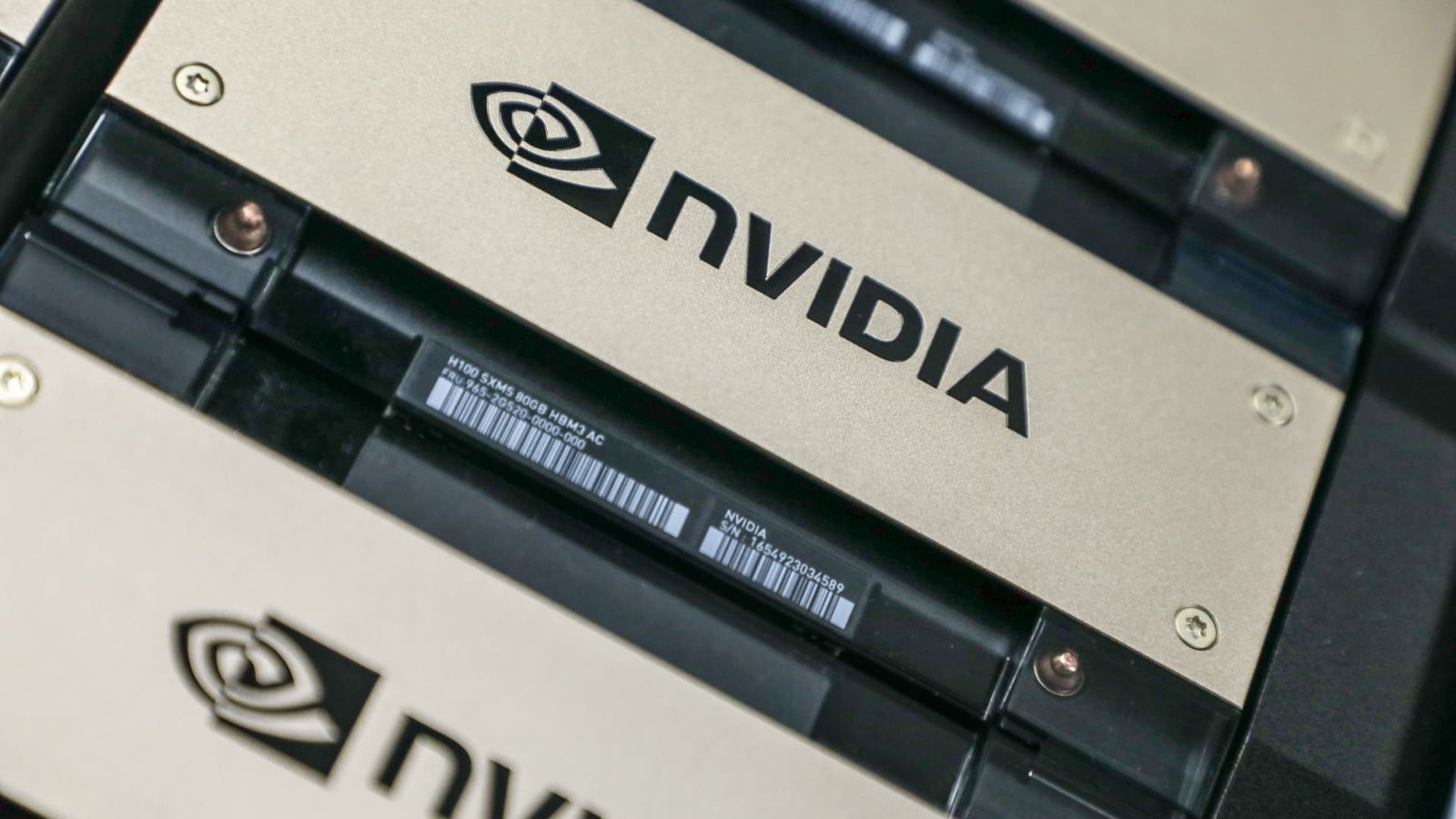

Nvidia’s stock saw a modest increase of 0.5% following its announcement that it will acquire assets from artificial intelligence startup Groq for $20 billion, marking the company’s largest acquisition to date. This strategic move is expected to enhance Nvidia’s capabilities in the AI sector.

In the digital memory sector, stocks for Micron Technology and SanDisk have also shown positive trends. According to industry sources cited by DigiTimes, Samsung Electronics and SK Hynix are planning to raise prices for their forthcoming fifth-generation high-bandwidth memory 3E chips by nearly 20% for deliveries scheduled in 2026. As a result, Micron Technology’s stock rose nearly 2%, while SanDisk experienced a jump of 4%.

Conversely, airline stocks experienced a decline due to the looming threat of a winter storm, which poses challenges to flight schedules. Shares of United Airlines and American Airlines saw slight decreases in response to this weather-related concern.

Why this story matters

- Significant acquisitions and pricing adjustments in tech can have widespread implications for market dynamics.

Key takeaway

- Nvidia’s record acquisition underscores the growing competition in the AI market, while memory chip pricing changes signal possible inflation in technology costs.

Opposing viewpoint

- While some view the price increases in memory chips as a necessary adjustment, others argue it may stifle innovation and burden consumers and businesses.