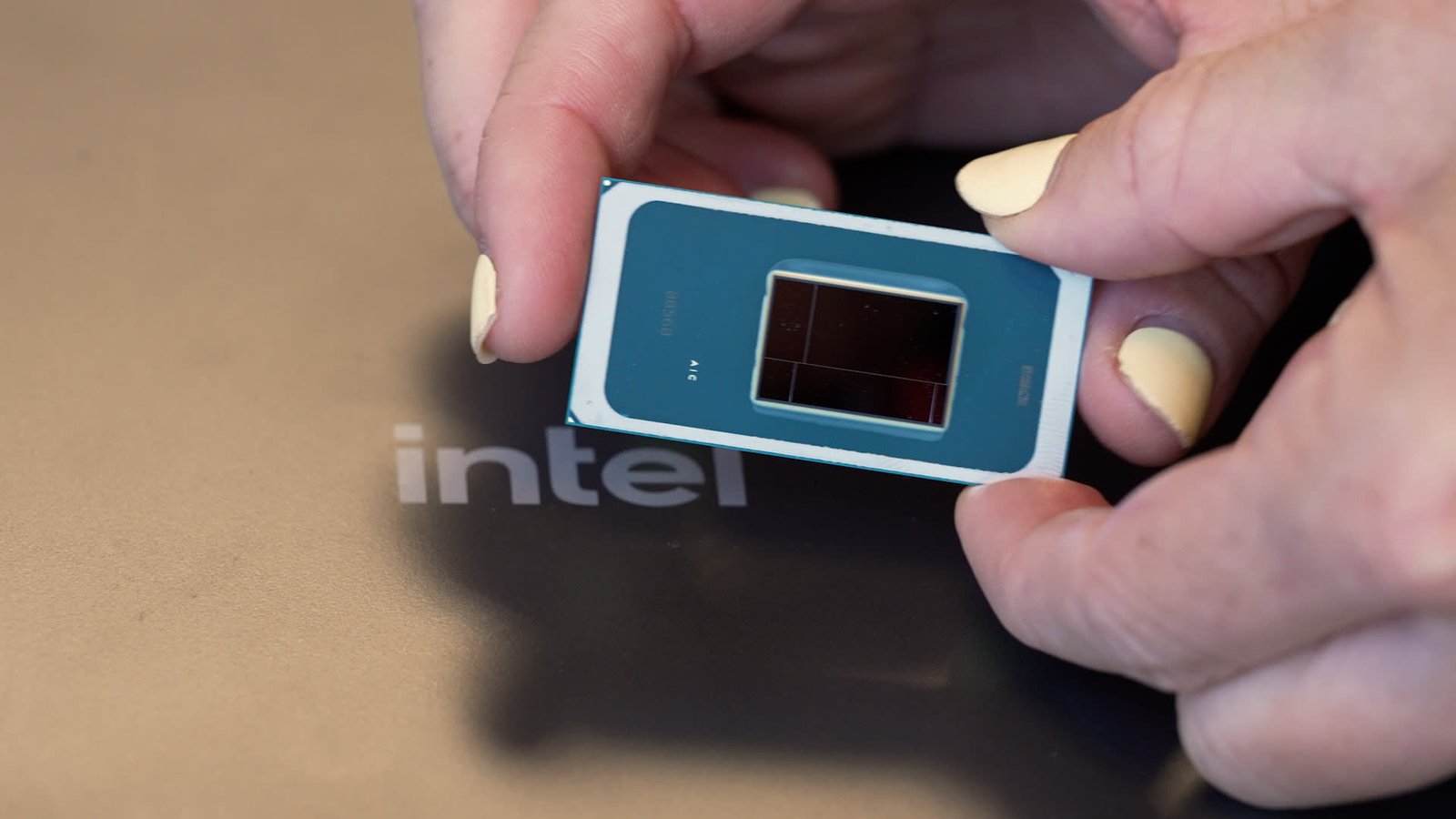

Intel’s stock saw an increase of 1% following Nvidia’s recent completion of a $5 billion equity investment in the company. In a related development, shares of Taiwan Semiconductor Manufacturing also rose by 1%, as reports indicated that Nvidia requested the firm to enhance its H200 production in response to more than two million unit orders from China for 2026.

Conversely, shares of Warner Bros Discovery fell by 1% after the company announced plans to reject a takeover bid from Paramount Skydance, as reported by CNBC. Meanwhile, Hyatt Hotels experienced a decline of over 1% after revising its 2025 outlook to reflect the impact of Hurricane Melissa, which affected operations in Jamaica. Hyatt anticipates its adjusted EBITDA will land at the lower end of the projected range of $1.09 billion to $1.11 billion.

On a positive note, Nike’s stock surged approximately 3% after board members Tim Cook and Robert Holmes Swan, along with Nike CEO Elliott Hill, reportedly increased their stakes in the company, according to Verity data. This action takes place as Nike concludes a challenging fiscal year.

Why this story matters

- Developments in major technology and entertainment companies can signal shifts in market dynamics and investor confidence.

Key takeaway

- Significant investments and production adjustments among firms reflect their responses to market demands and external pressures.

Opposing viewpoint

- Concerns remain about the long-term stability of companies like Warner Bros Discovery and Hyatt Hotels, especially in light of recent operational challenges and strategic decisions.