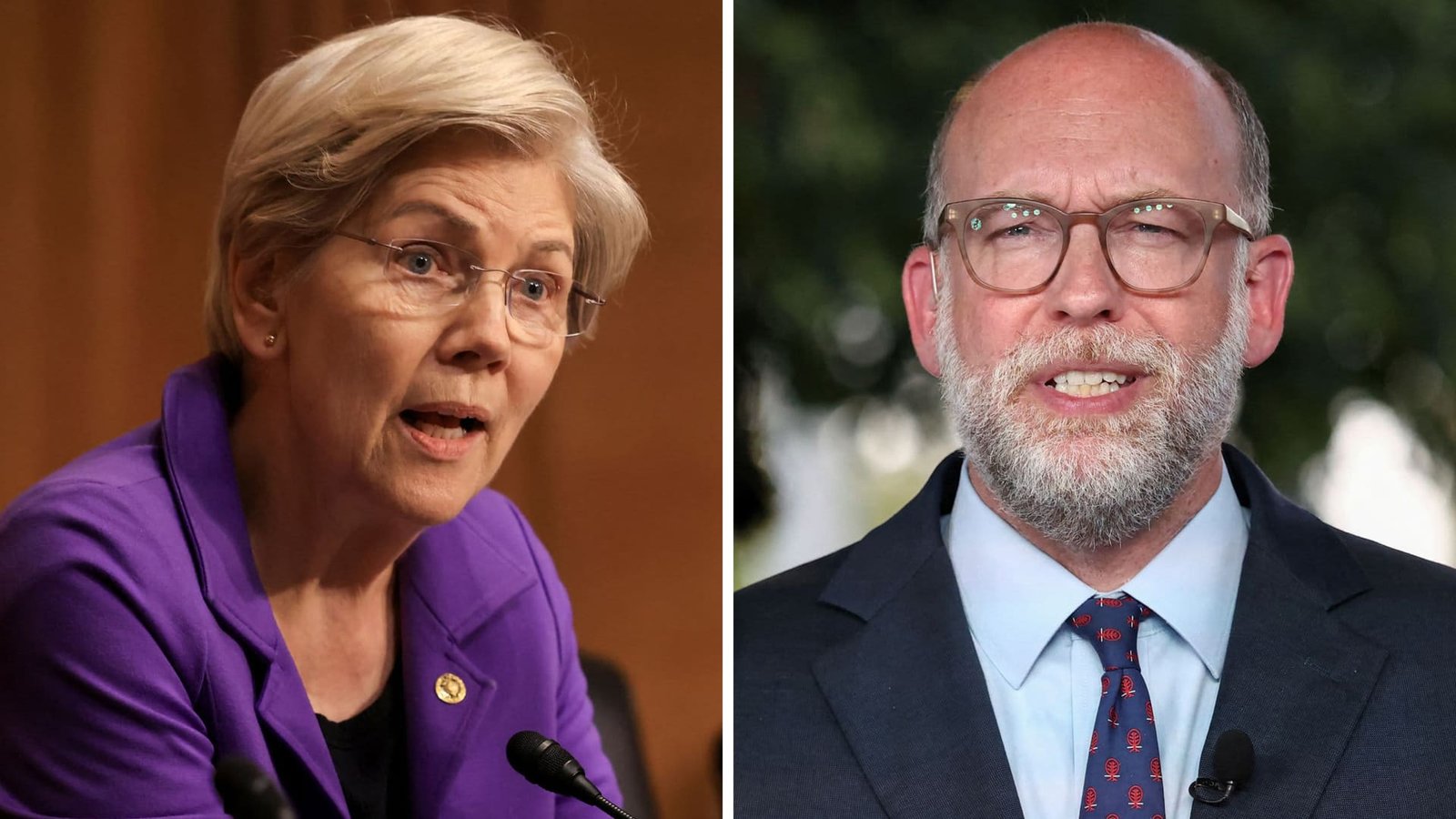

U.S. Senator Elizabeth Warren (D-MA) has criticized the acting director of the Consumer Financial Protection Bureau (CFPB), Russell Vought, for actions she claims contradict President Donald Trump’s initiative to make credit cards more affordable. In a letter addressed to Vought, Warren highlighted recent CFPB actions, including the decision to withdraw a rule limiting late fees on credit cards, siding with lenders in litigation concerning deceptive practices, and halting enforcement actions against financial institutions.

Earlier this month, President Trump called for U.S. banks to voluntarily cap credit card interest rates at 10% for one year. Following the banks’ lack of compliance, Trump urged Congress to legislate a cap. Warren’s correspondence with Vought points out that his leadership is undermining the President’s goals, arguing that his actions facilitate rather than restrict the financial exploitation of consumers.

Warren emphasized that the CFPB, which she played a role in establishing during the Obama administration, is experiencing significant challenges under Vought’s management, with claims that the agency is nearly incapacitated. Vought has been accused of attempting to enact mass layoffs and halt funding for the agency, which many believe is aligned with a broader deregulatory agenda from the Trump administration.

The CFPB has responded by noting that it is prohibited from capping credit card rates under the Dodd-Frank Act. Warren urged Vought to make use of the CFPB’s full authority to address high credit card costs and tackle dishonest practices within the industry. She called for the reinstatement of rules to limit late fees and enforce regulations surrounding interest rate monitoring and consumer complaint handling.

Why this story matters:

- It highlights the contrasting priorities within the Trump administration regarding consumer financial protections.

Key takeaway:

- Elizabeth Warren’s letter criticizes the CFPB’s leadership for actions that appear misaligned with the President’s affordability agenda.

Opposing viewpoint:

- The CFPB argues it lacks the legal authority to impose limits on credit card rates as proposed by Warren and Trump.