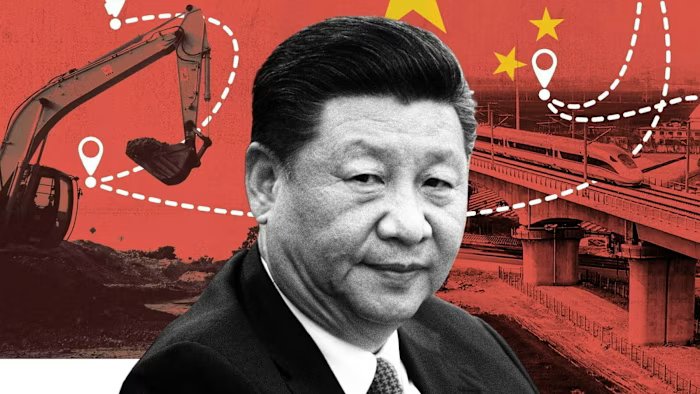

China’s Belt and Road Initiative (BRI), a key component of Beijing’s foreign investment strategy, saw an unprecedented surge in funding, reaching $213.5 billion in 2025. This increase represents a 75% rise compared to the previous year, as China seeks to capitalize on diminishing U.S. influence globally. The initiative primarily focuses on significant investments in gas infrastructure and green energy projects, according to research from Griffith University of Australia and Shanghai’s Green Finance & Development Center. In 2025, China signed 350 new investment deals, a notable jump from 293 agreements worth $122.6 billion in 2024.

The heightened investment aligns with ongoing tensions between the U.S. and China, particularly regarding trade and technology, which have disrupted global supply chains. Christoph Nedopil Wang, an expert in energy and finance at Griffith University, projected continued spending growth fueled by interests in energy, mining, and technological advancements. The study also highlighted that BRI’s cumulative contracts and investments have reached $1.4 trillion since its inception in 2012.

The recent rise in gas megaprojects includes major developments like a gas project in Congo and a petrochemical facility in Indonesia, reflecting the growing trust developing nations place in Chinese companies. Energy-related projects totaled $93.9 billion, marking the highest investment level since the BRI’s launch. However, increasing scrutiny surrounds the potential long-term debt implications for participating countries.

Concerns raised by various analysts, including those from the U.S. Congressional Research Service, indicate potential issues regarding debt sustainability and the opaque nature of the credit terms associated with BRI projects.

Why this story matters

Key takeaway

Opposing viewpoint