BiggerPockets members are exhibiting cautious optimism regarding the real estate market’s trajectory through 2026. According to a recent survey, despite challenges in various markets over the past year, members express a positive outlook on potential opportunities for investment, driven by expectations of lower interest rates and stabilization in housing affordability.

This sentiment represents a shift from the previous frenetic market environment of 2020-2022, moving toward a belief that conditions are improving, albeit gradually. Realtor.com anticipates that interest rates will average around 6.3% in 2026, slightly down from 2025, with home price growth expected to be moderate. This could present increased buying opportunities for conscientious investors aiming to expand their portfolios.

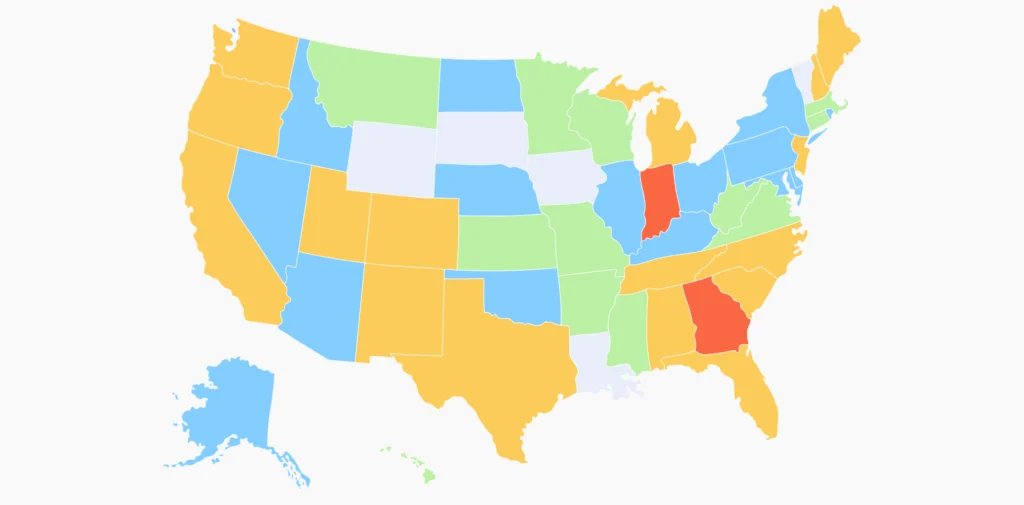

However, not all markets are poised for growth. Major cities like Atlanta and Indianapolis are projected to experience over a 5% decline in home prices, affected by factors such as softening rents and rising insurance costs. For these areas, market investors may benefit from taking a wait-and-see approach, allowing time for prices to stabilize before engaging in new investments.

Conversely, other regions, particularly in the Northeast and parts of the Midwest, are expected to see stable housing appreciation, with cities like Hartford, Connecticut, predicted to experience significant growth. These markets are currently characterized by relatively low prices, population growth, and limited housing supply, making them potentially attractive for long-term investments.

In summary, stakeholders in the real estate sector are advised to cultivate disciplined investment strategies that focus on stable markets with modest appreciation, while navigating the complexities presented by such factors as homeownership rates and rental demand.

Why this story matters: Insights from BiggerPockets members highlight potential areas for investment as real estate markets stabilize.

Key takeaway: Investors are encouraged to adopt a cautious but optimistic approach, targeting markets with steady growth while avoiding speculative risks.

Opposing viewpoint: Critics may argue that recent price corrections could indicate deeper market issues, suggesting a need for greater caution in investment decisions.