Several companies are making noteworthy moves in midday trading, reflecting diverse market responses to recent developments.

Fortinet’s shares increased by over 7% following an upgrade from TD Cowen, which shifted its rating from hold to buy. The firm stated that rising memory prices would have a less detrimental effect on the company than previously thought, setting a price target of $100, indicating a potential 29% upside.

In contrast, Bausch Health experienced a 9% decline after one of its experimental treatments for hepatic encephalopathy failed to meet targets in a late-stage clinical trial. This condition involves the buildup of toxins in the blood affecting brain function in patients with liver disease.

Moderna’s stock fell by 6%, ending a four-day winning streak, after CEO Stephane Bancel informed Bloomberg TV that the company would not invest in new late-stage vaccine trials due to growing U.S. opposition to immunizations.

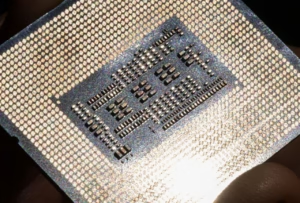

Intel’s shares dropped by 16% after mixed fourth-quarter results were reported alongside a weak forecast. The company anticipates first-quarter revenue between $11.7 billion and $12.7 billion, with adjusted profits expected to break even. Analysts had forecasted earnings of 5 cents per share on revenue of $12.51 billion.

On a positive note, Clorox’s shares rose nearly 3% after announcing the acquisition of Gojo Industries for $2.25 billion while reaffirming its outlook for 2026. Similarly, SLM, also known as Sallie Mae, saw nearly a 3% increase after reporting fourth-quarter earnings that beat expectations and authorizing a $500 million share repurchase program.

Other notable movements included nearly a 28% rise for Life360, which reported a significant growth in its user base, and Booz Allen Hamilton, which increased its first-quarter earnings forecast. Conversely, Capital One’s shares fell over 6% after announcing its acquisition of startup Brex for $5.15 billion and reporting adjusted earnings that missed analyst estimates.

Why this story matters: Market shifts reflect broader trends in technology, healthcare, and consumer goods sectors.

Key takeaway: Companies are experiencing significant fluctuations in stock prices based on financial performance and strategic decisions.

Opposing viewpoint: While some firms thrive, others face setbacks due to clinical trial outcomes and changing market conditions.