The U.S. economy experienced an annualized growth rate of 4.3% in the third quarter of 2023, significantly exceeding economists’ forecasts of 3.2%. This robust growth, reported by the Bureau of Economic Analysis, is primarily attributed to increased consumer spending in healthcare and technology sectors, along with heightened government defense expenditure and strong exports.

Thomas Simons of Jefferies remarked on the unexpected performance, indicating that expectations for the fourth quarter have now been set very high. President Donald Trump claimed credit for this growth, touting it as part of what he calls the “Trump Economic Golden Age.”

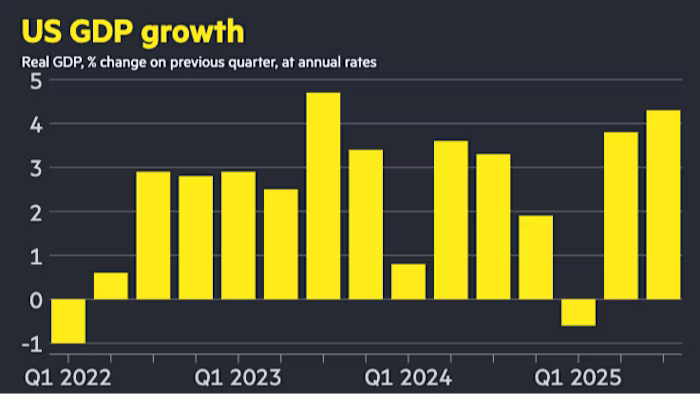

However, consumer confidence has seen a decline, reaching its second-lowest level in five years according to the Conference Board’s December data. This backdrop raises concerns about the sustainability of the economic momentum. The recent growth figures have followed a period of economic fluctuations influenced by trade dynamics related to tariffs imposed by the Trump administration. Earlier this year, the economy experienced a contraction of 0.5% in the first quarter, only to rebound at a 3.8% rate in the subsequent quarter.

While the third-quarter results were bolstered by consumer spending, analysts are cautious about whether such growth can be maintained. Oliver Allen from Pantheon Macroeconomics cautioned that the positive trade impact may not be sustainable. Market reactions to the release were mixed, with the S&P 500 achieving a record high, although trading volumes were low due to the holiday season.

Looking forward, economic experts are closely monitoring trends in consumer spending and government investments, particularly in light of potential weaknesses stemming from recent structural changes and the impact of tariffs.

Why this story matters: Insights into economic growth help gauge the health of the U.S. economy and inform policy decisions.

Key takeaway: The unexpected growth in Q3 raises questions about sustainability in the coming quarters amid declining consumer confidence.

Opposing viewpoint: Some economists argue that the growth observed may not be indicative of overall economic strength, given potential headwinds from reduced consumer spending and tariffs.